Irs Form 656 2014

What is the IRS Form 656

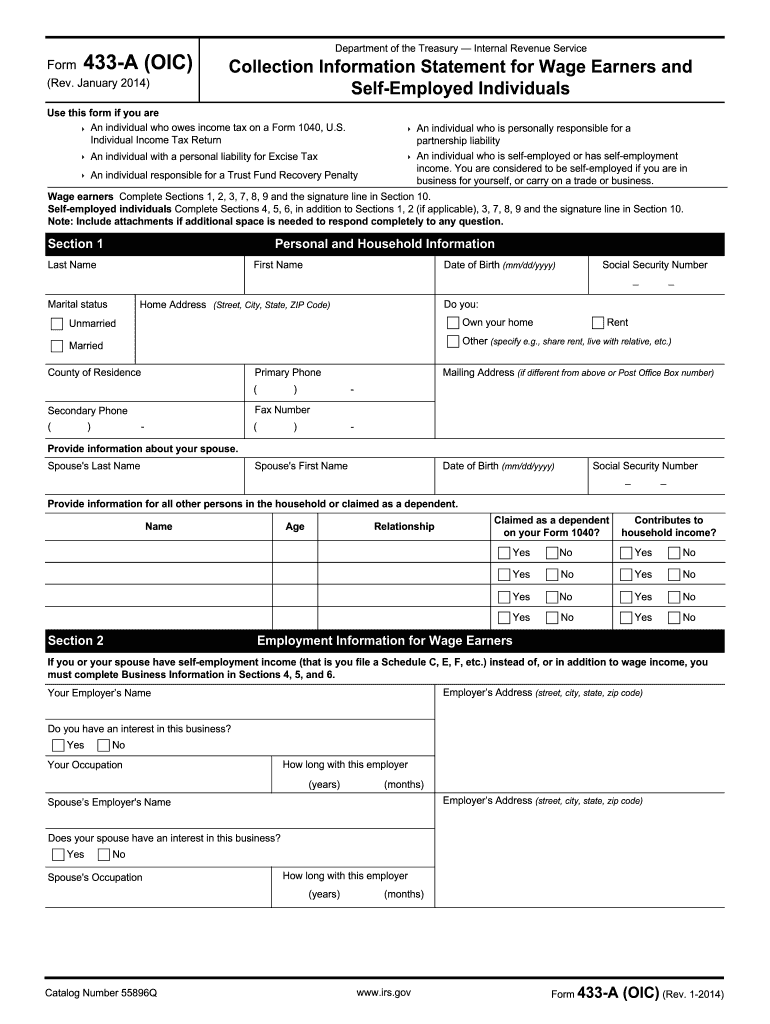

The IRS Form 656 is an official document used by taxpayers in the United States to apply for an offer in compromise (OIC). This form allows individuals to settle their tax debts for less than the full amount owed. It is particularly useful for taxpayers who cannot pay their tax liabilities in full due to financial hardship. The form requires detailed financial information to assess the taxpayer's ability to pay and the legitimacy of the offer.

How to Obtain the IRS Form 656

To obtain the IRS Form 656, taxpayers can visit the official IRS website, where the form is available for download in PDF format. Additionally, individuals can request a physical copy by calling the IRS or visiting a local IRS office. It is essential to ensure that you are using the most current version of the form to avoid any issues during the submission process.

Steps to Complete the IRS Form 656

Completing the IRS Form 656 involves several key steps:

- Begin by providing your personal information, including your name, address, and Social Security number.

- Detail your financial situation by filling out the financial disclosure section, which includes income, expenses, assets, and liabilities.

- Indicate the amount you are offering to pay as part of the compromise.

- Sign and date the form, ensuring that all information is accurate and complete.

Legal Use of the IRS Form 656

The IRS Form 656 is legally binding once submitted and accepted by the IRS. It is crucial that all information provided is truthful and accurate, as any discrepancies can lead to penalties or rejection of the offer. The form must be accompanied by the appropriate fee and any supporting documentation that verifies the financial information disclosed.

Eligibility Criteria for the IRS Form 656

To be eligible to submit the IRS Form 656, taxpayers must meet specific criteria. These include having filed all required tax returns and not being in an open bankruptcy proceeding. Additionally, the taxpayer's offer must reflect their reasonable collection potential, which is assessed based on their financial situation. Understanding these criteria is vital for a successful application.

Form Submission Methods

Taxpayers can submit the IRS Form 656 through various methods. The form can be filed online using the IRS e-Services, which provides a secure and efficient way to submit documents. Alternatively, individuals may choose to mail the completed form to the appropriate IRS address or deliver it in person to a local IRS office. Each submission method has its own processing times and requirements.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of filing deadlines associated with the IRS Form 656. Generally, there are no specific deadlines for submitting an offer in compromise, but timely submission can affect the resolution of tax debts. Taxpayers should also consider the expiration of the statute of limitations on collections, which can impact their offer's acceptance.

Quick guide on how to complete 2014 irs form 656

Effortlessly Complete Irs Form 656 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 656 on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign Irs Form 656 with Ease

- Obtain Irs Form 656 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal weight as an original handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Irs Form 656 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs form 656

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs form 656

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is IRS Form 656 and how can airSlate SignNow help?

IRS Form 656 is a form used to apply for an Offer in Compromise with the IRS. airSlate SignNow streamlines the signing process for IRS Form 656, allowing users to easily send and eSign the document online, ensuring quick submission to the IRS.

-

How does airSlate SignNow ensure the security of my IRS Form 656?

When you use airSlate SignNow to manage your IRS Form 656, your documents are protected with advanced encryption and security protocols. This ensures that your sensitive information remains confidential and secure during the eSigning process.

-

Is there a cost to using airSlate SignNow for IRS Form 656?

airSlate SignNow offers a cost-effective solution with various pricing plans tailored to meet your needs. You can choose a plan that suits your business requirements while efficiently managing documents like IRS Form 656 with ease.

-

Can I integrate airSlate SignNow with other software to manage IRS Form 656?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for managing IRS Form 656. You can connect it with CRM software, cloud storage solutions, and more, making it easier to handle all your document needs.

-

What features does airSlate SignNow offer for IRS Form 656?

airSlate SignNow provides features like customizable templates, document tracking, and in-app notifications, specifically useful for IRS Form 656. These tools help you stay organized and ensure that your submissions are timely and accurate.

-

How can airSlate SignNow benefit my business when handling IRS Form 656?

By using airSlate SignNow, your business can save time and reduce errors when handling IRS Form 656. The platform simplifies the document management process, allowing for faster approvals and improved efficiency in your workflow.

-

Is it easy to use airSlate SignNow for IRS Form 656?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple to prepare, send, and eSign IRS Form 656. Even those with minimal technical skills can navigate the platform effortlessly.

Get more for Irs Form 656

- Required documents that you will need to attach when submitting this form r r r r r copy of florida health insurance license

- Oxygen prescription template form

- Existing agency info sheet revised 07 12 form

- Allianz withdrawal form

- Pulmonary patient history form

- 2840 legacy drive suite 300 frisco tx 75034 form

- Sbli proxy voting form

- Penn mutual certification of trust pm1174 form

Find out other Irs Form 656

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later