Form 656 B Rev 3 Form 656 Booklet Offer in Compromise 2012

Understanding the IRS Form 656 Booklet Offer In Compromise

The IRS Form 656 booklet is essential for individuals seeking to settle their tax debts for less than the total amount owed. This process, known as an Offer in Compromise (OIC), allows taxpayers to negotiate a reduced tax liability based on their financial situation. The form outlines the eligibility criteria, necessary documentation, and the steps required to submit an OIC to the IRS. Understanding this form is crucial for anyone looking to alleviate their tax burden effectively.

Steps to Complete the IRS Form 656 Booklet Offer In Compromise

Completing the IRS Form 656 booklet involves several important steps to ensure accuracy and compliance. Here’s a breakdown of the process:

- Gather Financial Information: Collect all necessary financial documents, including income statements, expenses, assets, and liabilities.

- Determine Eligibility: Review the eligibility criteria outlined in the form to confirm that you qualify for an Offer in Compromise.

- Fill Out the Form: Carefully complete the form, providing accurate information regarding your financial situation and tax liabilities.

- Include Required Documentation: Attach all necessary documents that support your offer, such as proof of income and expenses.

- Review and Sign: Double-check all entries for accuracy before signing the form to ensure it is valid.

- Submit the Form: Send the completed form along with any required fees to the appropriate IRS address.

Legal Use of the IRS Form 656 Booklet Offer In Compromise

The IRS Form 656 booklet is legally binding once submitted correctly. It is essential to provide truthful and accurate information, as any discrepancies can lead to penalties or denial of the offer. The form must be filled out in accordance with IRS guidelines, ensuring that all claims made are substantiated by the attached documentation. Understanding the legal implications of submitting this form is vital for protecting oneself from potential legal issues.

Key Elements of the IRS Form 656 Booklet Offer In Compromise

The IRS Form 656 booklet contains several key elements that are crucial for a successful submission:

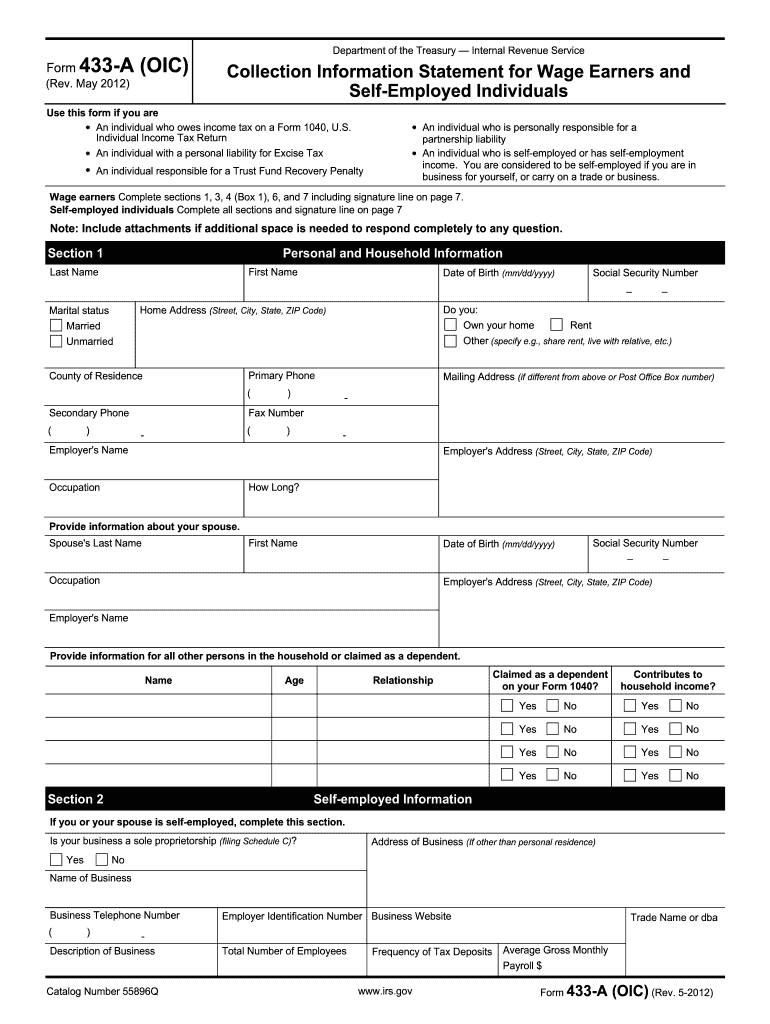

- Taxpayer Information: Basic details about the taxpayer, including name, address, and Social Security number.

- Offer Amount: The proposed amount the taxpayer is willing to pay to settle their tax debt.

- Financial Disclosure: Detailed information about income, expenses, assets, and liabilities to support the offer.

- Signature: The taxpayer’s signature is required to validate the form and confirm the accuracy of the information provided.

Filing Deadlines and Important Dates for the IRS Form 656 Booklet

Timely submission of the IRS Form 656 booklet is crucial for taxpayers. While there are no specific deadlines for submitting an Offer in Compromise, it is advisable to file as soon as possible, especially if facing financial hardship. Additionally, taxpayers should be aware of any deadlines related to their tax liabilities, as these can affect the acceptance of their offer. Keeping track of important dates ensures that taxpayers remain compliant with IRS requirements.

Eligibility Criteria for the IRS Form 656 Booklet Offer In Compromise

To qualify for an Offer in Compromise using the IRS Form 656 booklet, taxpayers must meet specific eligibility criteria. These include:

- Inability to Pay: The taxpayer must demonstrate that they cannot pay the full tax liability.

- Compliance with Tax Filing: All required tax returns must be filed before submitting the offer.

- Current Tax Payments: The taxpayer must be current with all estimated tax payments and withholding obligations.

Meeting these criteria is essential for the IRS to consider the offer favorably.

Quick guide on how to complete form 656 b rev 3 2018 form 656 booklet offer in compromise

Effortlessly Prepare Form 656 B Rev 3 Form 656 Booklet Offer In Compromise on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the proper form and securely store it online. airSlate SignNow equips you with all the essential tools to generate, modify, and eSign your documents promptly without any holdups. Manage Form 656 B Rev 3 Form 656 Booklet Offer In Compromise on any device with airSlate SignNow's Android or iOS applications and enhance any paperwork process today.

The Easiest Method to Modify and eSign Form 656 B Rev 3 Form 656 Booklet Offer In Compromise Effortlessly

- Obtain Form 656 B Rev 3 Form 656 Booklet Offer In Compromise and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget the hassle of lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Form 656 B Rev 3 Form 656 Booklet Offer In Compromise and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 b rev 3 2018 form 656 booklet offer in compromise

Create this form in 5 minutes!

How to create an eSignature for the form 656 b rev 3 2018 form 656 booklet offer in compromise

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the IRS Form 656 booklet?

The IRS Form 656 booklet is an essential resource for taxpayers seeking to negotiate an Offer in Compromise with the IRS. It provides detailed instructions, the necessary forms, and guidelines for effectively submitting your offer. Understanding this booklet is crucial for anyone wanting to resolve their tax debts efficiently.

-

How can airSlate SignNow help with the IRS Form 656 booklet?

airSlate SignNow simplifies the process of completing and submitting the IRS Form 656 booklet by providing electronic signing and document management features. Users can easily fill out the forms, add signatures, and send them securely to the IRS, eliminating the hassle of paper documents. This ensures a smooth submission process and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for the IRS Form 656 booklet?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, which include features for handling the IRS Form 656 booklet. Our plans are designed to be cost-effective while providing users with all necessary functionalities to manage and eSign documents. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the IRS Form 656 booklet?

airSlate SignNow offers a range of features tailored for the IRS Form 656 booklet, including document templates, eSignature capabilities, and workflow automation. Users can collaborate in real-time, ensuring all required information is included and accurately filled out. These features streamline the process from start to finish, enhancing efficiency.

-

Can I integrate airSlate SignNow with other software for the IRS Form 656 booklet?

Yes, airSlate SignNow integrates seamlessly with various software and applications, making it easy to manage the IRS Form 656 booklet alongside your existing tools. Integrations with popular CRM and accounting software allow for a seamless flow of information and enhance your document management capabilities. This flexibility is ideal for businesses looking to maintain an organized workflow.

-

What are the benefits of using airSlate SignNow for my IRS Form 656 booklet submissions?

Using airSlate SignNow for your IRS Form 656 booklet submissions ensures a secure, efficient, and compliant process. With electronic signatures and secure document storage, you can rest assured your submissions are handled safely. Additionally, the ease of use and accessibility can signNowly reduce the time and effort needed to complete and submit your forms.

-

Is airSlate SignNow user-friendly for completing the IRS Form 656 booklet?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate the platform and complete the IRS Form 656 booklet. Whether you're tech-savvy or new to digital solutions, our intuitive interface guides you through each step, ensuring a smooth experience.

Get more for Form 656 B Rev 3 Form 656 Booklet Offer In Compromise

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497306868 form

- Application for review by full board for workers compensation indiana form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497306870 form

- Indiana landlord in form

- Indiana landlord tenant form

- Indiana landlord tenant in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497306874 form

- Letter landlord tenant notice 497306875 form

Find out other Form 656 B Rev 3 Form 656 Booklet Offer In Compromise

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now