Form 656 B Rev 4 Form 656 Booklet Offer in Compromise 2022

Understanding the Form 656 B

The Form 656 B, also known as the IRS forgiveness form, is essential for individuals seeking an Offer in Compromise (OIC) with the Internal Revenue Service (IRS). This form allows taxpayers to settle their tax debts for less than the full amount owed. The 656 B booklet provides detailed instructions and guidelines for completing the form, ensuring that all necessary information is included for a successful application. Understanding the purpose and requirements of the Form 656 B is crucial for anyone looking to alleviate their tax burden through this program.

Steps to Complete the Form 656 B

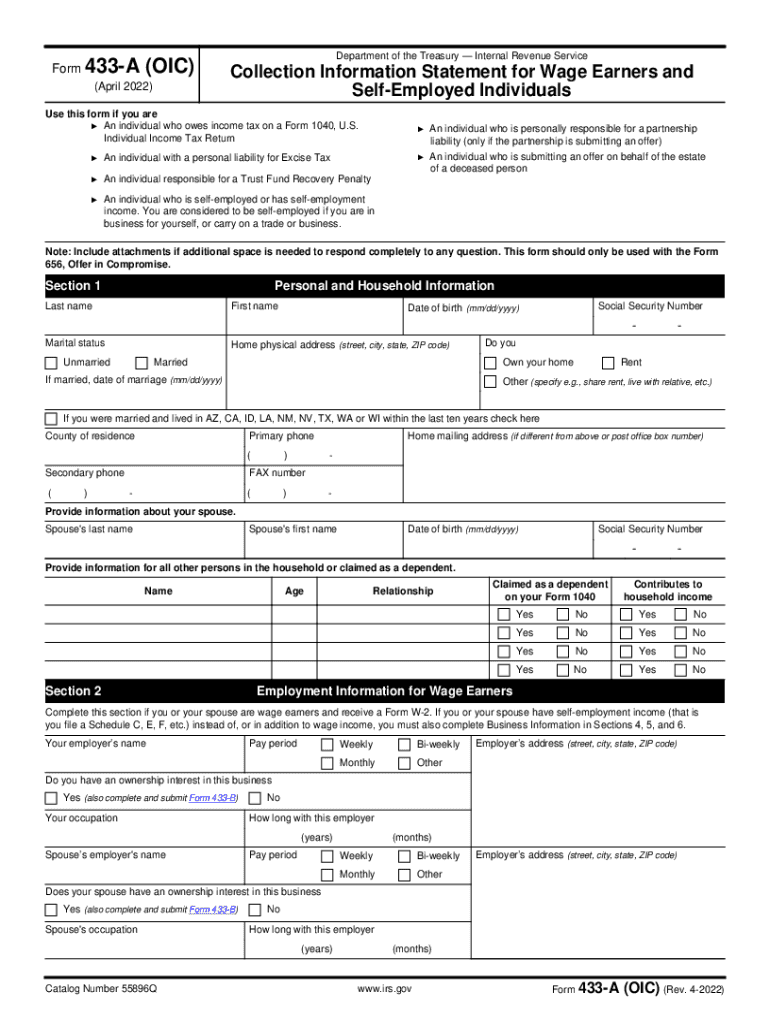

Completing the Form 656 B involves several important steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary financial documents, including income statements, bank statements, and information about assets and liabilities. Next, fill out the form carefully, providing detailed information about your financial situation. Be sure to include any required attachments, such as the IRS Form 433-A (OIC) or Form 433-B (OIC), which provide a comprehensive overview of your financial status. After completing the form, review it thoroughly for any errors or omissions before submission.

Eligibility Criteria for the Form 656 B

To qualify for the Offer in Compromise using the Form 656 B, taxpayers must meet specific eligibility criteria set forth by the IRS. Generally, individuals must demonstrate an inability to pay the full tax liability or that paying the full amount would create financial hardship. The IRS evaluates factors such as income, expenses, asset equity, and overall financial situation. Additionally, taxpayers must be current on all filing and payment requirements to be considered for an OIC. Understanding these criteria is vital for determining if this option is suitable for your financial circumstances.

Required Documents for Submission

When submitting the Form 656 B, certain documents are required to support your application. These typically include the completed Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses, which detail your financial situation. Additionally, you may need to provide proof of income, such as pay stubs or tax returns, as well as documentation of any assets and liabilities. Ensuring that all required documents are included with your submission can significantly impact the processing time and outcome of your Offer in Compromise.

Filing Deadlines for the Form 656 B

It is essential to be aware of the filing deadlines associated with the Form 656 B to avoid complications in the application process. The IRS does not have a specific deadline for submitting an Offer in Compromise; however, it is advisable to file as soon as possible to minimize interest and penalties on outstanding tax debts. Additionally, if you are under a payment plan or facing collection actions, timely submission of the form can help halt those actions while your offer is being considered.

Form Submission Methods

The Form 656 B can be submitted to the IRS through various methods, depending on your preference and circumstances. Taxpayers can choose to file the form electronically using IRS e-file options or submit it via mail. If you opt for mailing, ensure that you send the form to the correct address specified in the instructions, as this can vary based on your location and the type of offer you are submitting. In-person submissions are also possible at designated IRS offices, though appointments may be necessary.

IRS Guidelines for the Form 656 B

The IRS provides comprehensive guidelines for completing and submitting the Form 656 B, which are crucial for ensuring compliance and increasing the likelihood of acceptance. These guidelines outline the necessary steps for filling out the form, the documentation required, and the evaluation process for offers. Familiarizing yourself with these guidelines can help streamline the application process and clarify any questions you may have about your eligibility or the information needed to support your offer.

Quick guide on how to complete form 656 b rev 4 2022 form 656 booklet offer in compromise

Complete Form 656 B Rev 4 Form 656 Booklet Offer In Compromise effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage Form 656 B Rev 4 Form 656 Booklet Offer In Compromise on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 656 B Rev 4 Form 656 Booklet Offer In Compromise with ease

- Obtain Form 656 B Rev 4 Form 656 Booklet Offer In Compromise and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, slow form navigation, or mistakes that require reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form 656 B Rev 4 Form 656 Booklet Offer In Compromise and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 b rev 4 2022 form 656 booklet offer in compromise

Create this form in 5 minutes!

People also ask

-

What is the IRS forgiveness form?

The IRS forgiveness form is a document used to request loan forgiveness for certain business loans. This form is critical for businesses looking to relieve their financial obligations post-COVID-19. Understanding the IRS forgiveness form can ensure you maximize your benefits and comply with legal requirements.

-

How can airSlate SignNow help with the IRS forgiveness form?

AirSlate SignNow streamlines the process of completing and submitting the IRS forgiveness form. With our easy-to-use platform, you can quickly fill out the form, get it signed electronically, and send it efficiently. This eliminates the stress of paperwork and tracks your submission seamlessly.

-

What features does airSlate SignNow offer for managing the IRS forgiveness form?

Our platform offers features like customizable templates, real-time tracking, and secure e-signatures, making it ideal for managing the IRS forgiveness form. You can easily create a workflow that includes all necessary documentation, ensuring nothing gets overlooked. These features simplify the process and enhance your compliance.

-

Is airSlate SignNow affordable for small businesses needing the IRS forgiveness form?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage the IRS forgiveness form. With flexible pricing plans tailored to fit various budgets, our platform ensures that you can eSign and send documents without breaking the bank. Plus, our time-saving features can lead to reduced administrative costs.

-

Can I integrate airSlate SignNow with other tools while working on the IRS forgiveness form?

Absolutely! AirSlate SignNow seamlessly integrates with popular software like Google Drive, Salesforce, and many others, enhancing your productivity when dealing with the IRS forgiveness form. This allows you to centralize your documentation and streamline your workflows without switching between different tools.

-

What are the benefits of using airSlate SignNow for the IRS forgiveness form?

Using airSlate SignNow for the IRS forgiveness form brings numerous benefits, including increased speed, security, and convenience. You can complete the form faster with e-signatures, reducing turnaround time for approvals. Additionally, our robust security measures protect your sensitive information throughout the process.

-

How do I get started with airSlate SignNow for the IRS forgiveness form?

Getting started with airSlate SignNow is straightforward. Simply sign up for an account on our website, and you can immediately access tools for the IRS forgiveness form. We also offer tutorials and customer support to help you make the most out of your experience.

Get more for Form 656 B Rev 4 Form 656 Booklet Offer In Compromise

Find out other Form 656 B Rev 4 Form 656 Booklet Offer In Compromise

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement