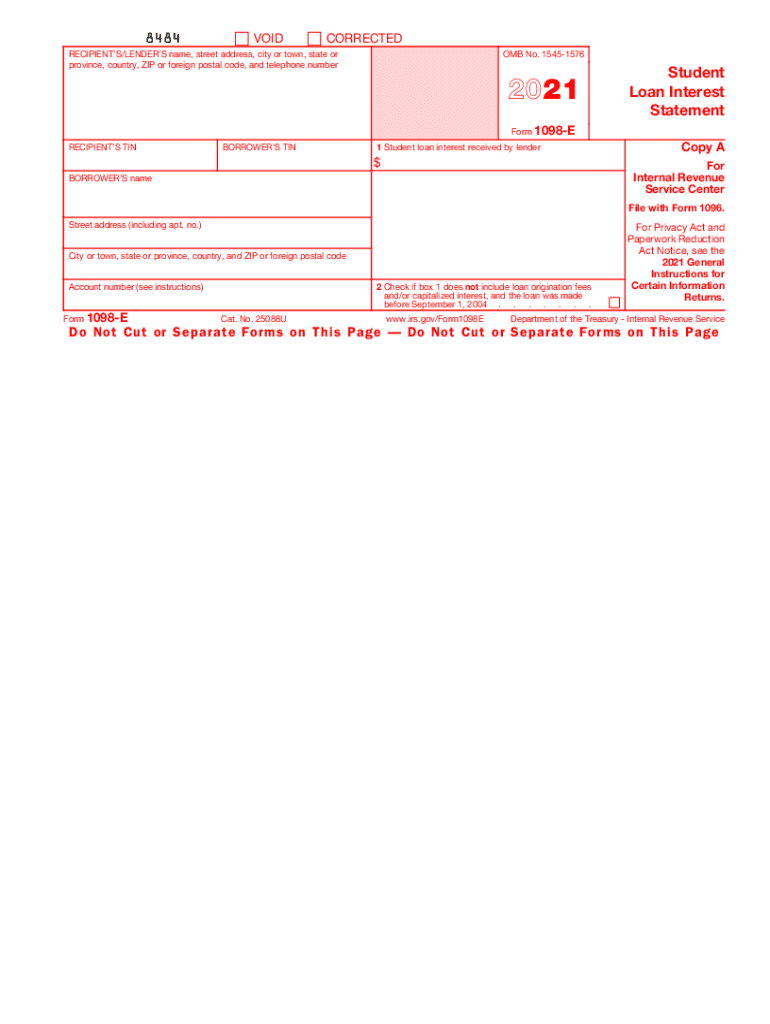

Form 1098 E Student Loan Interest Statement 2021

What is the Form 1098 E Student Loan Interest Statement

The Form 1098 E is a tax document issued by lenders to report the amount of interest paid on student loans during the tax year. This form is crucial for individuals who have taken out student loans, as it allows them to claim a tax deduction for the interest paid, potentially lowering their taxable income. The information provided on the form includes the borrower’s name, the lender’s details, and the total interest paid, which is essential for accurately filing tax returns.

How to use the Form 1098 E Student Loan Interest Statement

To utilize the Form 1098 E effectively, taxpayers should first gather all relevant financial documents, including the 1098 E itself. The next step involves entering the reported interest amount on the appropriate line of the federal tax return, typically on Form 1040. It is important to ensure that the total interest claimed does not exceed the maximum allowable deduction, which is subject to income limits. Taxpayers should also keep a copy of the form for their records, in case of future audits or inquiries.

Steps to complete the Form 1098 E Student Loan Interest Statement

Completing the Form 1098 E is straightforward. Here are the steps involved:

- Receive the form from your loan servicer, usually by January 31 each year.

- Review the form for accuracy, ensuring your name, Social Security number, and reported interest amount are correct.

- If any information is incorrect, contact your loan servicer for corrections.

- Use the reported interest amount when preparing your tax return.

- File your tax return by the deadline, ensuring you include the 1098 E information.

Legal use of the Form 1098 E Student Loan Interest Statement

The Form 1098 E is legally recognized by the IRS as a valid document for claiming student loan interest deductions. To ensure compliance, it is vital that taxpayers use the form as intended and report the information accurately. Failure to do so may result in penalties or denial of the deduction. Additionally, keeping records of the form and any correspondence with the lender is advisable in case of future audits.

Who Issues the Form

The Form 1098 E is typically issued by the loan servicer or lender that manages the student loan. This may include federal or private student loan providers. Borrowers should expect to receive this form annually, detailing the interest paid during the previous tax year. If a borrower does not receive the form, they should contact their loan servicer to ensure that it has been issued and sent to the correct address.

Filing Deadlines / Important Dates

For taxpayers, it is essential to be aware of the filing deadlines associated with the Form 1098 E. Generally, the IRS requires that individual tax returns be filed by April 15 each year. However, if April 15 falls on a weekend or holiday, the deadline may be extended. Borrowers should ensure they have their Form 1098 E in hand by the end of January to facilitate timely filing of their tax returns.

Quick guide on how to complete 2021 form 1098 e student loan interest statement

Easily prepare Form 1098 E Student Loan Interest Statement on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 1098 E Student Loan Interest Statement on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign Form 1098 E Student Loan Interest Statement effortlessly

- Locate Form 1098 E Student Loan Interest Statement and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1098 E Student Loan Interest Statement, ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1098 e student loan interest statement

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1098 e student loan interest statement

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a 1098 e, and why is it important for tax filing?

A 1098 e is a tax form used to report interest paid on student loans. It's crucial for tax filing as it can help reduce your taxable income, leading to potential refund savings. By accurately submitting a 1098 e, you can ensure you're taking full advantage of available tax benefits.

-

How does airSlate SignNow streamline the signing of 1098 e forms?

airSlate SignNow provides an easy-to-use interface allowing users to electronically sign and send 1098 e forms securely. Our platform ensures that your documents are completed efficiently while maintaining compliance with legal standards. This simplifies the process for both individuals and institutions when managing student loan documentation.

-

What pricing options does airSlate SignNow offer for handling 1098 e documents?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs. You can choose from various subscription models that provide unlimited access to features for sending and signing 1098 e forms. Additionally, each plan is designed to be cost-effective, ensuring you get the best value for handling your document management.

-

Can airSlate SignNow integrate with other financial software for 1098 e processing?

Yes, airSlate SignNow integrates seamlessly with various financial and accounting software, making 1098 e processing more efficient. This integration allows for direct data transfer, which minimizes errors and saves time during tax season. Users can easily connect their existing tools to enhance their document workflow.

-

Is airSlate SignNow secure for sending sensitive 1098 e documents?

Absolutely! airSlate SignNow employs advanced security measures to ensure all sensitive 1098 e documents are protected. Our platform uses encryption and secure storage options to safeguard your data from unauthorized access. You can confidently send and store your documents, knowing they are in safe hands.

-

What are the benefits of using airSlate SignNow over traditional methods for 1098 e forms?

Using airSlate SignNow for 1098 e forms offers numerous benefits over traditional methods, including time savings and increased efficiency. Electronic signing eliminates the need for printing and mailing, allowing for rapid document turnaround. Additionally, the platform provides tracking features, so you can monitor the status of all your forms in real-time.

-

Can I customize my 1098 e documents using airSlate SignNow?

Yes, airSlate SignNow allows for customizable templates, enabling you to tailor your 1098 e documents to meet specific organizational requirements. Easily add logos, modify fields, and set workflows that suit your needs. This flexibility ensures you maintain professionalism while adapting to different scenarios.

Get more for Form 1098 E Student Loan Interest Statement

- Quitclaim deed for four individuals to living trust florida form

- Quitclaim deed for two individuals or husband and wife to three individuals as joint tenants with the right of survivorship form

- Fl warranty deed 497303488 form

- Warranty deed from two individuals to two individuals as joint tenants with the right of survivorship with retained life form

- Quitclaim deed two individuals to three individuals florida form

- Quitclaim deed three individuals to husband and wife as joint tenants florida form

- Quitclaim deed four individuals to husband and wife as joint tenants florida form

- 3 1 form

Find out other Form 1098 E Student Loan Interest Statement

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast