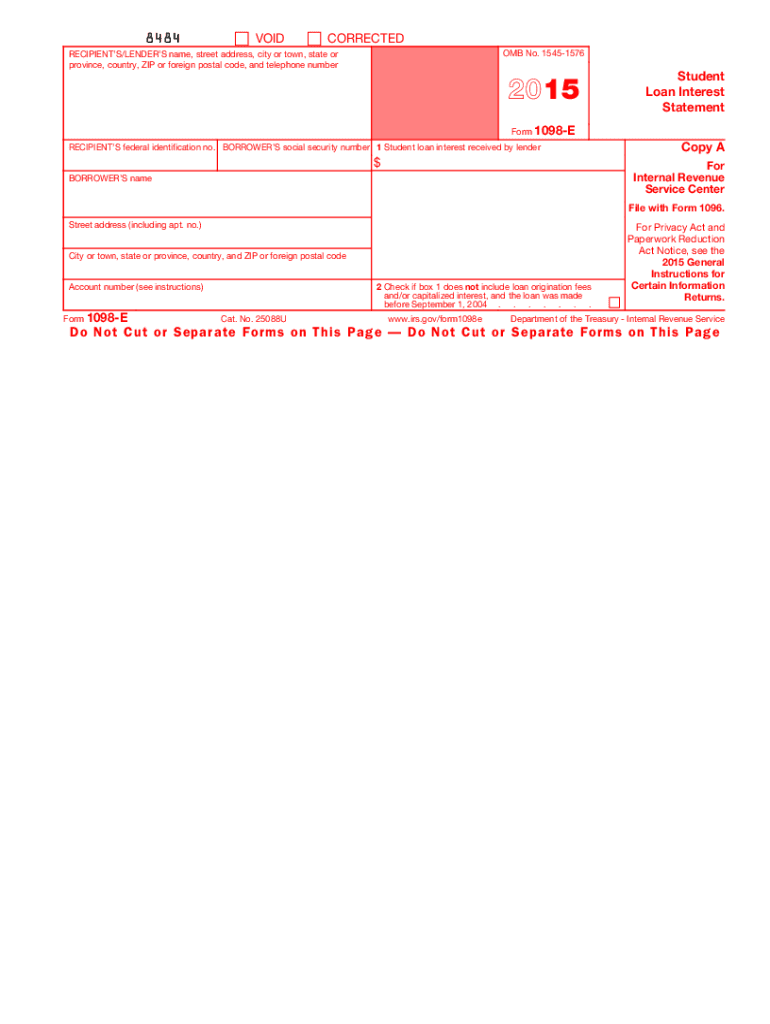

Irs Student Form 2015

What is the IRS Student Form

The IRS Student Form is a specific document used by students to report their income and claim educational tax benefits. This form is essential for those who are pursuing higher education and may qualify for various tax credits or deductions related to their educational expenses. It typically includes sections for reporting income from jobs, scholarships, and grants, as well as expenses such as tuition and fees. Understanding this form is crucial for maximizing potential tax benefits and ensuring compliance with IRS regulations.

How to obtain the IRS Student Form

To obtain the IRS Student Form, individuals can visit the official IRS website or contact the IRS directly. The form is often available for download in PDF format, allowing for easy access and printing. Additionally, many educational institutions provide guidance on how to access and complete this form, ensuring that students have the necessary resources to fulfill their tax obligations. It's important to ensure that you are using the most current version of the form to avoid any issues during filing.

Steps to complete the IRS Student Form

Completing the IRS Student Form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1098-T forms, and any records of scholarships or grants.

- Fill out personal information: Enter your name, Social Security number, and other identifying information accurately.

- Report income: Include all sources of income, such as wages from part-time jobs and any taxable scholarships.

- Detail educational expenses: List qualified expenses like tuition, fees, and required course materials.

- Review and sign: Carefully review the completed form for accuracy, then sign and date it before submission.

Legal use of the IRS Student Form

The IRS Student Form must be completed and submitted in accordance with IRS guidelines to ensure it is legally binding. This includes providing accurate information and adhering to deadlines for submission. Failure to comply with these regulations can result in penalties or the denial of tax credits. It is advisable to keep copies of the submitted form and any supporting documents for future reference and to maintain compliance with tax laws.

Key elements of the IRS Student Form

Key elements of the IRS Student Form include:

- Personal Information: This section requires basic details such as name, address, and Social Security number.

- Income Reporting: Students must report all income earned during the tax year, including wages and scholarships.

- Educational Expenses: This section allows students to detail tuition, fees, and other qualified expenses.

- Tax Credits: The form may include sections for claiming education-related tax credits, such as the American Opportunity Credit or Lifetime Learning Credit.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Student Form typically align with the general tax filing deadlines in the United States. Generally, individual tax returns must be filed by April 15 of each year. However, students should be aware of any specific deadlines related to educational tax credits or extensions that may apply. It is essential to stay informed about these dates to avoid late penalties and ensure timely processing of any refunds or credits.

Quick guide on how to complete 2015 irs student form

Accomplish Irs Student Form effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Irs Student Form across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Irs Student Form with ease

- Find Irs Student Form and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Highlight pertinent sections of your documents or black out confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Irs Student Form and guarantee exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs student form

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs student form

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Irs Student Form and how can airSlate SignNow help?

The Irs Student Form is a crucial document for students applying for financial aid or tax benefits. With airSlate SignNow, you can easily eSign and send the Irs Student Form, ensuring that it is securely delivered and promptly processed. Our platform simplifies the signing process, making it hassle-free for students and institutions alike.

-

How does airSlate SignNow ensure the security of the Irs Student Form?

Security is a top priority at airSlate SignNow. When you eSign the Irs Student Form using our platform, it is protected with advanced encryption and secure cloud storage. This ensures that your sensitive information remains confidential and safe from unauthorized access.

-

Is there a cost associated with using airSlate SignNow for the Irs Student Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different user needs, including those who need to eSign the Irs Student Form. Our plans are designed to be cost-effective, providing value for students and businesses alike. You can choose a plan that suits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for managing the Irs Student Form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and more. This allows you to streamline your workflow when handling the Irs Student Form, making it easier to manage documents across different platforms.

-

What features does airSlate SignNow provide for completing the Irs Student Form?

airSlate SignNow provides a variety of features to simplify the completion of the Irs Student Form, including template creation, customizable workflows, and real-time tracking. These tools help you efficiently manage the signing process and ensure that all necessary information is accurately captured.

-

Can I access my completed Irs Student Form from anywhere?

Yes, with airSlate SignNow, you can access your completed Irs Student Form from any device with internet access. Our cloud-based solution ensures that your documents are available anytime you need them, whether you're on a computer, tablet, or smartphone.

-

What are the benefits of using airSlate SignNow for the Irs Student Form?

Using airSlate SignNow for the Irs Student Form offers numerous benefits, including faster processing times, enhanced security, and reduced paperwork. Our platform simplifies the signing process, allowing you to focus on your studies while ensuring that all necessary forms are submitted correctly and on time.

Get more for Irs Student Form

- Skip a pay application form

- Form 125 356

- Medical leave fact sheet human resources illinois state form

- Food waiver request application form

- Authorization to release student information midwestern state

- La verne academy outline ampamp application cover sheet faculty form

- Update information human resources

- Federal loan cancellation form wentworth institute of technology wit

Find out other Irs Student Form

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer