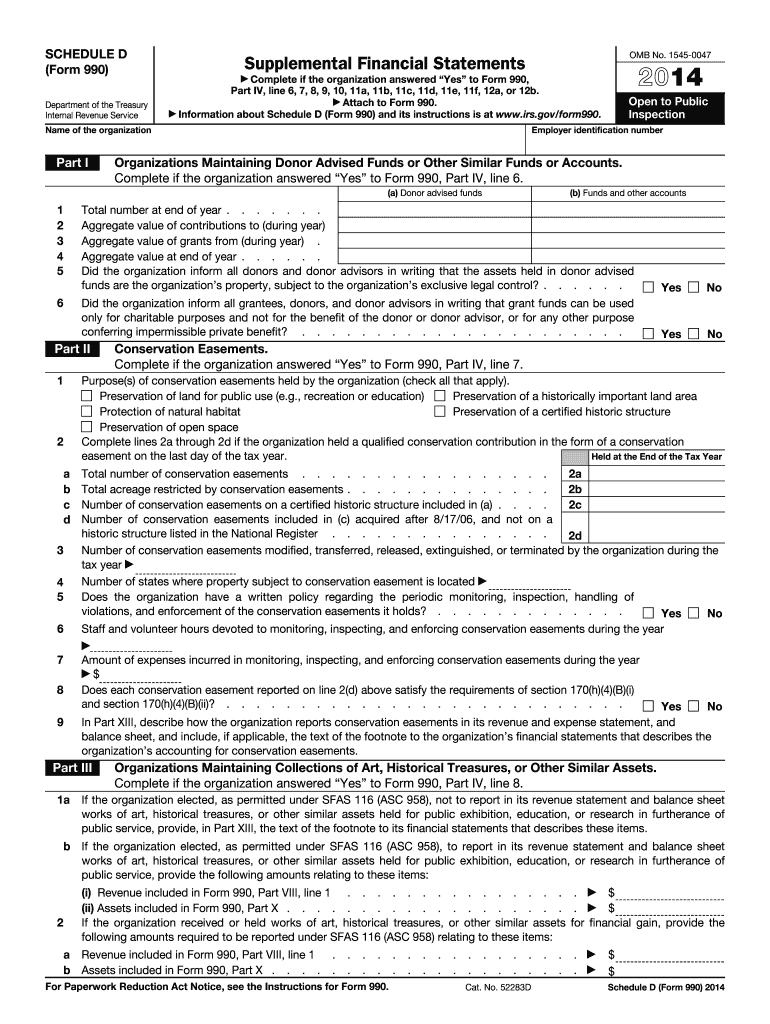

Irs Form 990 Schedule D for 2014

What is the IRS Form 990 Schedule D For

The IRS Form 990 Schedule D is primarily used by tax-exempt organizations to provide supplementary information regarding their financial activities. This form is an integral part of the IRS Form 990, which is the annual information return that tax-exempt organizations must file. Schedule D specifically addresses details about the organization’s governance, financial statements, and disclosures related to its operations. It helps ensure transparency and compliance with federal regulations, allowing the IRS and the public to better understand the financial health and management practices of these organizations.

How to Use the IRS Form 990 Schedule D

Using the IRS Form 990 Schedule D involves several steps to ensure that all necessary information is accurately reported. Organizations typically begin by gathering their financial statements and governance documents. It is essential to review the instructions provided by the IRS for Schedule D, which outline the specific sections that need to be completed based on the organization’s activities. Each section requires detailed responses, including information about the organization’s policies, procedures, and any significant changes in governance or financial practices. After filling out the form, organizations must ensure that it is signed and dated before submission.

Steps to Complete the IRS Form 990 Schedule D

Completing the IRS Form 990 Schedule D involves a systematic approach:

- Gather necessary financial documents, including previous Form 990 filings, financial statements, and governance policies.

- Review the IRS instructions for Schedule D to understand the required sections and information.

- Fill out each section of the form, ensuring accuracy and completeness in reporting governance and financial details.

- Double-check all entries for errors or omissions before finalizing the form.

- Sign and date the form to validate its authenticity.

- Submit the completed Schedule D along with the main Form 990 by the designated deadline.

Key Elements of the IRS Form 990 Schedule D

Several key elements must be included in the IRS Form 990 Schedule D to provide a comprehensive overview of the organization’s governance and financial practices:

- Governance Structure: Details about the board of directors, including the number of members and their qualifications.

- Financial Statements: Summary of the organization’s financial position, including assets, liabilities, and net assets.

- Policies: Information about conflict of interest policies, whistleblower policies, and document retention policies.

- Disclosure Practices: Description of how the organization discloses its financial information to the public and stakeholders.

Legal Use of the IRS Form 990 Schedule D

The IRS Form 990 Schedule D serves a legal purpose by ensuring that tax-exempt organizations comply with federal regulations. Organizations must accurately complete and file this form to maintain their tax-exempt status. Failure to provide the required information can lead to penalties, including loss of tax-exempt status. The legal framework surrounding the use of Schedule D emphasizes transparency and accountability, allowing the IRS to monitor compliance and the public to access critical financial information about these organizations.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the IRS Form 990 Schedule D to avoid penalties. Typically, the deadline for filing Form 990, including Schedule D, is the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Organizations can apply for an automatic six-month extension if needed, but they must file the extension request before the original deadline.

Quick guide on how to complete irs form 990 schedule d for 2014

Effortlessly Prepare Irs Form 990 Schedule D For on Any Device

Digital document management has gained traction among businesses and individuals. It offers a sustainable alternative to traditional printed and signed papers, allowing you to obtain the necessary format and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Irs Form 990 Schedule D For on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Steps to Modify and Electronically Sign Irs Form 990 Schedule D For with Ease

- Acquire Irs Form 990 Schedule D For and click on Get Form to initiate.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional ink signature.

- Review all information carefully and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Leave behind the worry of lost or mislaid files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign Irs Form 990 Schedule D For and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 990 schedule d for 2014

Create this form in 5 minutes!

How to create an eSignature for the irs form 990 schedule d for 2014

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the purpose of IRS Form 990 Schedule D?

IRS Form 990 Schedule D is used by tax-exempt organizations to provide supplemental information regarding their financial statements. This form helps organizations disclose their governance, management, and financial practices, ensuring compliance with IRS regulations. Understanding IRS Form 990 Schedule D is crucial for maintaining transparency and trust with stakeholders.

-

How can airSlate SignNow assist with IRS Form 990 Schedule D documentation?

AirSlate SignNow enables businesses to prepare and eSign documents related to IRS Form 990 Schedule D efficiently. Our platform offers a user-friendly interface for creating, editing, and securely signing your forms. This streamlines the process and ensures that you meet filing deadlines with ease.

-

What features does airSlate SignNow provide for IRS Form 990 Schedule D signings?

With airSlate SignNow, you can easily send IRS Form 990 Schedule D for review and eSignature in just a few clicks. Key features include document templates, real-time tracking, and secure cloud storage. These tools not only facilitate faster signings but also enhance the overall efficiency of your document management.

-

Is airSlate SignNow a cost-effective solution for managing IRS Form 990 Schedule D?

Yes, airSlate SignNow offers a cost-effective solution for managing IRS Form 990 Schedule D documentation. Our competitive pricing plans are designed to accommodate businesses of all sizes, allowing you to streamline your signing processes without exceeding your budget. Investing in our solution can save you both time and money in the long run.

-

What benefits does airSlate SignNow provide when handling IRS Form 990 Schedule D?

By using airSlate SignNow for IRS Form 990 Schedule D, you can enjoy benefits like improved efficiency and reduced processing time. The platform allows for quicker approvals and enhances collaboration among team members. Additionally, our secure handling of sensitive information helps protect your organization’s data.

-

Can airSlate SignNow integrate with other tools for managing IRS Form 990 Schedule D?

Absolutely! airSlate SignNow offers seamless integration with various third-party applications such as CRM and accounting tools. This capability allows you to manage IRS Form 990 Schedule D documents within your existing workflows, ensuring a streamlined process that enhances productivity.

-

Is training available for using airSlate SignNow with IRS Form 990 Schedule D?

Yes, airSlate SignNow provides comprehensive training resources and support for users managing IRS Form 990 Schedule D. Our tutorials, webinars, and customer support ensure that you and your team can effectively utilize our platform. This assistance can help you maximize your investment and ensure compliance with IRS requirements.

Get more for Irs Form 990 Schedule D For

- Form 8850 rev 2009 pre screening notice and certification request for the work opportunity credit irs

- 2011 943 fillable form pdf

- 990 pf instruction 2011 form

- 886 form

- Form 14157 a rev 5 2012 tax return preparer fraud or misconduct affidavit

- Form 433 b oic dor mo

- 2013 943 fillable form pdf

- 2015 instructions for schedule m 3 form 1065 instructions for schedule m 3 form 1065 net income loss reconciliation for certain

Find out other Irs Form 990 Schedule D For

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed