Fillable Form 940 2024

What is the Fillable Form 940

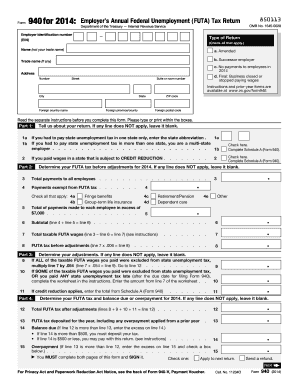

The Fillable Form 940 is an essential document used by employers in the United States to report their annual Federal Unemployment Tax Act (FUTA) tax liability. This form is crucial for businesses that pay unemployment compensation to their employees. The information provided on Form 940 helps the Internal Revenue Service (IRS) track and ensure that employers are fulfilling their tax obligations related to unemployment benefits.

How to use the Fillable Form 940

Using the Fillable Form 940 involves several straightforward steps. First, employers must gather relevant information, including total wages paid, the number of employees, and any state unemployment taxes paid. Next, they can fill out the form electronically, ensuring all fields are accurately completed. After filling out the form, employers should review it for any errors before submitting it to the IRS. The electronic version allows for easy corrections and saves time compared to paper forms.

Steps to complete the Fillable Form 940

Completing the Fillable Form 940 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including employer identification number (EIN) and payroll records.

- Access the Fillable Form 940 online and begin entering your business information.

- Input total wages paid to employees and calculate the FUTA tax owed.

- Review any state unemployment taxes that may apply.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or print it for mailing to the IRS.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines when filing the Fillable Form 940. The annual deadline for submitting the form is typically January 31 of the following year. If employers have made timely payments of their FUTA tax, they may have until February 10 to file. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Legal use of the Fillable Form 940

The legal use of the Fillable Form 940 is mandated by federal law for employers subject to FUTA. This form must be completed accurately to reflect the employer's tax liabilities. Failure to file or inaccuracies can lead to penalties, including fines and interest on unpaid taxes. Employers should maintain records of their filings and any supporting documentation to ensure compliance with IRS requirements.

Who Issues the Form

The Fillable Form 940 is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides guidelines and updates regarding the form, ensuring that employers have the necessary information to comply with federal tax regulations. It is essential for employers to refer to the IRS website for the most current version of the form and any changes in filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct fillable form 940

Create this form in 5 minutes!

How to create an eSignature for the fillable form 940

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fillable Form 940?

A Fillable Form 940 is an electronic version of the IRS Form 940, used for reporting annual Federal Unemployment Tax Act (FUTA) taxes. With airSlate SignNow, you can easily create, fill out, and eSign this form, streamlining your tax reporting process.

-

How can airSlate SignNow help with Fillable Form 940?

airSlate SignNow provides a user-friendly platform to create and manage your Fillable Form 940. You can fill out the form online, add electronic signatures, and securely send it to relevant parties, ensuring compliance and efficiency.

-

Is there a cost associated with using Fillable Form 940 on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to Fillable Form 940 and other document management features. You can choose a plan that fits your business needs and budget, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for Fillable Form 940?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure cloud storage for your Fillable Form 940. These features enhance your workflow, making it easier to manage and submit your tax forms.

-

Can I integrate airSlate SignNow with other software for Fillable Form 940?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to connect your Fillable Form 940 with your existing tools. This integration helps streamline your processes and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for Fillable Form 940?

Using airSlate SignNow for your Fillable Form 940 offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, ensuring that your forms are completed accurately and submitted on time.

-

Is it easy to use airSlate SignNow for Fillable Form 940?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to fill out and eSign the Fillable Form 940. The intuitive interface guides you through the process, ensuring a smooth experience from start to finish.

Get more for Fillable Form 940

- This contract has been approved by the rockland county bar form

- Christopher lunn form

- Tenant billing authorization form cityofrochester

- Fec form 5 fillable

- Ps form 1840b

- Usps letterhead pdf 239336830 form

- Pennsylvania state board of certified real estate pa gov form

- Water sector utility incident action checklistwildfire examples of activities that water and wastewater utilities can take to form

Find out other Fillable Form 940

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple