Form 656 Irs 2019

What is the Form 656 IRS?

The Form 656 is an official document used by taxpayers in the United States to apply for an Offer in Compromise (OIC) with the Internal Revenue Service (IRS). This form allows individuals to settle their tax debts for less than the full amount owed. The IRS considers various factors, including the taxpayer's ability to pay, income, expenses, and asset equity when evaluating the application. The 2018 version of the form includes specific instructions and requirements that applicants must follow to ensure their submission is complete and compliant with IRS guidelines.

Steps to Complete the Form 656 IRS

Completing the Form 656 involves several important steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements, bank statements, and details of assets. Next, fill out the form with precise information regarding your financial situation, including your offer amount and the reasons for your inability to pay the full tax liability. It is crucial to provide a detailed explanation of your circumstances and attach any required documentation. Finally, review the form for completeness and accuracy before submission to avoid delays in processing.

How to Obtain the Form 656 IRS

The Form 656 can be obtained directly from the IRS website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Alternatively, individuals can request a physical copy by contacting the IRS directly. It is important to ensure that you are using the most current version of the form, as updates may occur that could affect the application process.

Legal Use of the Form 656 IRS

The Form 656 is legally binding once it is signed and submitted to the IRS. For the form to be considered valid, it must meet specific requirements set forth by the IRS, including proper signatures and the inclusion of all necessary documentation. Additionally, the submission of the form must comply with eSignature regulations if completed electronically. Using a reliable electronic signature platform can enhance the legal standing of your submission by ensuring compliance with relevant laws.

Eligibility Criteria for the Form 656 IRS

To qualify for an Offer in Compromise using the Form 656, taxpayers must meet certain eligibility criteria established by the IRS. These criteria include demonstrating an inability to pay the full amount of tax owed, showing that the offer is in the best interest of both the taxpayer and the IRS, and providing complete financial disclosure. Taxpayers must also be current with all filing and payment requirements to be considered for an OIC.

Form Submission Methods

The Form 656 can be submitted to the IRS through various methods. Taxpayers have the option to file the form online using a secure electronic signature platform, or they can mail a printed copy to the appropriate IRS address. In some cases, individuals may also deliver the form in person at a local IRS office. It is essential to follow the submission guidelines carefully to ensure timely processing.

Required Documents for the Form 656 IRS

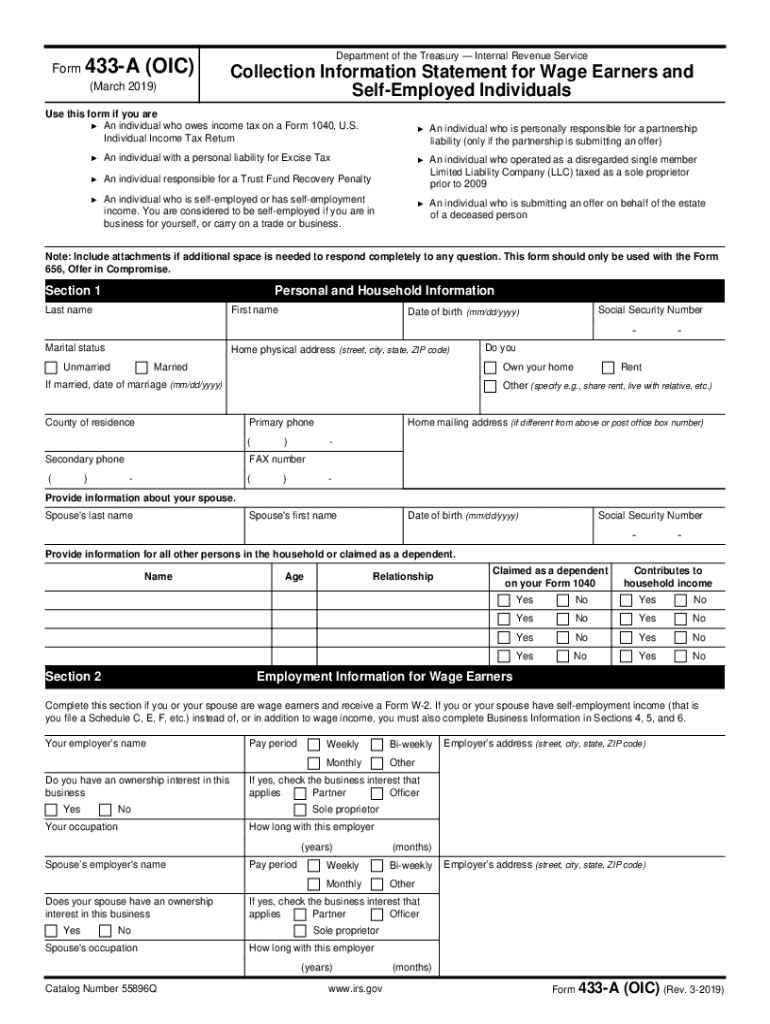

When submitting the Form 656, taxpayers must include several required documents to support their application. These documents typically include proof of income, a completed Form 433-A or Form 433-B (Collection Information Statement), and any additional financial statements that provide a comprehensive view of the taxpayer's financial situation. Ensuring that all required documentation is included can significantly impact the approval process.

Quick guide on how to complete form 656 irs

Complete Form 656 Irs effortlessly on any platform

Managing documents online has gained traction among businesses and individuals alike. It presents an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle Form 656 Irs on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign Form 656 Irs with ease

- Access Form 656 Irs and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or blackout sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow attends to all your document management needs in just a few clicks from any device of your preference. Adjust and electronically sign Form 656 Irs to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 irs

Create this form in 5 minutes!

How to create an eSignature for the form 656 irs

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Form 656 IRS and why is it important?

Form 656 IRS is a crucial document used to apply for an Offer in Compromise with the IRS. This form allows taxpayers to settle their tax debts for less than the full amount owed. Understanding how to properly complete and submit Form 656 IRS can signNowly impact your financial situation.

-

How can airSlate SignNow help with Form 656 IRS?

airSlate SignNow provides an easy-to-use platform for securely eSigning and sending Form 656 IRS. With our service, you can ensure that your form is completed accurately and submitted on time, streamlining the process of dealing with the IRS.

-

Is there a cost associated with using airSlate SignNow for Form 656 IRS?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. We provide a cost-effective solution for managing documents, including Form 656 IRS, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Form 656 IRS?

airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and real-time tracking of your Form 656 IRS submission. These features make it easier to manage your documents and ensure compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other software for filing Form 656 IRS?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow when filing Form 656 IRS. This integration helps you manage your documents more efficiently and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for Form 656 IRS?

Using airSlate SignNow for Form 656 IRS offers numerous benefits including speed, security, and ease of use. You can quickly send and receive signed documents, keeping your negotiation with the IRS efficient and organized.

-

How does airSlate SignNow ensure the security of my Form 656 IRS?

airSlate SignNow prioritizes your security by employing industry-standard encryption and secure data storage methods. When you use our platform for Form 656 IRS, you can trust that your sensitive information is protected throughout the signing process.

Get more for Form 656 Irs

- Tsp1 2015 2019 form

- Ttb form

- Kinship guardianship form

- Federal direct consolidation loan application and promissory note william d ford federal direct loan program form

- Form prevailing 2016 2019

- Nz visitor application 2018 2019 form

- Laciv 244 comp w gen ord for lim juris ud trial readiness new 10 01 14docx form

- Ucs rev 62016 eff 8116 supreme court of the state nycourts form

Find out other Form 656 Irs

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter