990 Schecdule D Form 2015

What is the 990 Schedule D Form

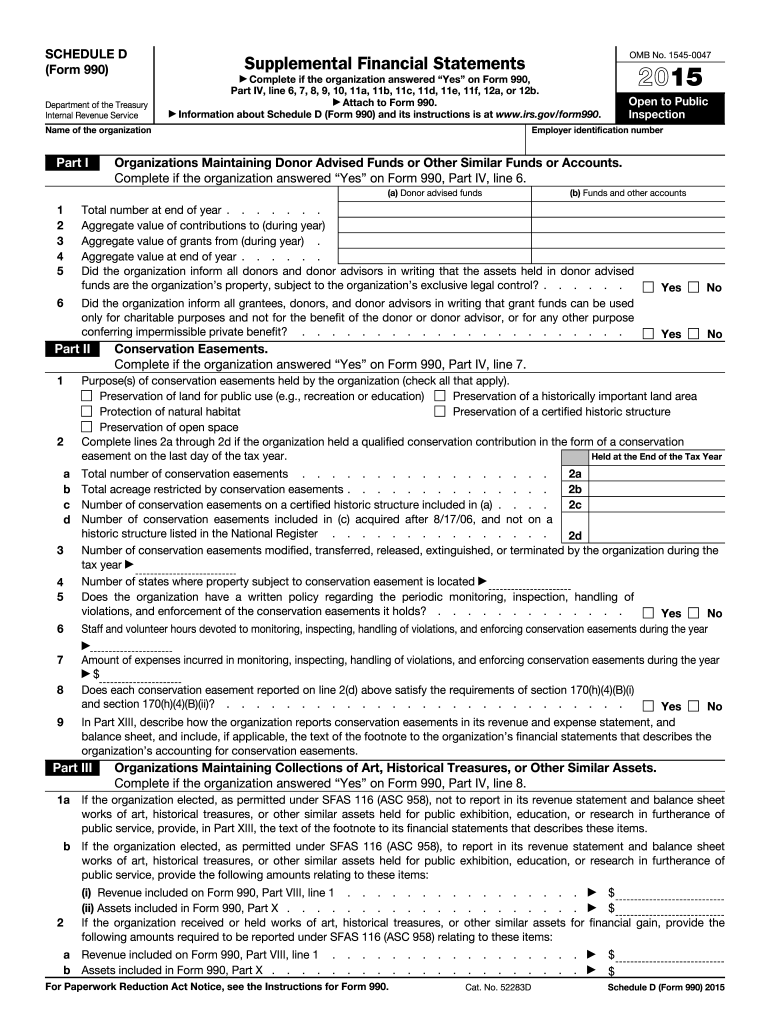

The 990 Schedule D Form is a crucial document used by tax-exempt organizations in the United States. It provides detailed information about the organization's financial activities, including its net assets and liabilities. This form supplements the main Form 990, which is the annual return that tax-exempt organizations must file with the IRS. Schedule D is specifically designed to disclose important financial details that help the IRS assess compliance with tax regulations. It is essential for maintaining transparency and accountability in the nonprofit sector.

How to use the 990 Schedule D Form

Using the 990 Schedule D Form involves several steps to ensure accurate and complete reporting. Organizations must first gather all relevant financial information, including balance sheets and income statements. Next, they should carefully fill out each section of the form, ensuring that all figures are accurate and reflect the organization's financial status. After completing the form, it must be submitted along with the main Form 990. Proper use of this form helps organizations maintain compliance with IRS requirements and provides stakeholders with a clear picture of the organization's financial health.

Steps to complete the 990 Schedule D Form

Completing the 990 Schedule D Form requires attention to detail and a systematic approach. Here are the essential steps:

- Gather financial records, including previous tax returns, balance sheets, and income statements.

- Review the instructions provided by the IRS for the 990 Schedule D Form to understand the requirements.

- Fill out each section of the form, ensuring that all information is accurate and complete.

- Double-check calculations and ensure that all necessary supporting documents are included.

- Submit the completed form along with the main Form 990 by the designated filing deadline.

Key elements of the 990 Schedule D Form

The 990 Schedule D Form includes several key elements that organizations must report. These elements typically encompass:

- Organization's financial position, including total assets and liabilities.

- Details of any significant changes in net assets from the previous year.

- Information on investments and other financial activities.

- Disclosures related to governance and management practices.

Accurate reporting of these elements is essential for maintaining compliance and providing transparency to stakeholders.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Schedule D Form align with the deadlines for the main Form 990. Generally, tax-exempt organizations must file their returns by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this typically means a due date of May fifteenth. Organizations can apply for an extension, which may extend the deadline by six months. It is crucial to adhere to these deadlines to avoid penalties and maintain good standing with the IRS.

Penalties for Non-Compliance

Non-compliance with the requirements for the 990 Schedule D Form can result in significant penalties for organizations. The IRS may impose fines for failing to file the form or for filing incomplete or inaccurate information. These penalties can accumulate over time, leading to increased financial burdens. Additionally, non-compliance can damage an organization's reputation and jeopardize its tax-exempt status. Therefore, it is essential for organizations to take the filing of this form seriously and ensure that all requirements are met.

Quick guide on how to complete 2015 990 schecdule d form

Effortlessly Prepare 990 Schecdule D Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle 990 Schecdule D Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Edit and eSign 990 Schecdule D Form Without Stress

- Locate 990 Schecdule D Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only a few seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 990 Schecdule D Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 990 schecdule d form

Create this form in 5 minutes!

How to create an eSignature for the 2015 990 schecdule d form

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the 990 Schedule D Form and why is it important?

The 990 Schedule D Form is a critical document for tax-exempt organizations, providing necessary information about their governance, policies, and relationship with related organizations. Properly completing the 990 Schedule D Form ensures compliance with IRS regulations and transparency for stakeholders.

-

How does airSlate SignNow facilitate the signing of the 990 Schedule D Form?

airSlate SignNow offers a user-friendly platform that allows organizations to easily send and eSign the 990 Schedule D Form electronically. This streamlines the submission process, reduces paperwork, and ensures that all signatures are securely collected and stored.

-

What pricing plans are available for using airSlate SignNow to manage 990 Schedule D Forms?

airSlate SignNow provides a range of pricing plans designed to accommodate different organizational needs. Each plan includes features that support the management and signing of documents like the 990 Schedule D Form, ensuring that you receive the best value for your investment.

-

Are there any integrations for managing the 990 Schedule D Form using airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications that can help manage financial and tax documents, including the 990 Schedule D Form. These integrations enhance workflow efficiency, enabling organizations to automatically populate fields and streamline data collection.

-

What are the key benefits of eSigning the 990 Schedule D Form with airSlate SignNow?

eSigning the 990 Schedule D Form with airSlate SignNow offers numerous benefits such as increased efficiency, reduced turnaround time, and enhanced security. By using our platform, organizations can ensure that their forms are signed promptly, minimizing delays in compliance.

-

Can airSlate SignNow help me track the status of my 990 Schedule D Form?

Absolutely! airSlate SignNow provides real-time tracking for all sent documents, including the 990 Schedule D Form. This feature allows you to monitor who has signed, who has yet to sign, and ensures that you stay updated throughout the signing process.

-

How does airSlate SignNow ensure the security of sensitive information in the 990 Schedule D Form?

airSlate SignNow employs top-notch security measures, including encryption and secure storage, to protect sensitive information contained in the 990 Schedule D Form. Our platform complies with industry standards, ensuring that your data is safe at all times.

Get more for 990 Schecdule D Form

- Sheetrock drywall contractor package hawaii form

- Flooring contractor package hawaii form

- Trim carpentry contractor package hawaii form

- Fencing contractor package hawaii form

- Hvac contractor package hawaii form

- Landscaping contractor package hawaii form

- Commercial contractor package hawaii form

- Excavation contractor package hawaii form

Find out other 990 Schecdule D Form

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template