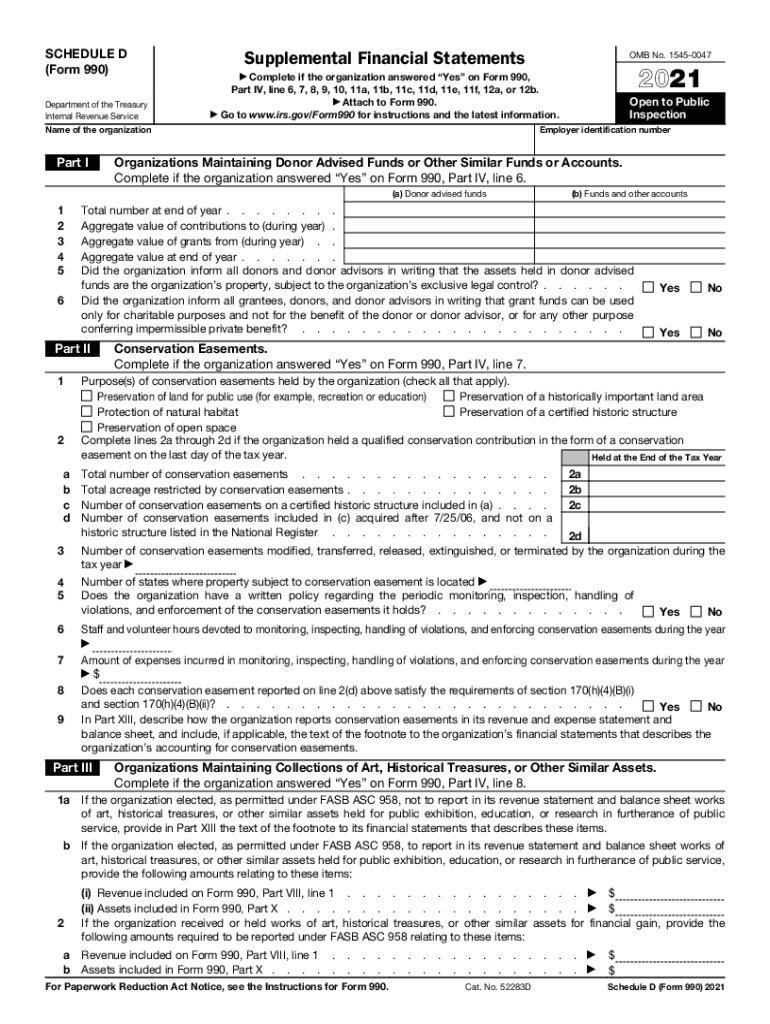

Schedule D Form 990 Supplemental Financial Statements 2021

What is the Schedule D Form 990 Supplemental Financial Statements

The Schedule D Form 990 is a supplemental financial statement required by the IRS for certain tax-exempt organizations. It provides detailed information about the organization’s financial activities, including its assets, liabilities, and net assets. This form is essential for transparency and accountability, allowing the IRS and the public to understand how organizations manage their finances. The Schedule D is particularly relevant for organizations that hold significant investments or have complex financial structures.

How to use the Schedule D Form 990 Supplemental Financial Statements

Using the Schedule D Form 990 involves several steps. Organizations must first determine if they are required to file this form based on their financial activities. Next, they should gather all necessary financial data, including details about investments, endowments, and other assets. Once the data is compiled, organizations can complete the form by accurately reporting their financial information. It is crucial to ensure that all entries are correct and consistent with the organization’s overall financial statements.

Steps to complete the Schedule D Form 990 Supplemental Financial Statements

Completing the Schedule D Form 990 requires careful attention to detail. Here are the key steps:

- Review the IRS guidelines to confirm the need for the Schedule D.

- Collect relevant financial documents, such as balance sheets and investment records.

- Fill out the form, providing detailed information about assets, liabilities, and net assets.

- Ensure that all figures are accurate and match the organization’s financial statements.

- Submit the completed form along with the main Form 990 by the filing deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form 990. These guidelines outline the information required, the format for reporting, and the deadlines for submission. Organizations should familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. The IRS also offers resources and publications that can assist organizations in understanding the requirements for the Schedule D.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form 990 align with the deadlines for the main Form 990. Typically, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. Extensions may be available, but it is essential to file any requests for extensions before the original deadline.

Penalties for Non-Compliance

Failure to file the Schedule D Form 990 can result in significant penalties for organizations. The IRS may impose fines for late submissions or for failing to provide accurate information. Additionally, organizations that consistently fail to comply with filing requirements may risk losing their tax-exempt status. It is crucial for organizations to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete 2021 schedule d form 990 supplemental financial statements

Complete Schedule D Form 990 Supplemental Financial Statements seamlessly on any device

Online document management has become favored by enterprises and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow supplies you with all the tools you require to create, modify, and eSign your paperwork swiftly without delays. Manage Schedule D Form 990 Supplemental Financial Statements on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to modify and eSign Schedule D Form 990 Supplemental Financial Statements effortlessly

- Obtain Schedule D Form 990 Supplemental Financial Statements and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Schedule D Form 990 Supplemental Financial Statements and ensure outstanding communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule d form 990 supplemental financial statements

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule d form 990 supplemental financial statements

How to generate an e-signature for a PDF file in the online mode

How to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your smartphone

The best way to create an e-signature for a PDF file on iOS devices

How to make an e-signature for a PDF file on Android

People also ask

-

What is the IRS Form Schedule D used for?

The IRS Form Schedule D is used to report capital gains and losses from the sale of assets such as stocks or real estate. Understanding how to accurately fill out this form is essential for individuals and businesses alike, as it impacts overall tax liabilities. Properly managing your Schedule D can help ensure compliance with tax regulations and optimize your financial health.

-

How can airSlate SignNow help me in preparing IRS Form Schedule D?

airSlate SignNow streamlines the document signing process, making it easy to collect electronic signatures on your IRS Form Schedule D. With our platform, you can quickly share the form with tax professionals for review and approval. This efficiency not only saves time but also reduces the risk of errors in document handling.

-

What are the pricing options for airSlate SignNow when using IRS Form Schedule D?

airSlate SignNow offers various pricing plans tailored to meet diverse business needs. Pricing is competitive and based on features such as the number of users and document workflows. By choosing our service, businesses can efficiently handle IRS Form Schedule D while keeping costs manageable.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow provides a free trial that allows you to explore its features, including those that assist in completing IRS Form Schedule D. During the trial, you can experience firsthand how easy it is to prepare and manage your documents. This risk-free opportunity enables you to assess whether our solution meets your eSigning needs.

-

Can I integrate airSlate SignNow with accounting software for IRS Form Schedule D?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software. This capability allows users to import necessary data for IRS Form Schedule D directly, enhancing accuracy and saving time during the tax preparation process.

-

What benefits does airSlate SignNow provide for handling IRS Form Schedule D?

Using airSlate SignNow for IRS Form Schedule D offers numerous benefits, including enhanced security and ease of use. Digital signatures ensure that your documents are legally binding, and our user-friendly interface makes navigating the signing process straightforward. This can help reduce anxiety associated with tax reports and compliance.

-

Is eSigning IRS Form Schedule D secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes security, ensuring that your IRS Form Schedule D is signed and stored securely. We use advanced encryption and comply with various regulatory standards to protect your sensitive data. Your documents are safe, allowing you to focus on what matters most: accurately filing your taxes.

Get more for Schedule D Form 990 Supplemental Financial Statements

- Letter to lienholder to notify of trust hawaii form

- Hawaii timber sale contract hawaii form

- Hawaii forest products timber sale contract hawaii form

- Assumption agreement of mortgage and release of original mortgagors hawaii form

- Hawaii foreign judgment enrollment hawaii form

- Hawaii estate 497304583 form

- Hawaii eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497304585 form

Find out other Schedule D Form 990 Supplemental Financial Statements

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF