Instructions ForForms 1099 MISCand 1099 NEC Instructions ForForms 1099 MISCand 1099 NEC, Miscellaneous Income AndNonemployee Com 2020

Understanding 1099 Instructions for Forms MISC and NEC

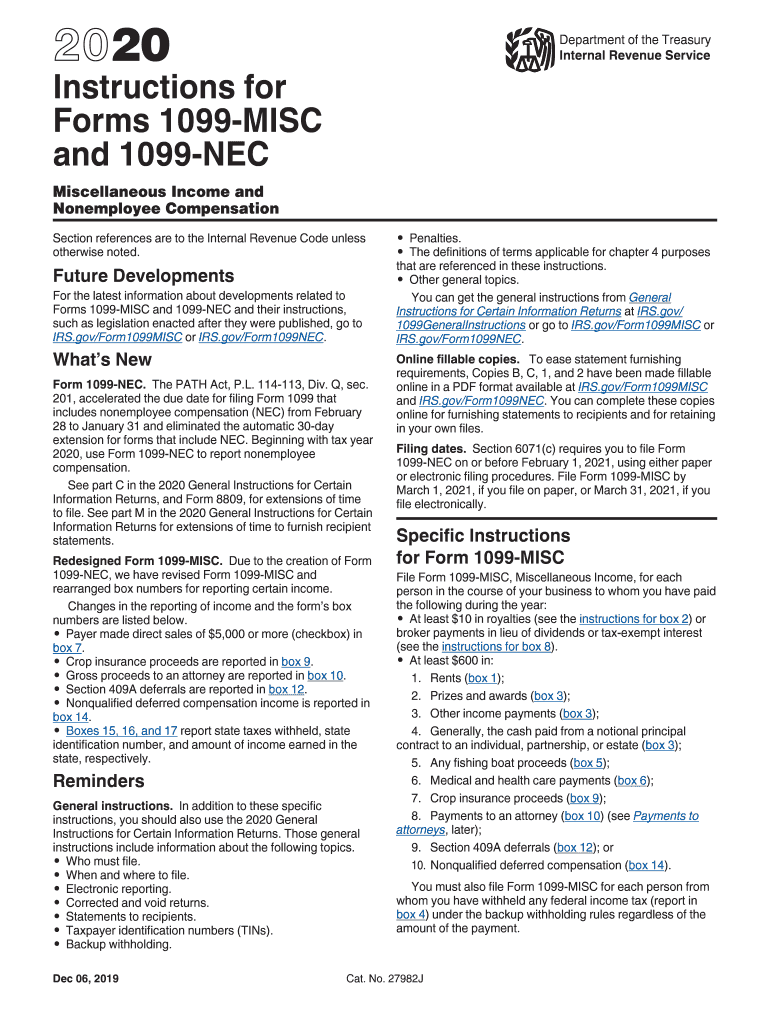

The 1099 instructions provide essential guidance for completing Forms 1099 MISC and 1099 NEC, which report miscellaneous income and nonemployee compensation, respectively. These forms are crucial for independent contractors and businesses that pay them. The instructions detail who needs to file these forms, what information must be included, and how to ensure compliance with IRS regulations.

Steps to Complete the 1099 Forms

Completing the 1099 MISC and 1099 NEC forms involves several key steps:

- Gather necessary information about the payee, including their name, address, and taxpayer identification number (TIN).

- Determine the type of income being reported and select the appropriate form.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for errors before submission.

- File the form with the IRS and provide a copy to the payee by the specified deadline.

IRS Guidelines for Filing

The IRS provides specific guidelines regarding the filing of 1099 forms. It is important to adhere to these guidelines to avoid penalties. Key points include:

- Forms must be filed by January 31 of the year following the tax year in which the payments were made.

- Ensure that all information is accurate and matches IRS records.

- Use the correct form variant based on the type of payment.

Penalties for Non-Compliance

Failure to comply with 1099 filing requirements can result in significant penalties. The IRS imposes fines based on how late the forms are filed:

- $50 per form if filed within 30 days of the due date.

- $100 per form if filed more than 30 days late but by August 1.

- $260 per form if filed after August 1 or not filed at all.

Eligibility Criteria for Issuing 1099 Forms

Not every payment requires a 1099 form. The eligibility criteria include:

- Payments made to independent contractors or freelancers totaling $600 or more in a calendar year.

- Certain types of payments, such as rents, prizes, and awards.

- Payments made to corporations may not require a 1099, except in specific cases.

Obtaining the 1099 Instructions

The 1099 instructions can be obtained directly from the IRS website or through tax preparation software. These resources provide the most current information and updates regarding filing requirements and procedures. Always ensure you are referencing the latest version of the instructions for accuracy.

Quick guide on how to complete 2020 instructions forforms 1099 miscand 1099 nec instructions forforms 1099 miscand 1099 nec miscellaneous income

Complete Instructions ForForms 1099 MISCand 1099 NEC Instructions ForForms 1099 MISCand 1099 NEC, Miscellaneous Income AndNonemployee Com effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly solution to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without interruptions. Manage Instructions ForForms 1099 MISCand 1099 NEC Instructions ForForms 1099 MISCand 1099 NEC, Miscellaneous Income AndNonemployee Com on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Instructions ForForms 1099 MISCand 1099 NEC Instructions ForForms 1099 MISCand 1099 NEC, Miscellaneous Income AndNonemployee Com with ease

- Locate Instructions ForForms 1099 MISCand 1099 NEC Instructions ForForms 1099 MISCand 1099 NEC, Miscellaneous Income AndNonemployee Com and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from your chosen device. Modify and electronically sign Instructions ForForms 1099 MISCand 1099 NEC Instructions ForForms 1099 MISCand 1099 NEC, Miscellaneous Income AndNonemployee Com and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions forforms 1099 miscand 1099 nec instructions forforms 1099 miscand 1099 nec miscellaneous income

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions forforms 1099 miscand 1099 nec instructions forforms 1099 miscand 1099 nec miscellaneous income

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What are the basic 1099 instructions for using airSlate SignNow?

To use airSlate SignNow for your 1099 instructions, start by uploading your 1099 forms to the platform. You can then easily add recipients and customize the eSignature process to meet your needs. Once completed, the signed documents can be securely stored and shared.

-

How does airSlate SignNow simplify the 1099 instructions process?

airSlate SignNow simplifies 1099 instructions by allowing you to automate document workflows and eliminate manual processes. The platform’s intuitive interface lets you easily send forms for electronic signatures, speeding up the process signNowly. This not only saves time but also reduces the risk of errors.

-

Are there any costs associated with managing 1099 instructions on airSlate SignNow?

Yes, while airSlate SignNow offers a cost-effective solution, there are pricing plans tailored to your needs. These plans include various features for managing documents, including 1099 instructions. You can choose a plan that fits your business size and frequency of use.

-

Can I integrate airSlate SignNow with other tools to manage 1099 instructions?

Absolutely! airSlate SignNow offers integrations with various third-party applications that can enhance your management of 1099 instructions. By connecting with accounting software or CRMs, you can streamline your workflow and keep all your documents organized.

-

What are the benefits of using airSlate SignNow for 1099 instructions?

Using airSlate SignNow for 1099 instructions provides several benefits, such as ease of use, enhanced security, and fast turnaround times. The platform ensures that your sensitive information remains secure while providing a user-friendly experience. This allows businesses to process 1099 forms efficiently.

-

Is airSlate SignNow compliant with IRS requirements for 1099 instructions?

Yes, airSlate SignNow complies with IRS regulations, making it suitable for handling 1099 instructions. The eSigning process is legally binding and meets all necessary requirements set forth by the IRS for electronic signatures. This provides peace of mind when sending your 1099 forms.

-

What features are specifically useful for 1099 instructions in airSlate SignNow?

Key features for 1099 instructions in airSlate SignNow include customizable templates, automated reminders, and real-time tracking of document status. These features ensure that you can manage your 1099 forms effectively, ensuring that deadlines are met and all parties involved can easily access the documents.

Get more for Instructions ForForms 1099 MISCand 1099 NEC Instructions ForForms 1099 MISCand 1099 NEC, Miscellaneous Income AndNonemployee Com

Find out other Instructions ForForms 1099 MISCand 1099 NEC Instructions ForForms 1099 MISCand 1099 NEC, Miscellaneous Income AndNonemployee Com

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms