990 Schedule Dpdffillercom Form 2016

What is the 990 Schedule Dpdffillercom Form

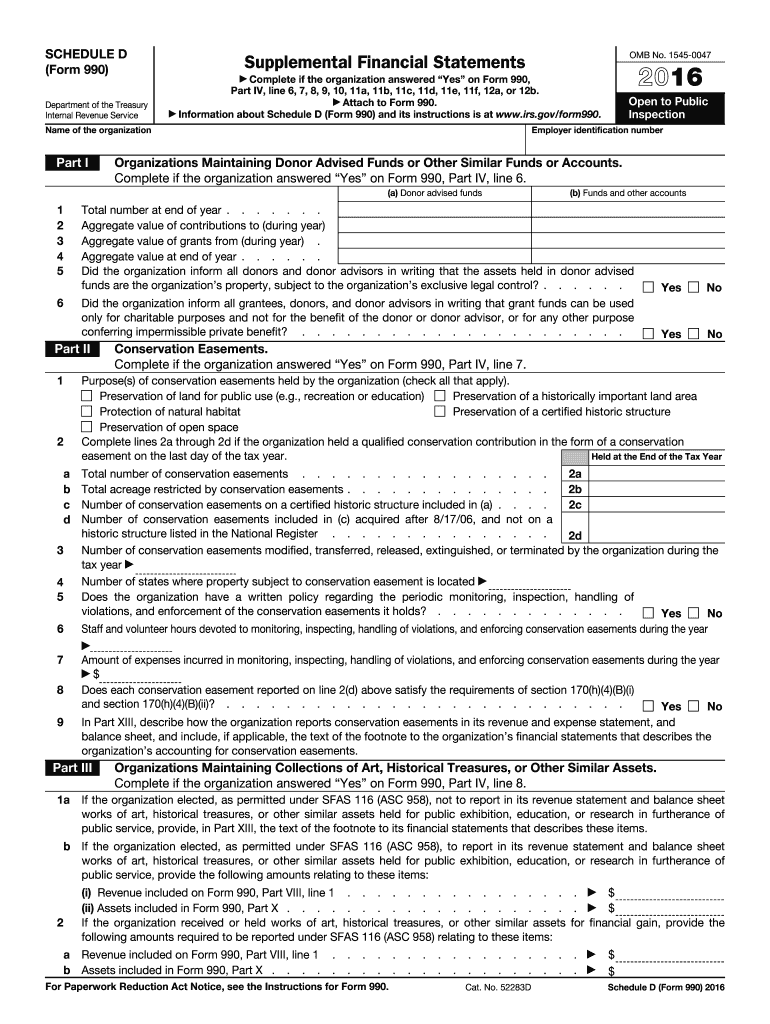

The 990 Schedule Dpdffillercom Form is a crucial document used by tax-exempt organizations in the United States to provide detailed financial information to the Internal Revenue Service (IRS). This form is part of the annual information return that organizations must file to maintain their tax-exempt status. It includes data on revenue, expenses, and other financial activities, which helps the IRS ensure compliance with tax regulations. Understanding the purpose and requirements of this form is essential for organizations seeking to uphold their tax-exempt status.

How to use the 990 Schedule Dpdffillercom Form

Using the 990 Schedule Dpdffillercom Form involves several steps to ensure accurate completion. First, organizations should gather all necessary financial records, including income statements, balance sheets, and details of any grants or contributions received. Next, the organization should carefully fill out each section of the form, providing precise figures and explanations where required. It is important to review the completed form for accuracy before submission, as errors may lead to penalties or complications with the IRS.

Steps to complete the 990 Schedule Dpdffillercom Form

Completing the 990 Schedule Dpdffillercom Form can be broken down into a series of methodical steps:

- Gather all financial documents, including previous tax returns and current year financial statements.

- Access the form through the IRS website or a reliable electronic filing service.

- Fill in the organization’s identifying information, including name, address, and Employer Identification Number (EIN).

- Complete the financial sections, detailing revenue, expenses, and net assets.

- Provide additional disclosures as required, such as information about governance and compliance.

- Review the form thoroughly for accuracy and completeness.

- Submit the form electronically or via mail, ensuring it is sent by the IRS deadline.

Legal use of the 990 Schedule Dpdffillercom Form

The 990 Schedule Dpdffillercom Form serves a legal purpose, as it is mandated by the IRS for tax-exempt organizations. Proper completion and submission of this form are necessary to comply with federal tax laws. Failure to file or inaccuracies in the form can lead to penalties, loss of tax-exempt status, or legal scrutiny. Organizations must ensure that the information provided is truthful and complete to fulfill their legal obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Schedule Dpdffillercom Form are crucial for compliance. Generally, organizations must file their return by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. Extensions may be available, but they must be requested before the original deadline. Staying aware of these dates helps organizations avoid penalties and maintain their tax-exempt status.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the 990 Schedule Dpdffillercom Form. The preferred method is electronic filing, which can be done through the IRS e-file system or authorized e-file providers. This method is often faster and provides immediate confirmation of receipt. Alternatively, organizations can submit the form by mail, ensuring it is postmarked by the deadline. In-person submissions are generally not accepted for this form. Choosing the right submission method can help streamline the filing process.

Quick guide on how to complete 990 schedule dpdffillercom 2016 form

Effortlessly Prepare 990 Schedule Dpdffillercom Form on Any Gadget

Digital document handling has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage 990 Schedule Dpdffillercom Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

The most efficient method to modify and electronically sign 990 Schedule Dpdffillercom Form effortlessly

- Locate 990 Schedule Dpdffillercom Form and click on Get Form to initiate.

- Employ the tools we provide to complete your form.

- Emphasize relevant segments of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this task.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to preserve your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, laborious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and electronically sign 990 Schedule Dpdffillercom Form and guarantee superior communication throughout every step of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 990 schedule dpdffillercom 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 990 schedule dpdffillercom 2016 form

How to make an electronic signature for your 990 Schedule Dpdffillercom 2016 Form in the online mode

How to make an electronic signature for your 990 Schedule Dpdffillercom 2016 Form in Google Chrome

How to create an electronic signature for putting it on the 990 Schedule Dpdffillercom 2016 Form in Gmail

How to generate an eSignature for the 990 Schedule Dpdffillercom 2016 Form right from your smart phone

How to create an electronic signature for the 990 Schedule Dpdffillercom 2016 Form on iOS devices

How to create an eSignature for the 990 Schedule Dpdffillercom 2016 Form on Android devices

People also ask

-

What is the 990 Schedule DsignNowcom Form?

The 990 Schedule DsignNowcom Form is a crucial tax document used by nonprofits to report their financial activities. This form helps organizations provide transparency about their financial health, ensuring compliance with IRS regulations. By using airSlate SignNow, you can easily fill out and eSign the 990 Schedule DsignNowcom Form, streamlining your filing process.

-

How can airSlate SignNow help with the 990 Schedule DsignNowcom Form?

airSlate SignNow offers a user-friendly platform that simplifies the completion and signing of the 990 Schedule DsignNowcom Form. With features like drag-and-drop document uploads and customizable templates, you can ensure that your form is filled out accurately. Additionally, our eSignature capability allows for quick approvals, helping you meet deadlines effortlessly.

-

Is there a cost associated with using airSlate SignNow for the 990 Schedule DsignNowcom Form?

Yes, airSlate SignNow provides various pricing plans tailored to the needs of different organizations. Whether you're a small nonprofit or a larger entity, you can choose a plan that fits your budget while providing access to essential features for managing the 990 Schedule DsignNowcom Form. We offer a free trial so you can explore our services before committing.

-

What features does airSlate SignNow offer for the 990 Schedule DsignNowcom Form?

airSlate SignNow includes several features to enhance your experience with the 990 Schedule DsignNowcom Form. You can utilize templates, automated workflows, and secure storage for your documents. Additionally, our platform ensures compliance with legal standards, making it easier to manage your filing requirements.

-

Can I integrate airSlate SignNow with other software for handling the 990 Schedule DsignNowcom Form?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to seamlessly manage your 990 Schedule DsignNowcom Form alongside your existing systems. This integration capability enhances your efficiency, ensuring all your financial data is interconnected for better management and reporting.

-

How secure is the information on the 990 Schedule DsignNowcom Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform to manage the 990 Schedule DsignNowcom Form, your data is protected with industry-leading encryption and compliance with regulatory standards. We ensure that all your sensitive information remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for the 990 Schedule DsignNowcom Form?

Using airSlate SignNow for the 990 Schedule DsignNowcom Form provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced collaboration among team members. Our solution streamlines the entire process, allowing for faster completion and submission of your forms. Plus, you can easily track the status of your documents in real-time.

Get more for 990 Schedule Dpdffillercom Form

Find out other 990 Schedule Dpdffillercom Form

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online