Form 656 B Rev 2 Form 656 Booklet Offer in Compromise 2016

What is the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise

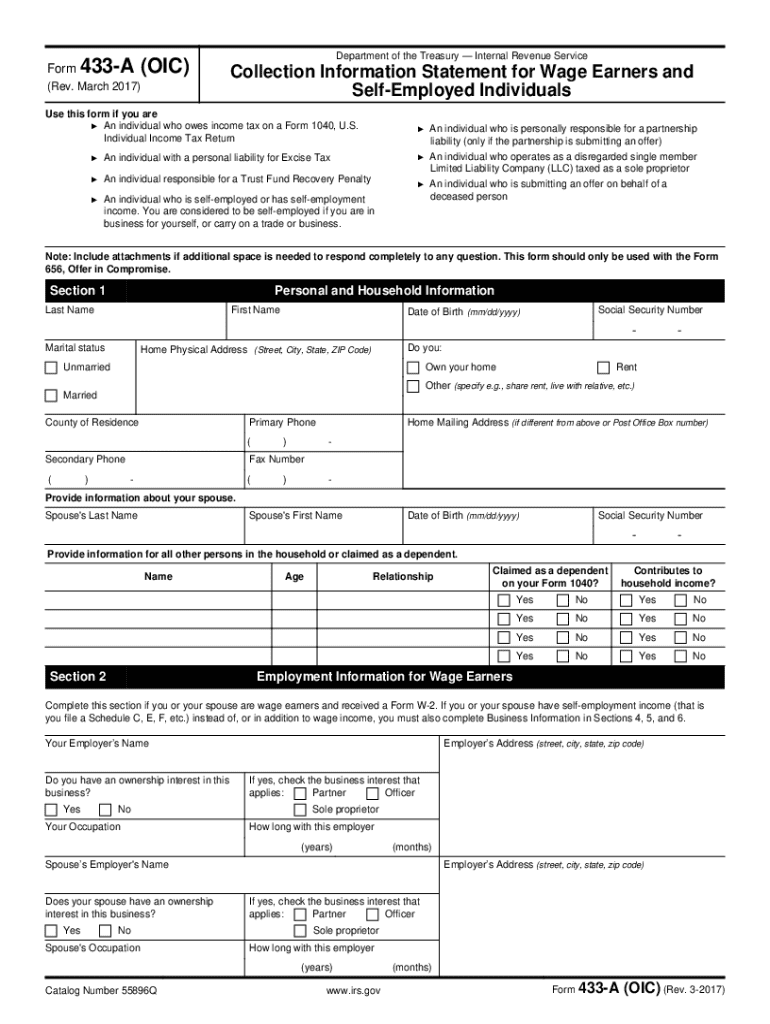

The Form 656 B Rev 2, also known as the Form 656 Booklet Offer In Compromise, is a document used by taxpayers in the United States to negotiate a settlement with the Internal Revenue Service (IRS) regarding their tax liabilities. This form allows individuals to propose a reduced amount to settle their tax debts when they are unable to pay the full amount owed. The Offer In Compromise program is designed for taxpayers who demonstrate that paying the full tax liability would cause financial hardship.

How to use the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise

Using the Form 656 B Rev 2 involves several steps. First, taxpayers must determine their eligibility based on their financial situation. Once eligibility is established, the taxpayer can fill out the form, providing detailed information about their income, expenses, and assets. It is essential to be thorough and accurate when completing the form, as any discrepancies can lead to delays or denials. After filling out the form, it should be submitted to the IRS along with the required payment and supporting documentation.

Steps to complete the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise

Completing the Form 656 B Rev 2 requires careful attention to detail. Here are the steps to follow:

- Review the eligibility criteria to ensure you qualify for an Offer In Compromise.

- Gather necessary financial documents, including income statements, expense reports, and asset valuations.

- Fill out the form accurately, providing all required information, including personal details and financial data.

- Calculate the offer amount based on your ability to pay, ensuring it is reasonable and justifiable.

- Submit the completed form along with any required fees and supporting documents to the IRS.

Legal use of the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise

The legal use of the Form 656 B Rev 2 is governed by IRS regulations. It is essential for taxpayers to understand that submitting this form does not automatically guarantee acceptance of the offer. The IRS will review the submitted information and may request additional documentation. If the offer is accepted, it becomes a legally binding agreement, and the taxpayer must adhere to the terms outlined in the acceptance letter.

Eligibility Criteria

To qualify for submitting the Form 656 B Rev 2, taxpayers must meet specific eligibility criteria set by the IRS. These criteria include demonstrating an inability to pay the full tax liability, having filed all required tax returns, and not being in an open bankruptcy proceeding. Additionally, the taxpayer's financial situation must show that paying the full amount would create undue hardship.

Required Documents

When submitting the Form 656 B Rev 2, several documents are required to support the claim. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and living costs.

- Asset statements, such as bank statements or property valuations.

- Any other relevant financial information that demonstrates the taxpayer's financial situation.

Quick guide on how to complete form 656 b rev 2 2016 form 656 booklet offer in compromise

Accomplish Form 656 B Rev 2 Form 656 Booklet Offer In Compromise effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Form 656 B Rev 2 Form 656 Booklet Offer In Compromise on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Form 656 B Rev 2 Form 656 Booklet Offer In Compromise effortlessly

- Find Form 656 B Rev 2 Form 656 Booklet Offer In Compromise and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, arduous form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Form 656 B Rev 2 Form 656 Booklet Offer In Compromise and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 b rev 2 2016 form 656 booklet offer in compromise

Create this form in 5 minutes!

How to create an eSignature for the form 656 b rev 2 2016 form 656 booklet offer in compromise

How to create an electronic signature for your Form 656 B Rev 2 2016 Form 656 Booklet Offer In Compromise online

How to make an eSignature for your Form 656 B Rev 2 2016 Form 656 Booklet Offer In Compromise in Chrome

How to create an electronic signature for signing the Form 656 B Rev 2 2016 Form 656 Booklet Offer In Compromise in Gmail

How to generate an electronic signature for the Form 656 B Rev 2 2016 Form 656 Booklet Offer In Compromise from your smartphone

How to create an electronic signature for the Form 656 B Rev 2 2016 Form 656 Booklet Offer In Compromise on iOS

How to create an electronic signature for the Form 656 B Rev 2 2016 Form 656 Booklet Offer In Compromise on Android

People also ask

-

What is the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise?

The Form 656 B Rev 2 Form 656 Booklet Offer In Compromise is a critical document used by individuals to negotiate tax debts with the IRS. This form allows taxpayers to propose a settlement for less than the total amount owed. It includes comprehensive guidelines to navigate the Offer In Compromise process successfully.

-

How does airSlate SignNow facilitate the signing of the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise?

airSlate SignNow simplifies the signing process of the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise by providing a secure and user-friendly platform for e-signatures. Users can easily upload the form, invite signers, and track the signing progress, all in a streamlined manner. This ensures a hassle-free experience for completing important tax documents.

-

Are there any costs associated with using airSlate SignNow for the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise?

Yes, airSlate SignNow offers various subscription plans tailored to different business needs, allowing you to choose the best value for sending and eSigning documents like the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise. Pricing is competitive, and you can benefit from a free trial to evaluate the features before committing. This ensures you get the best return on investment.

-

What features does airSlate SignNow provide for the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise?

airSlate SignNow includes various features that enhance the efficiency of managing the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise. These features include customizable templates, bulk sending options, real-time notifications, and a secure audit trail. Together, these tools ensure your documents are handled accurately and efficiently.

-

How can integrating airSlate SignNow optimize the compliance process for the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise?

By integrating airSlate SignNow with your existing systems, you can ensure compliance with IRS regulations while managing the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise. This integration allows for automated data capture, reducing the risk of errors. Moreover, it streamlines workflow, ensuring your submissions are both timely and accurate.

-

What benefits can I expect from using airSlate SignNow for tax-related documents like the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise?

Using airSlate SignNow for tax documents such as the Form 656 B Rev 2 Form 656 Booklet Offer In Compromise offers numerous benefits, including increased efficiency, cost savings, and enhanced security. The platform allows you to send and sign documents quickly, reducing paper waste and speeding up the filing process. Additionally, robust security measures protect your sensitive information.

-

Can I track the status of my Form 656 B Rev 2 Form 656 Booklet Offer In Compromise once sent through airSlate SignNow?

Absolutely! airSlate SignNow provides a tracking feature that allows you to monitor the status of your Form 656 B Rev 2 Form 656 Booklet Offer In Compromise after sending it. You will receive real-time notifications when the document is viewed or signed, ensuring you are always aware of its progress throughout the signing process.

Get more for Form 656 B Rev 2 Form 656 Booklet Offer In Compromise

- Src proposal form 2000 san francisco bay area science fair sfbasf

- Phs 1637 form

- Printable nursing home evaluation form legacy lawyers

- Home loan form nri_a42_210607qxd

- Grant application da davidson amp co form

- Pistons custom form

- Class registration form community scholar university of virginia scps virginia

- Lost stolen county property report name department form

Find out other Form 656 B Rev 2 Form 656 Booklet Offer In Compromise

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now