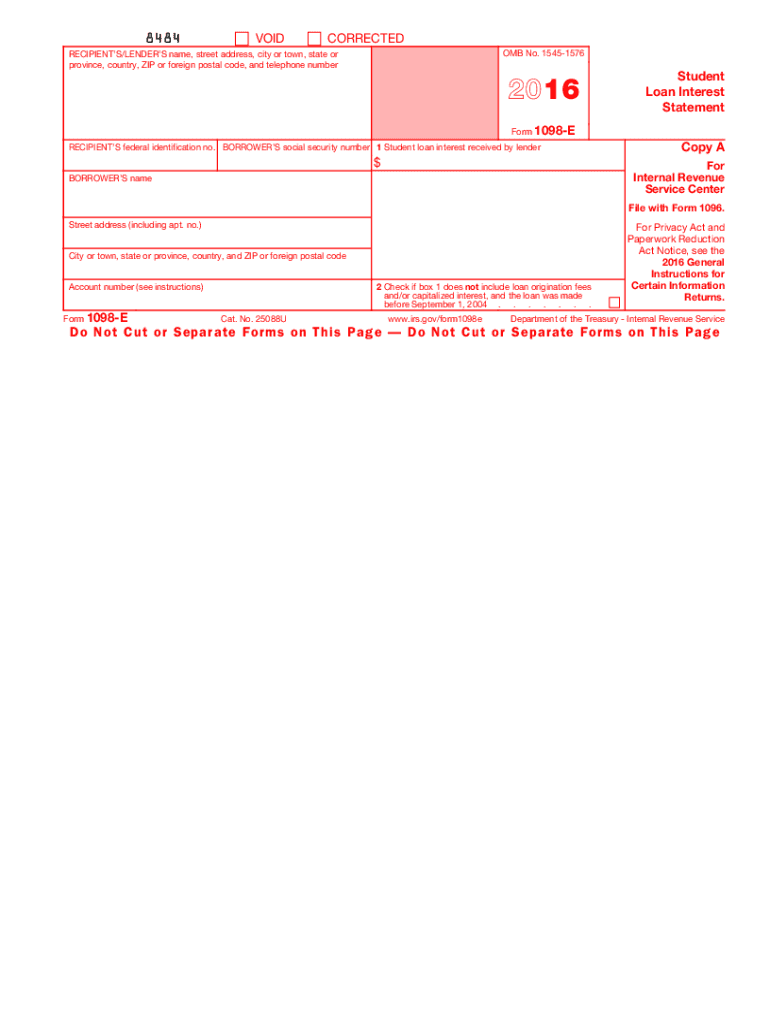

1098 E Form 2016

What is the 1098 E Form

The 1098 E Form is a tax document used in the United States to report the amount of interest paid on student loans during the tax year. This form is essential for individuals who have taken out student loans and are seeking to claim a deduction on their federal income tax return. The information provided on the 1098 E Form can help taxpayers reduce their taxable income, making it a valuable tool for managing educational expenses.

How to use the 1098 E Form

To effectively use the 1098 E Form, taxpayers should first ensure they receive the form from their loan servicer, typically by January 31 of each year. Once received, the next step is to review the reported interest amount for accuracy. Taxpayers can then use this information when completing their federal tax return, specifically on Form 1040, to claim the student loan interest deduction. It is important to keep a copy of the 1098 E Form for personal records and future reference.

Steps to complete the 1098 E Form

Completing the 1098 E Form involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and the loan account number.

- Review the interest amount reported by your loan servicer on the form for accuracy.

- Transfer the interest amount to the appropriate line on your federal tax return, typically Form 1040.

- Ensure you meet the eligibility criteria for the student loan interest deduction.

- File your tax return by the designated deadline, keeping the 1098 E Form for your records.

Legal use of the 1098 E Form

The 1098 E Form is legally recognized by the IRS as a valid document for reporting student loan interest. To ensure compliance, taxpayers must accurately report the interest amount and adhere to IRS guidelines regarding eligibility for the deduction. Misreporting or failing to include the form can lead to penalties or disallowed deductions, emphasizing the importance of careful completion and submission.

Who Issues the Form

The 1098 E Form is issued by loan servicers or lenders who manage federal or private student loans. These entities are responsible for providing borrowers with the necessary documentation detailing the interest paid during the tax year. Borrowers should expect to receive this form by the end of January each year, allowing sufficient time to prepare their tax returns.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the 1098 E Form. The form is typically issued by January 31, and taxpayers must file their federal tax returns by April 15. If additional time is needed, individuals can file for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 1098 e form 2016

Accomplish 1098 E Form effortlessly on any platform

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without interruptions. Handle 1098 E Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign 1098 E Form without stress

- Find 1098 E Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to secure your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

No more worries about lost or misfiled documents, lengthy form searches, or mistakes that require printing out new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1098 E Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098 e form 2016

Create this form in 5 minutes!

How to create an eSignature for the 1098 e form 2016

How to make an electronic signature for your 1098 E Form 2016 online

How to make an eSignature for your 1098 E Form 2016 in Google Chrome

How to create an electronic signature for signing the 1098 E Form 2016 in Gmail

How to create an electronic signature for the 1098 E Form 2016 straight from your smart phone

How to create an electronic signature for the 1098 E Form 2016 on iOS

How to create an electronic signature for the 1098 E Form 2016 on Android devices

People also ask

-

What is a 1098 E Form and why is it important?

The 1098 E Form is a tax document used to report interest paid on student loans, which can help borrowers claim deductions on their tax returns. Understanding this form is essential for borrowers to maximize their tax benefits and ensure compliance with tax regulations.

-

How can airSlate SignNow help with sending a 1098 E Form?

airSlate SignNow offers a user-friendly platform to securely send and eSign your 1098 E Form. With our solution, you can easily manage documents, ensuring they are signed and sent quickly while maintaining legal compliance.

-

What features does airSlate SignNow provide for handling 1098 E Forms?

With airSlate SignNow, you can create, edit, and eSign your 1098 E Form effortlessly. Features such as templates, cloud storage integrations, and automated workflows simplify the document management process, making tax season stress-free.

-

Is there a cost associated with using airSlate SignNow for 1098 E Forms?

airSlate SignNow operates on a cost-effective pricing model that scales based on your needs. Whether you're an individual or a business, you can choose a plan that fits your requirements for managing 1098 E Forms without breaking the bank.

-

Can airSlate SignNow integrate with my existing software for 1098 E Forms?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to import and export your 1098 E Form data efficiently. This compatibility ensures you can work with the tools you already use while enhancing your document workflow.

-

What are the benefits of using airSlate SignNow for 1098 E Forms?

Using airSlate SignNow for 1098 E Forms streamlines the signing process and improves document security. You'll benefit from quicker turnaround times, reduced paper waste, and the convenience of managing all your documents in a single platform.

-

How do I get started with airSlate SignNow for my 1098 E Form?

Getting started with airSlate SignNow is simple. Just sign up for an account, and you can quickly create or upload your 1098 E Form for electronic signatures. Our intuitive interface guides you through the process step-by-step.

Get more for 1098 E Form

- 2008 cf 6r form

- Mech 1c alt hvac form

- Mech forms

- State of idaho division of building safety citizen complaint form

- Kelsey jenney college transcripts form

- Download application u l coleman companies form

- Application form for payment of retirement benefits for

- Liquidambar street tree removal permit application for sunnyvale ca form

Find out other 1098 E Form

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement