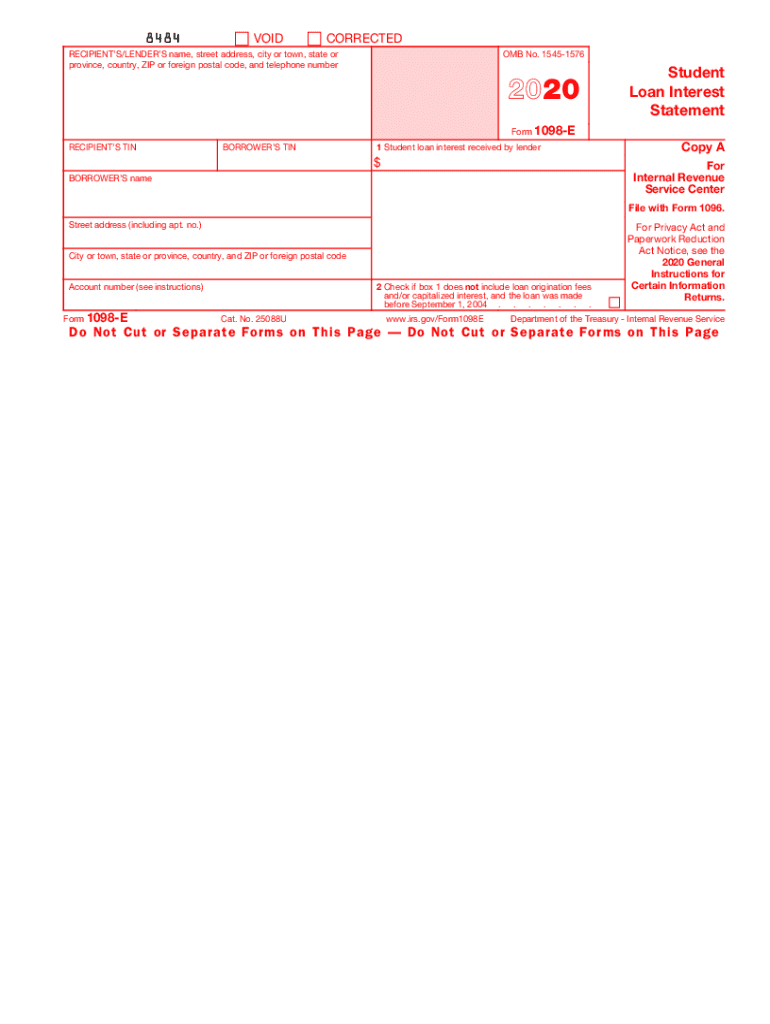

Form 1098 E Student Loan Interest Statement 2020

What is the Form 1098 E Student Loan Interest Statement

The Form 1098 E is a tax document used to report the amount of interest paid on student loans during the tax year. This form is essential for individuals who have taken out student loans and wish to claim a deduction for the interest paid on those loans. The information reported on the 1098 E can help taxpayers reduce their taxable income, potentially leading to a lower tax bill. It is typically issued by the loan servicer or lender and is sent to borrowers who have paid more than $600 in interest during the year.

How to use the Form 1098 E Student Loan Interest Statement

To effectively use the Form 1098 E, taxpayers should first ensure they receive this document from their loan servicer. Once obtained, the borrower should review the form for accuracy, including the total interest paid and personal information. This information is then entered on the appropriate line of the IRS tax return, specifically on Schedule 1 of Form 1040. By including this deduction, taxpayers may lower their overall taxable income, which can result in tax savings. It is important to keep the form for personal records in case of an audit.

Steps to complete the Form 1098 E Student Loan Interest Statement

Completing the Form 1098 E involves several steps:

- Gather all relevant information regarding your student loans, including the names of the lenders and the total interest paid.

- Fill out your personal information, such as your name, address, and Social Security number.

- Report the total interest paid as indicated on the form.

- Double-check the information for accuracy before submitting.

- File the form with your tax return by the appropriate deadline.

Key elements of the Form 1098 E Student Loan Interest Statement

The Form 1098 E contains several key elements that are important for taxpayers:

- Borrower's Information: This includes the name, address, and Social Security number of the borrower.

- Lender's Information: The name and contact information of the loan servicer or lender.

- Total Interest Paid: The total amount of interest paid on the student loans during the tax year.

- Loan Account Number: This number helps identify the specific loan associated with the interest reported.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the Form 1098 E. The form must be provided to borrowers by January 31 of the year following the tax year in which the interest was paid. Taxpayers should file their tax returns by the April 15 deadline, unless they file for an extension. It is advisable to keep track of these dates to ensure timely filing and avoid penalties.

Who Issues the Form

The Form 1098 E is issued by the loan servicer or lender to the borrower. This entity is responsible for reporting the interest paid on the student loans. Borrowers should expect to receive this form in the mail or electronically if they have opted for digital delivery. It is important for borrowers to verify that they receive this form, as it is necessary for claiming the student loan interest deduction on their tax returns.

Quick guide on how to complete 2020 form 1098 e student loan interest statement

Easily Prepare Form 1098 E Student Loan Interest Statement on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Handle Form 1098 E Student Loan Interest Statement on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign Form 1098 E Student Loan Interest Statement Effortlessly

- Locate Form 1098 E Student Loan Interest Statement and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive data using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information carefully and click on the Done button to save your edits.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate reprinting. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1098 E Student Loan Interest Statement and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1098 e student loan interest statement

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1098 e student loan interest statement

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is IRS Form 1098 and why do I need it?

IRS Form 1098 is a document used to report mortgage interest and certain other types of interest payments to the IRS. If you're a property owner who paid interest of $600 or more during the tax year, you'll need to file this form. This ensures that you can claim tax deductions accurately, making the process easier with airSlate SignNow.

-

How can airSlate SignNow help me manage my IRS Form 1098?

AirSlate SignNow allows you to easily eSign and send your IRS Form 1098 documents securely. With our user-friendly interface, you can streamline the process of preparing and filing your forms, saving time and reducing errors. Plus, you can access signed documents anytime, anywhere.

-

What features does airSlate SignNow offer for IRS Form 1098?

AirSlate SignNow offers features like eSigning, document templates, and secure document storage that help you manage your IRS Form 1098 efficiently. Our platform also provides tracking and notifications, so you can stay on top of who has signed your forms. This ensures a smooth and efficient filing process.

-

Is there a cost associated with using airSlate SignNow for IRS Form 1098?

Yes, airSlate SignNow offers flexible pricing plans tailored to fit your business needs. You can access bulk signing options at competitive rates, which can be especially beneficial if you need to manage multiple IRS Form 1098 filings. Check our pricing page for more details.

-

Can I integrate airSlate SignNow with other software for IRS Form 1098?

Absolutely! AirSlate SignNow integrates seamlessly with various third-party applications, including accounting and tax software. This makes it easier to automatically populate and manage your IRS Form 1098 with the information already stored in your existing tools, enhancing efficiency.

-

What benefits can I expect from using airSlate SignNow for IRS Form 1098?

Using airSlate SignNow for your IRS Form 1098 filings provides signNow benefits, including reduced paperwork, faster processing times, and enhanced security features. Our platform ensures that you comply with IRS regulations while also saving you time to focus on your business. Plus, you can manage your documents from any device.

-

How secure is airSlate SignNow when handling IRS Form 1098?

AirSlate SignNow prioritizes your data security with end-to-end encryption and compliance with industry standards. When you handle IRS Form 1098 documents, you can trust that your personal and financial information is protected. Regular security audits and updates further enhance our commitment to security.

Get more for Form 1098 E Student Loan Interest Statement

- Legal last will and testament form for widow or widower with minor children wyoming

- Legal last will form for a widow or widower with no children wyoming

- Legal last will and testament form for a widow or widower with adult and minor children wyoming

- Legal last will and testament form for divorced and remarried person with mine yours and ours children wyoming

- Legal last will and testament form with all property to trust called a pour over will wyoming

- Written revocation of will wyoming form

- Last will and testament for other persons wyoming form

- Notice to beneficiaries of being named in will wyoming form

Find out other Form 1098 E Student Loan Interest Statement

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple