California Resident Income Tax Return 540 Ftb Ca 2024

What is the California Resident Income Tax Return 540 Ftb Ca

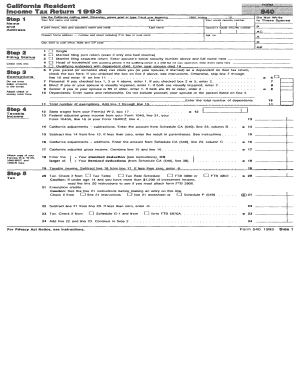

The California Resident Income Tax Return 540, commonly referred to as Form 540, is a state tax form used by residents of California to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and are required to pay state income taxes. The 540 form includes various sections where taxpayers can report wages, salaries, interest, dividends, and other sources of income. Additionally, it allows for deductions and credits that may reduce the overall tax owed, making it a crucial document for financial planning and compliance.

Steps to complete the California Resident Income Tax Return 540 Ftb Ca

Completing the California Resident Income Tax Return 540 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any records of deductions or credits.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Input your total income from various sources, ensuring accuracy to avoid discrepancies.

- Claim deductions: Identify and enter any eligible deductions, such as mortgage interest, property taxes, or medical expenses.

- Calculate tax owed: Use the provided tax tables or software to determine your tax liability based on your income and deductions.

- Review and sign: Double-check all entries for accuracy before signing and dating the form.

How to obtain the California Resident Income Tax Return 540 Ftb Ca

The California Resident Income Tax Return 540 can be obtained through several methods. Taxpayers can download the form directly from the California Franchise Tax Board (FTB) website, where it is available in PDF format. Alternatively, physical copies of the form can be requested by contacting the FTB or visiting local tax offices. Many tax preparation software programs also include Form 540, allowing users to complete and file their returns electronically.

Required Documents for the California Resident Income Tax Return 540 Ftb Ca

To successfully complete the California Resident Income Tax Return 540, certain documents are necessary:

- W-2 forms: These forms report wages and tax withheld from your employer.

- 1099 forms: These are used to report various types of income, including freelance work and interest earnings.

- Receipts for deductions: Keep records of expenses that may qualify for deductions, such as medical bills and charitable contributions.

- Previous year’s tax return: Having your last year's return can help with consistency and accuracy in reporting.

Filing Deadlines / Important Dates

Filing deadlines for the California Resident Income Tax Return 540 are crucial for compliance. Typically, the deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an automatic six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods for the California Resident Income Tax Return 540 Ftb Ca

Taxpayers have multiple options for submitting the California Resident Income Tax Return 540. The form can be filed electronically using tax preparation software, which often simplifies the process and allows for quicker refunds. Alternatively, individuals can print the completed form and mail it to the appropriate address specified by the California Franchise Tax Board. In-person submissions are also possible at designated FTB offices, providing another avenue for taxpayers who prefer direct interaction.

Create this form in 5 minutes or less

Find and fill out the correct california resident income tax return 540 ftb ca

Create this form in 5 minutes!

How to create an eSignature for the california resident income tax return 540 ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Resident Income Tax Return 540 Ftb Ca?

The California Resident Income Tax Return 540 Ftb Ca is the official form used by residents of California to report their income and calculate their state tax liability. This form is essential for ensuring compliance with California tax laws and can help you maximize your deductions and credits.

-

How can airSlate SignNow assist with filing the California Resident Income Tax Return 540 Ftb Ca?

airSlate SignNow provides a seamless platform for electronically signing and sending your California Resident Income Tax Return 540 Ftb Ca. With our user-friendly interface, you can easily manage your tax documents, ensuring they are securely signed and submitted on time.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial. Our cost-effective solutions ensure that you can efficiently manage your California Resident Income Tax Return 540 Ftb Ca without breaking the bank.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the California Resident Income Tax Return 540 Ftb Ca, automated reminders, and secure storage. These features streamline the process and help you stay organized during tax season.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to import and export your California Resident Income Tax Return 540 Ftb Ca data effortlessly. This integration enhances your workflow and ensures that all your financial documents are in sync.

-

What benefits does airSlate SignNow offer for eSigning tax documents?

Using airSlate SignNow for eSigning your California Resident Income Tax Return 540 Ftb Ca offers numerous benefits, including faster processing times, enhanced security, and reduced paper usage. Our platform ensures that your documents are signed quickly and securely, helping you meet deadlines with ease.

-

Is airSlate SignNow compliant with California tax regulations?

Yes, airSlate SignNow is fully compliant with California tax regulations, ensuring that your California Resident Income Tax Return 540 Ftb Ca is handled according to state laws. Our platform prioritizes security and compliance, giving you peace of mind while managing your tax documents.

Get more for California Resident Income Tax Return 540 Ftb Ca

- 2016 nebraska tax calculation schedule for individual income tax form

- Download nm form pit x taxhow

- State of new york department of civil service employee benefits division albany ny 12239 employee benefits division nyperl nys form

- Public works ampamp utilitiestown of dundee florida form

- Understanding severe chronic neutropenia form

- First aid assessment worksheeet occupational first aid form

- Skills bookletsubjectyeartaskdue date form

- Maine minimum tax credit and carryforward to 795007134 form

Find out other California Resident Income Tax Return 540 Ftb Ca

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself