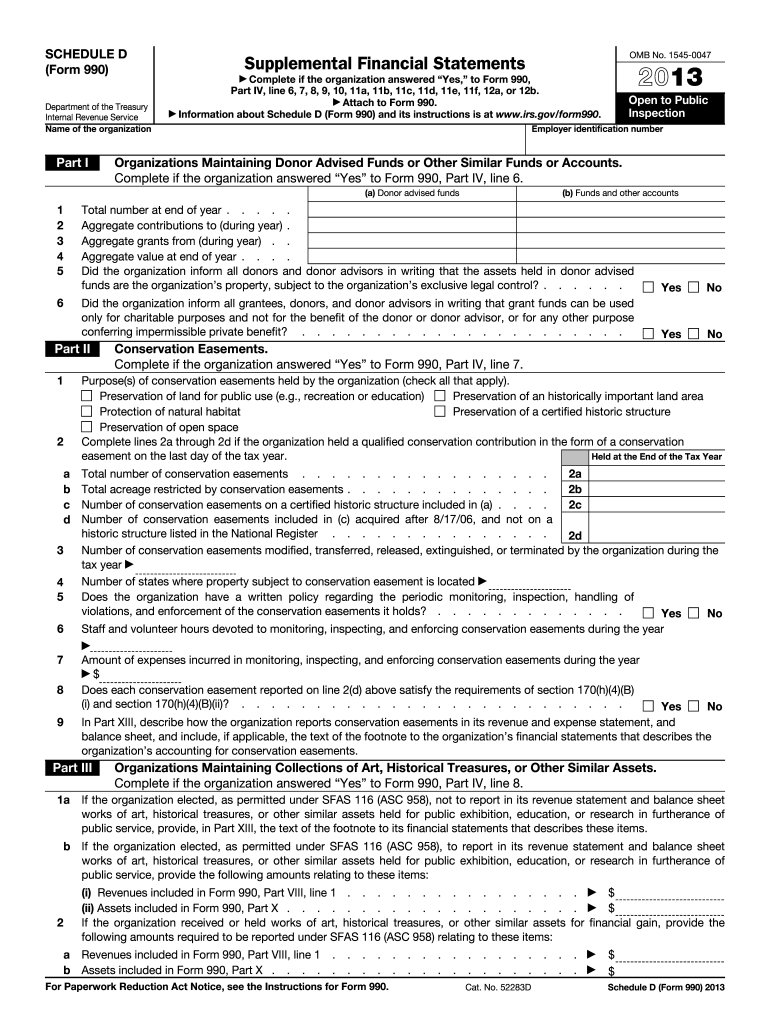

Form 990 Schedule D 2013

What is the Form 990 Schedule D

The Form 990 Schedule D is an essential document used by tax-exempt organizations in the United States to provide additional information about their financial activities. This schedule is part of the larger Form 990, which organizations must file annually with the Internal Revenue Service (IRS). Schedule D specifically focuses on the organization’s governance, policies, and any significant changes in its financial condition. It helps the IRS and the public understand the organization’s financial health and operational transparency.

How to use the Form 990 Schedule D

Using the Form 990 Schedule D involves several steps to ensure accurate reporting. Organizations must first gather all necessary financial documents and records related to their governance and policies. This includes information about board members, conflict of interest policies, and financial statements. Once the relevant information is collected, organizations can complete the schedule by providing detailed responses to the questions outlined in the form. It is crucial to ensure that all information is accurate and complete, as this contributes to the overall integrity of the Form 990 submission.

Steps to complete the Form 990 Schedule D

Completing the Form 990 Schedule D requires careful attention to detail. Here are the key steps involved:

- Gather financial records, including previous Form 990 filings and current financial statements.

- Review the questions on Schedule D to understand the information required.

- Provide accurate details about the organization’s governance structure, including board composition and policies.

- Document any changes in financial condition or operations since the last filing.

- Review the completed schedule for accuracy before submission.

Legal use of the Form 990 Schedule D

The legal use of the Form 990 Schedule D is governed by IRS regulations. Organizations must file this schedule as part of their annual tax return to maintain their tax-exempt status. Accurate reporting is essential, as discrepancies or omissions can lead to penalties or loss of tax-exempt status. The information provided in Schedule D must comply with federal laws and regulations, ensuring transparency and accountability in financial reporting.

Key elements of the Form 990 Schedule D

Several key elements are critical to the Form 990 Schedule D. These include:

- Governance policies: Information about the organization’s board of directors and governance practices.

- Conflict of interest policies: Details on how the organization addresses potential conflicts among board members.

- Financial health: Information about any significant changes in the organization’s financial condition.

- Public disclosure: Assurance that the organization is compliant with public disclosure requirements.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Form 990 Schedule D. Generally, the deadline for filing is the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically falls on May 15. It is crucial for organizations to be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations.

Quick guide on how to complete 2013 form 990 schedule d

Effortlessly prepare Form 990 Schedule D on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 990 Schedule D on any device with the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to edit and electronically sign Form 990 Schedule D with ease

- Obtain Form 990 Schedule D and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Revise and electronically sign Form 990 Schedule D and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 990 schedule d

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 990 schedule d

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 990 Schedule D and why is it important?

Form 990 Schedule D is a supplementary schedule that helps organizations provide detailed information about their endowment funds, investments, and the financial health of their organization. It is crucial for transparency, as it helps donors and the public understand how an organization manages its financial resources. Properly completing Form 990 Schedule D can enhance trust and accountability.

-

How can airSlate SignNow help with completing Form 990 Schedule D?

airSlate SignNow simplifies the process of completing Form 990 Schedule D by allowing users to easily fill out and eSign documents online. Our platform supports smooth collaboration and ensures that all necessary signatures are obtained swiftly. By using airSlate SignNow, you can save time and reduce the risk of errors in your Form 990 Schedule D.

-

Is airSlate SignNow suitable for large organizations handling Form 990 Schedule D?

Yes, airSlate SignNow is designed to accommodate organizations of all sizes, including large nonprofits needing to manage Form 990 Schedule D. Our platform offers scalable solutions that cater to various user needs, ensuring that large teams can collaborate efficiently on important documents like Form 990 Schedule D.

-

What are the pricing options for airSlate SignNow when preparing Form 990 Schedule D?

airSlate SignNow offers multiple pricing tiers to meet different organizational needs, making it a cost-effective solution for preparing Form 990 Schedule D. Our plans are tailored to provide value, ensuring you can choose an option that fits your budget while accessing all necessary features to streamline your document management.

-

Can airSlate SignNow integrate with other financial software for Form 990 Schedule D?

Absolutely! airSlate SignNow supports seamless integration with various financial software and tools that can help streamline the preparation of Form 990 Schedule D. These integrations allow you to import data directly into your documents, reducing manual entry and helping ensure accuracy.

-

What features does airSlate SignNow offer for managing Form 990 Schedule D effectively?

airSlate SignNow provides robust features such as document templates, advanced editing tools, and audit trails that can help you manage Form 990 Schedule D effectively. With eSignature capabilities, you can easily obtain signatures from key stakeholders, ensuring your documents are completed promptly and in compliance with regulations.

-

Is it secure to use airSlate SignNow for sensitive documents like Form 990 Schedule D?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure cloud storage to protect your sensitive documents, including Form 990 Schedule D. You can trust that your information is safe, compliant, and accessible only to authorized users.

Get more for Form 990 Schedule D

- Subcontractors agreement iowa form

- Option to purchase addendum to residential lease lease or rent to own iowa form

- Iowa prenuptial premarital agreement uniform premarital agreement act with financial statements iowa

- Iowa prenuptial form

- Amendment to prenuptial or premarital agreement iowa form

- Financial statements only in connection with prenuptial premarital agreement iowa form

- Revocation of premarital or prenuptial agreement iowa form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children iowa form

Find out other Form 990 Schedule D

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form