Form 656 B Rev 4 2020

What is the Form 656 B Rev 4

The Form 656 B Rev 4, commonly known as the Offer in Compromise booklet, is an official document provided by the IRS. It is used by taxpayers to propose a settlement of their tax debt for less than the full amount owed. This form is particularly relevant for individuals who may be experiencing financial hardship and are unable to pay their tax liabilities in full. The form outlines the necessary steps and requirements for submitting an offer to the IRS, making it a crucial resource for those seeking relief from tax burdens.

How to use the Form 656 B Rev 4

Using the Form 656 B Rev 4 involves several key steps. First, taxpayers must determine their eligibility for an Offer in Compromise by reviewing IRS guidelines. Once eligibility is confirmed, the taxpayer should complete the form accurately, providing detailed information about their financial situation. This includes income, expenses, and assets. After completing the form, it must be submitted to the IRS along with the required fee and supporting documentation to substantiate the offer. Properly following these steps increases the likelihood of acceptance by the IRS.

Steps to complete the Form 656 B Rev 4

Completing the Form 656 B Rev 4 requires careful attention to detail. Here are the essential steps:

- Gather financial information: Collect all necessary documents that reflect your income, expenses, and assets.

- Fill out the form: Provide accurate information in all required fields, including personal details and financial disclosures.

- Calculate your offer: Determine an appropriate amount to offer based on your financial situation and IRS guidelines.

- Review and sign: Ensure all information is correct, then sign the form to validate your submission.

- Submit the form: Send the completed form along with the required fee and documentation to the appropriate IRS address.

Legal use of the Form 656 B Rev 4

The legal use of the Form 656 B Rev 4 is governed by IRS regulations. To ensure that the offer is legally binding, taxpayers must comply with all requirements set forth by the IRS. This includes submitting accurate information and adhering to deadlines. An accepted offer in compromise can legally settle a taxpayer's debt with the IRS, but it is crucial to understand that any misrepresentation or failure to comply with IRS rules can result in penalties or rejection of the offer.

Eligibility Criteria

To qualify for an Offer in Compromise using the Form 656 B Rev 4, taxpayers must meet specific eligibility criteria. These include:

- Demonstrating an inability to pay the full tax liability.

- Providing evidence of financial hardship, such as income below necessary living expenses.

- Being compliant with all filing and payment requirements for the previous tax years.

Meeting these criteria is essential for the IRS to consider the offer seriously.

Required Documents

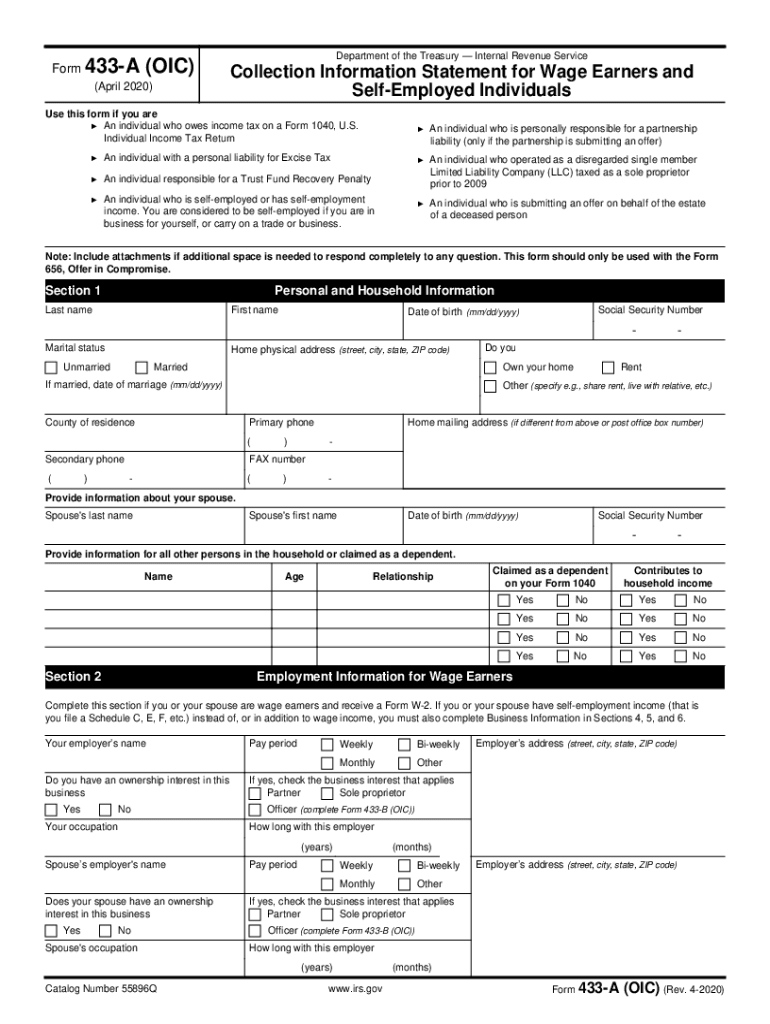

When submitting the Form 656 B Rev 4, taxpayers must include several supporting documents to substantiate their offer. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and other financial obligations.

- A completed Form 433-A (OIC) or Form 433-B (OIC), detailing financial information.

Providing comprehensive documentation helps the IRS evaluate the offer effectively.

Quick guide on how to complete form 656 b rev 4 2020

Easily Prepare Form 656 B Rev 4 on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional paper documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the resources required to quickly create, modify, and electronically sign your documents without delays. Manage Form 656 B Rev 4 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Form 656 B Rev 4

- Locate Form 656 B Rev 4 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sending the form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 656 B Rev 4 and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 b rev 4 2020

Create this form in 5 minutes!

How to create an eSignature for the form 656 b rev 4 2020

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is Form 656 B Rev 4 and how is it used?

Form 656 B Rev 4 is a document used by individuals applying for an Offer in Compromise with the IRS. This form allows taxpayers to negotiate a settlement for less than the total amount owed. By using airSlate SignNow, you can easily fill out and eSign Form 656 B Rev 4, streamlining the submission process.

-

How can airSlate SignNow help with eSigning Form 656 B Rev 4?

airSlate SignNow simplifies the eSigning process for Form 656 B Rev 4 by providing a user-friendly interface. You can quickly upload, sign, and send the form electronically, ensuring that it is securely submitted to the IRS without delays. This efficient process saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 656 B Rev 4?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for individuals and teams. These plans provide access to features that facilitate the eSigning of documents like Form 656 B Rev 4. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing Form 656 B Rev 4?

airSlate SignNow offers features such as customizable templates, secure storage, and automated workflows specifically designed for documents like Form 656 B Rev 4. These features ensure that you can efficiently manage the entire signing process, from preparation to final submission.

-

Can I integrate airSlate SignNow with other applications to manage Form 656 B Rev 4?

Yes, airSlate SignNow supports integration with various applications, allowing you to manage Form 656 B Rev 4 alongside other business tools. Whether you use CRM systems, cloud storage, or productivity apps, these integrations can help streamline your workflow and enhance efficiency.

-

How secure is airSlate SignNow for sending Form 656 B Rev 4?

Security is a top priority for airSlate SignNow, especially for sensitive documents like Form 656 B Rev 4. The platform employs advanced encryption protocols and secure cloud storage to ensure that your data remains protected throughout the signing process.

-

What support does airSlate SignNow provide for users of Form 656 B Rev 4?

airSlate SignNow offers comprehensive support for users, including resources for filling out Form 656 B Rev 4 and assistance with eSigning. You can access help through tutorials, FAQs, and customer service representatives who are ready to assist you with any questions or concerns.

Get more for Form 656 B Rev 4

- Illinois application and instructions for international registration plan form

- Your insurance card or other document form

- February 28 2022 form

- Formupack tn sales and use tax return 2018 2019

- Form dr 309632n florida department of revenue

- To nonprofit scholarship funding organizations sfos form

- Dr15n 2018 2019 form

- For most recent version see colorado form

Find out other Form 656 B Rev 4

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now