Form 656 B 2011

What is the Form 656 B

The Form 656 B is an official document used by individuals seeking to settle their tax liabilities with the IRS through an offer in compromise. This form allows taxpayers to propose a reduced amount to settle their tax debts, making it a crucial tool for those facing financial difficulties. The form is specifically designed for individuals who cannot pay their full tax liability or believe that doing so would create an undue financial hardship.

How to use the Form 656 B

Using the Form 656 B involves several key steps. First, taxpayers must fill out the form accurately, providing necessary personal and financial information. This includes details about income, expenses, assets, and liabilities. After completing the form, it should be submitted to the IRS along with the required fees and supporting documentation. It is essential to ensure that all information is complete and truthful, as inaccuracies can lead to delays or denials of the offer.

Steps to complete the Form 656 B

Completing the Form 656 B requires careful attention to detail. Here are the steps to follow:

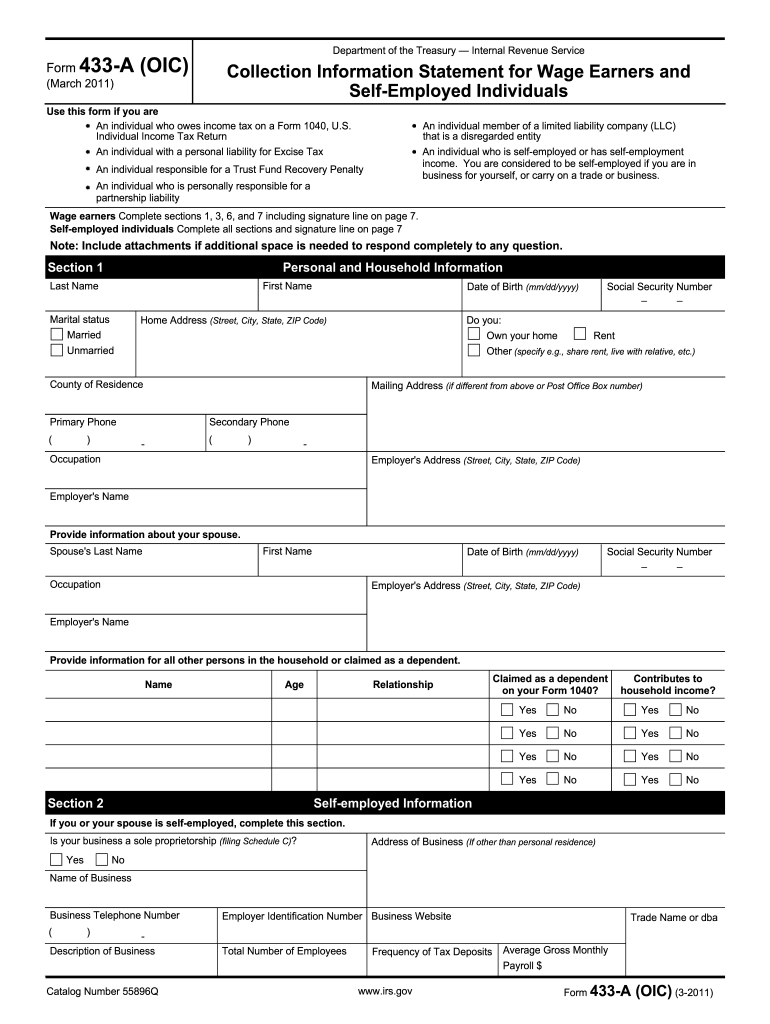

- Gather necessary documents: Collect your financial records, including income statements, expense reports, and asset valuations.

- Fill out personal information: Provide your name, address, and Social Security number at the top of the form.

- Detail your financial situation: Complete sections regarding your income, expenses, and assets to give the IRS a clear picture of your financial status.

- Propose an offer: Specify the amount you are willing to pay to settle your tax liability.

- Review and sign: Double-check all entries for accuracy and sign the form before submission.

Legal use of the Form 656 B

The Form 656 B is legally binding once signed and submitted to the IRS. It is essential to comply with all IRS guidelines and regulations when using this form. Failure to adhere to these legal requirements can result in rejection of the offer or further penalties. It is advisable to consult a tax professional if there are uncertainties regarding the legal implications of submitting the form.

Required Documents

When submitting the Form 656 B, certain documents must accompany it to support your offer. These may include:

- Proof of income: Recent pay stubs, tax returns, or other income documentation.

- Expense documentation: Receipts or statements that detail your monthly expenses.

- Asset documentation: Statements or appraisals for any assets you own, such as bank accounts, real estate, or vehicles.

Form Submission Methods

The Form 656 B can be submitted to the IRS through various methods. Taxpayers can choose to send the form by mail, ensuring it is sent to the correct IRS address based on their location. Alternatively, electronic submission may be available through certain tax software platforms, which can streamline the process. It is important to retain copies of the submitted form and any accompanying documents for personal records.

Quick guide on how to complete form 656 b 2011

Prepare Form 656 B effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Form 656 B on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to amend and eSign Form 656 B with ease

- Locate Form 656 B and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 656 B and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 b 2011

Create this form in 5 minutes!

How to create an eSignature for the form 656 b 2011

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is Form 656 B?

Form 656 B is a crucial document used in the Offer in Compromise process that allows taxpayers to settle their tax debt for less than the full amount owed. With airSlate SignNow, you can easily fill out and eSign Form 656 B, streamlining your submission process. This ensures that your documentation is filed accurately and efficiently.

-

How does airSlate SignNow simplify the signing of Form 656 B?

airSlate SignNow offers an intuitive platform that allows users to eSign Form 656 B quickly and securely. Our user-friendly interface makes it easy for anyone to upload, edit, and eSign their documents without prior technical experience. Plus, your signed Form 656 B will be stored securely and accessible anytime.

-

Is there a cost associated with using airSlate SignNow for Form 656 B?

Prices for using airSlate SignNow for documents like Form 656 B vary based on the plan you choose. We offer flexible pricing options designed to fit businesses of all sizes. Additionally, our cost-effective solution ensures that you save time and resources while managing your document needs.

-

What are the benefits of using airSlate SignNow for Form 656 B?

Using airSlate SignNow for Form 656 B provides numerous benefits, including faster processing times and increased accuracy in signing. Our platform also offers compliance features, ensuring your signed forms meet all regulatory requirements. Ultimately, using airSlate SignNow helps you avoid common pitfalls in the signing process.

-

Can airSlate SignNow integrate with other applications for processing Form 656 B?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when processing Form 656 B. Whether you are utilizing CRM tools, cloud storage services, or other document management systems, our integrations ensure a smooth experience. This connectivity allows for efficient document handling and signature collection.

-

How secure is my data when signing Form 656 B on airSlate SignNow?

Data security is our top priority at airSlate SignNow. When you eSign Form 656 B, your information is protected by bank-level encryption and compliance with industry standards. We ensure that your sensitive data remains private and secure throughout the signing process.

-

Can I use airSlate SignNow on mobile devices to manage Form 656 B?

Absolutely! airSlate SignNow is fully optimized for mobile devices, making it convenient to manage and eSign Form 656 B on the go. Our mobile app allows you to access your documents anywhere, ensuring flexibility and efficiency even when you are not at your desk.

Get more for Form 656 B

- Legal last will and testament form for civil union partner with adult children from prior marriage illinois

- Legal last will and testament form for divorced person not remarried with no children illinois

- Legal last will and testament form for divorced person not remarried with minor children illinois

- Legal last will and testament form for divorced person not remarried with adult and minor children illinois

- Illinois partner form

- Legal last will and testament form for a civil union partner with no children illinois

- Il civil union form

- Illinois last form

Find out other Form 656 B

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors