How to Fill Out a 1099 Form for Employees 2017

What is the 1099 Form for Employees

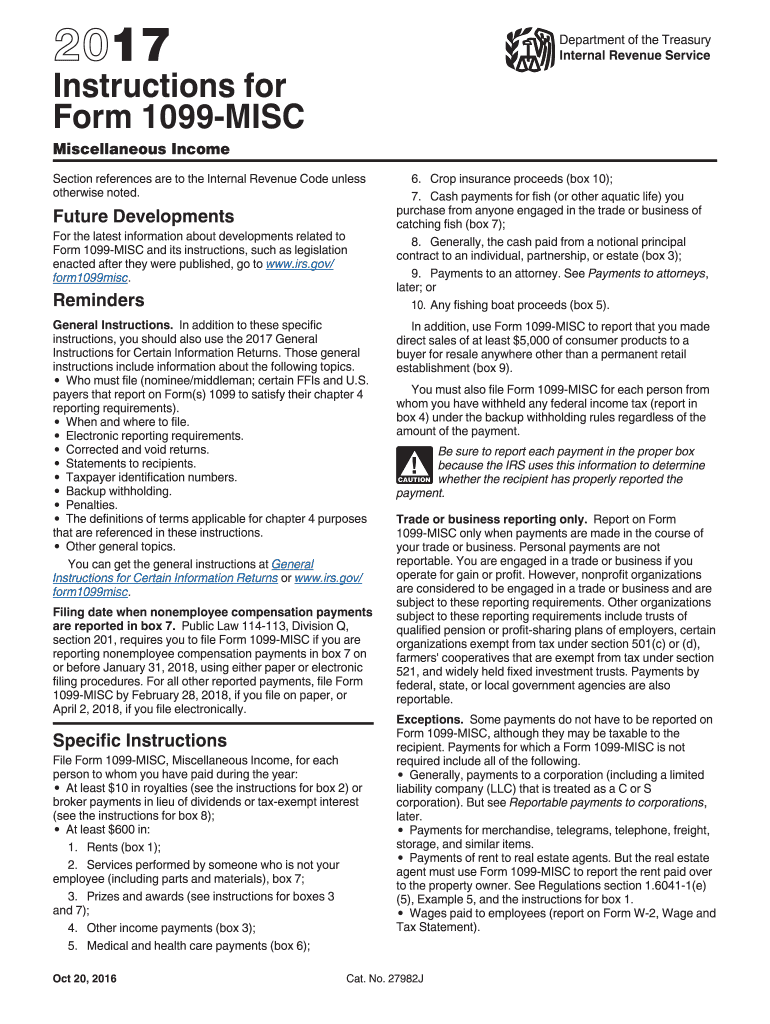

The 1099 form is a crucial document used in the United States for reporting various types of income other than wages, salaries, and tips. Specifically, the 1099-MISC and 1099-NEC forms are commonly utilized to report payments made to independent contractors and freelancers. Although employees typically receive a W-2 form, understanding the 1099 form is important for businesses that engage with non-employee workers. This form helps ensure compliance with IRS regulations and provides a clear record of payments made throughout the year.

Steps to Complete the 1099 Form for Employees

Filling out a 1099 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the recipient's name, address, and Social Security number or Employer Identification Number (EIN). Next, determine the total amount paid to the individual or business during the tax year. Then, select the appropriate 1099 form based on the type of payment. For example, use the 1099-NEC for reporting non-employee compensation. Finally, fill out the form accurately, ensuring all details are correct before submitting it to the IRS and providing a copy to the recipient.

Key Elements of the 1099 Form for Employees

Several key elements must be included when filling out a 1099 form. These include:

- Payer Information: The name, address, and Tax Identification Number (TIN) of the business issuing the form.

- Recipient Information: The name, address, and Social Security number or EIN of the individual or business receiving the payment.

- Payment Amount: The total amount paid to the recipient during the tax year.

- Form Type: Indicate which type of 1099 form is being used, such as 1099-NEC for non-employee compensation.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting 1099 forms. It is essential to adhere to these guidelines to avoid penalties. For instance, the IRS requires that 1099 forms be filed by January thirty-first of the following year for most types of payments. Additionally, businesses must ensure that they have accurate taxpayer identification information for recipients to avoid issues with reporting. Familiarizing yourself with the IRS instructions for the specific 1099 form being used can help ensure compliance and accuracy.

Filing Deadlines / Important Dates

Filing deadlines for 1099 forms are critical to ensure compliance with IRS regulations. Generally, the deadline for submitting 1099 forms to the IRS is January thirty-first of the year following the tax year in question. If you are filing electronically, the deadline may extend to March second. It is also important to provide a copy to the recipient by the same January thirty-first deadline. Keeping track of these dates helps avoid penalties and ensures that all parties have the necessary documentation for tax purposes.

Penalties for Non-Compliance

Failure to comply with 1099 reporting requirements can result in significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to file altogether. Penalties can vary based on how late the form is filed, ranging from a few hundred dollars to several thousand for larger businesses. Additionally, incorrect information may lead to audits or further scrutiny from the IRS. Understanding these potential penalties emphasizes the importance of accurate and timely filing of 1099 forms.

Quick guide on how to complete how to fill out a 1099 form for employees 2017

Complete How To Fill Out A 1099 Form For Employees seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to generate, amend, and electronically sign your documents quickly and without hassle. Manage How To Fill Out A 1099 Form For Employees on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign How To Fill Out A 1099 Form For Employees effortlessly

- Find How To Fill Out A 1099 Form For Employees and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important parts of your documents or redact confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign How To Fill Out A 1099 Form For Employees while ensuring outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to fill out a 1099 form for employees 2017

Create this form in 5 minutes!

How to create an eSignature for the how to fill out a 1099 form for employees 2017

How to generate an electronic signature for the How To Fill Out A 1099 Form For Employees 2017 in the online mode

How to make an eSignature for the How To Fill Out A 1099 Form For Employees 2017 in Google Chrome

How to make an eSignature for signing the How To Fill Out A 1099 Form For Employees 2017 in Gmail

How to create an electronic signature for the How To Fill Out A 1099 Form For Employees 2017 right from your mobile device

How to create an eSignature for the How To Fill Out A 1099 Form For Employees 2017 on iOS

How to make an electronic signature for the How To Fill Out A 1099 Form For Employees 2017 on Android

People also ask

-

What features does airSlate SignNow offer for filling out a 1099 form for employees?

airSlate SignNow provides a user-friendly platform to easily fill out a 1099 form for employees. With customizable templates and eSignature capabilities, it streamlines the entire process, ensuring accuracy and compliance. Plus, it offers real-time tracking and notifications for enhanced management.

-

How does airSlate SignNow help in understanding how to fill out a 1099 form for employees?

airSlate SignNow simplifies the process of filling out a 1099 form for employees with guided workflows and intuitive design. The platform includes helpful tips and prompts that ensure all necessary information is correctly entered. This educational aspect helps users learn how to fill out a 1099 form efficiently.

-

Is airSlate SignNow affordable for small businesses looking to fill out a 1099 form for employees?

Yes, airSlate SignNow offers a cost-effective solution for small businesses needing to fill out a 1099 form for employees. With various pricing plans available, businesses can choose a plan that fits their budget while accessing essential features. The value provided enhances workflow efficiency at a competitive price.

-

What integrations does airSlate SignNow support for filling out a 1099 form for employees?

airSlate SignNow integrates seamlessly with popular accounting and payroll software, making it easier to fill out a 1099 form for employees. These integrations streamline data transfer, reduce errors, and save time for businesses. Users can work within their existing systems effortlessly.

-

Can airSlate SignNow assist with multiple 1099 forms for different employees?

Absolutely, airSlate SignNow is designed to handle multiple 1099 forms for different employees simultaneously. Users can create and manage multiple documents, ensuring that all employees receive the necessary forms. This feature is particularly beneficial during tax season.

-

What security measures does airSlate SignNow implement for sensitive employee data?

Security is paramount at airSlate SignNow, especially when dealing with sensitive information like 1099 forms for employees. The platform employs robust encryption, secure cloud storage, and compliance with industry standards to protect user data. Users can confidently fill out a 1099 form without compromising security.

-

How can airSlate SignNow improve the process of filling out 1099 forms for employees?

airSlate SignNow enhances the 1099 form filling process for employees by providing a centralized platform for document management. With features like eSignatures, real-time collaboration, and automated reminders, it simplifies the entire workflow. Businesses can save time and reduce errors in their filing process.

Get more for How To Fill Out A 1099 Form For Employees

Find out other How To Fill Out A 1099 Form For Employees

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast