Govform1098e 2014

What is the Govform1098e

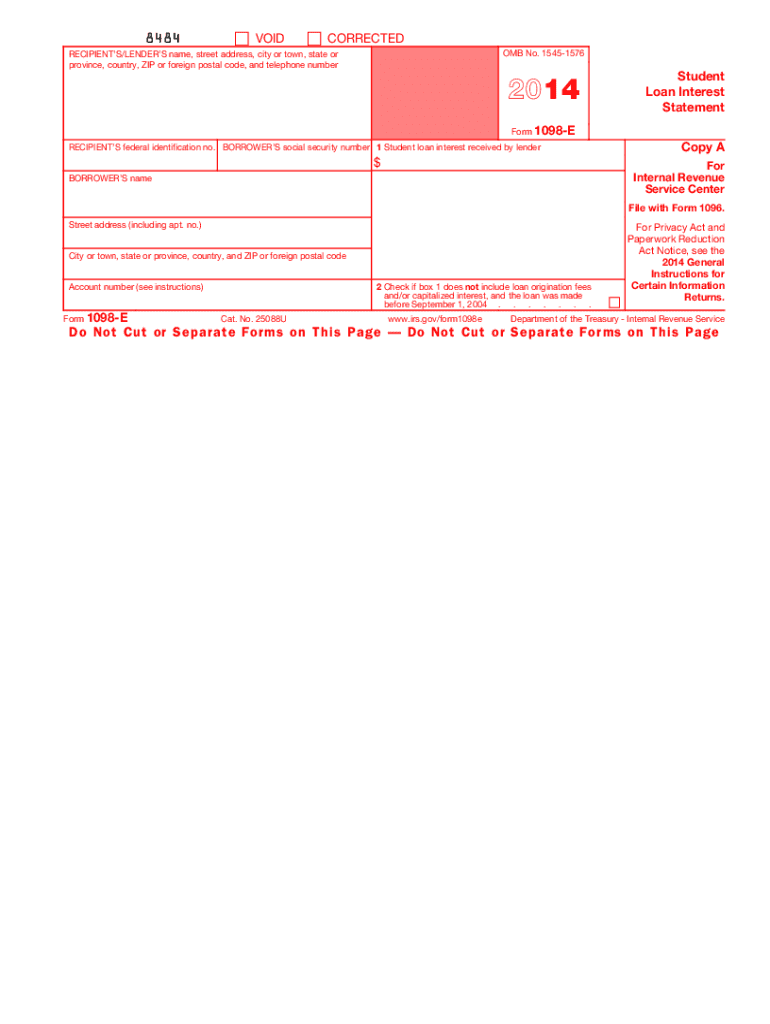

The Govform1098e is a tax form used in the United States to report interest paid on student loans. This form is essential for taxpayers who have made payments on qualified student loans during the tax year. It provides the necessary information for taxpayers to claim the student loan interest deduction, which can help reduce taxable income. Understanding this form is crucial for accurate tax filing and maximizing potential deductions.

How to use the Govform1098e

Using the Govform1098e involves several steps. First, ensure you have received the form from your loan servicer, which should be provided by January 31 of the following year. Review the information on the form for accuracy, including your name, Social Security number, and the total interest paid. When filing your taxes, include the amount reported on the Govform1098e on your tax return, specifically on Schedule 1 of Form 1040. This will enable you to claim the deduction for student loan interest, if eligible.

Steps to complete the Govform1098e

Completing the Govform1098e requires careful attention to detail. Follow these steps for accurate completion:

- Gather your student loan statements and any other relevant documentation.

- Verify your personal information on the form, ensuring your name and Social Security number are correct.

- Check the reported interest amount against your records to confirm accuracy.

- Consult IRS guidelines to determine your eligibility for the student loan interest deduction.

- Incorporate the interest amount into your tax return, ensuring it is correctly reported.

Legal use of the Govform1098e

The Govform1098e is legally binding as it provides essential information required for tax reporting. To ensure its legal validity, it must be filled out accurately and submitted in accordance with IRS regulations. The form must reflect genuine interest payments made during the tax year, and any discrepancies could lead to penalties or audits. Proper use of this form is crucial for compliance with tax laws and for claiming eligible deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Govform1098e align with the overall tax filing schedule in the United States. Typically, taxpayers must file their returns by April 15 of the following year. It is advisable to keep track of any changes in deadlines, especially if they occur due to holidays or weekends. Additionally, loan servicers must provide the Govform1098e to borrowers by January 31, allowing ample time for taxpayers to incorporate the information into their tax filings.

Who Issues the Form

The Govform1098e is issued by educational institutions or loan servicers that manage student loans. These entities are responsible for reporting the total interest paid by borrowers during the tax year. It is important for borrowers to ensure they receive this form from their loan servicer in a timely manner, as it is essential for accurate tax reporting and claiming deductions.

Quick guide on how to complete govform1098e

Complete Govform1098e effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Govform1098e on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Govform1098e with ease

- Find Govform1098e and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Govform1098e and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct govform1098e

Create this form in 5 minutes!

How to create an eSignature for the govform1098e

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is Govform1098e and how does it work?

Govform1098e is a specific document format used for reporting student loan interest. With airSlate SignNow, you can easily prepare, send, and eSign Govform1098e documents digitally, ensuring a seamless and efficient process for both businesses and customers.

-

How can airSlate SignNow help with completing Govform1098e?

airSlate SignNow simplifies the process of completing Govform1098e by providing templates and tools for easy input of necessary information. It also allows you to eSign and send the document securely, making compliance and record-keeping hassle-free.

-

Is there a cost to use airSlate SignNow for Govform1098e?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, making it a cost-effective solution for handling Govform1098e. You can choose a plan that provides the features you need without overspending.

-

What features does airSlate SignNow offer for Govform1098e?

airSlate SignNow provides features such as customizable templates for Govform1098e, secure eSigning, document tracking, and integration with various applications. These features enhance your workflow and improve document management efficiency.

-

Are there integrations available with airSlate SignNow for Govform1098e?

Yes, airSlate SignNow integrates with several applications, including Google Drive, Dropbox, and Microsoft Office. This allows users to easily access and manage their Govform1098e documents within their preferred platforms.

-

What are the benefits of using airSlate SignNow for Govform1098e?

Using airSlate SignNow for Govform1098e provides signNow benefits such as reduced paperwork, enhanced security, faster processing times, and better compliance. These advantages help businesses operate more efficiently and serve customers better.

-

How secure is airSlate SignNow when handling Govform1098e?

airSlate SignNow prioritizes security, employing industry-standard encryption and compliance measures to protect your Govform1098e documents. Your data remains safe and secure throughout the entire eSigning process.

Get more for Govform1098e

- Provider overpayment refund form draft 17dec08 4

- Chesapeake public schools micrifilm department form

- Provider overpayment refund form draft 17dec08 4 doc

- Chantilly high school college transcript request form fcps

- Lynn school department hac assistance manual form

- Health information form pdf fairfax county public schools fcps

- Wvuc b 6 11 form

- Newest version of wvuc b 6 11 back form

Find out other Govform1098e

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form