Gov Revenue Internal 2023

Understanding Form 1098-E

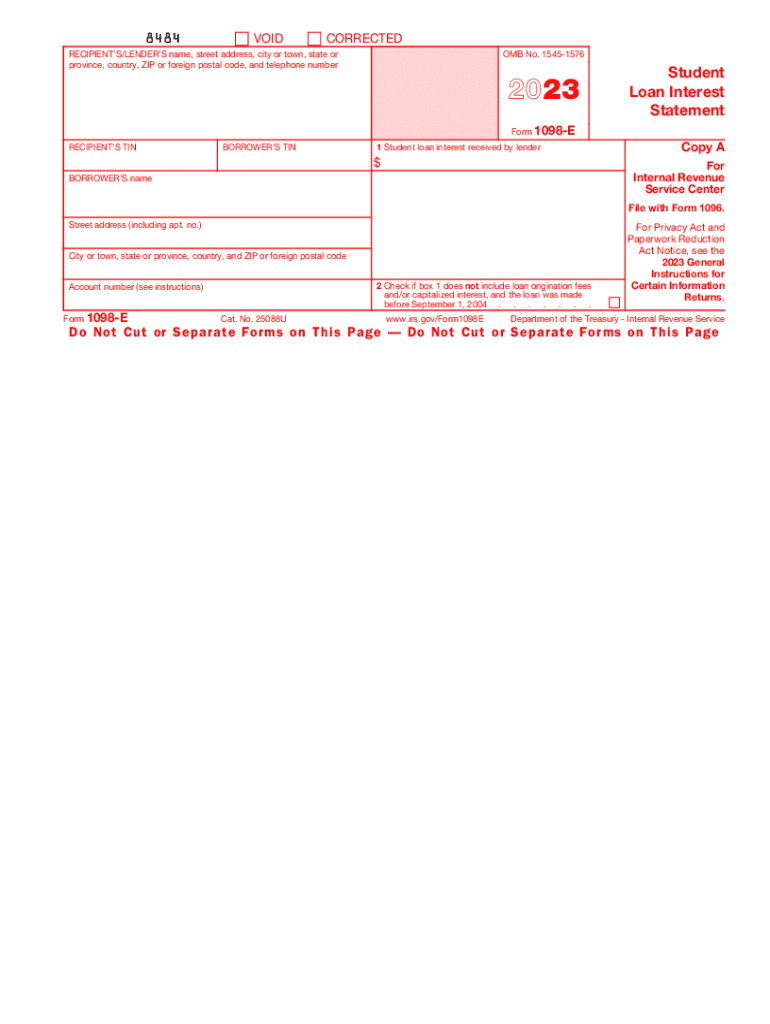

The 1098-E form is a tax document used in the United States to report student loan interest paid during the tax year. It is issued by lenders, such as banks or student loan servicers, to borrowers who have paid interest on qualified student loans. This form is essential for taxpayers looking to claim the student loan interest deduction on their tax returns. The information provided on the form helps individuals determine the amount of interest they can deduct, which can significantly impact their overall tax liability.

Key Elements of Form 1098-E

Form 1098-E includes several important pieces of information that taxpayers need to be aware of:

- Borrower's Information: This section includes the borrower's name, address, and taxpayer identification number (TIN).

- Lender's Information: Details about the lender, including their name, address, and TIN, are also provided.

- Interest Amount: The total amount of interest paid on the student loan during the tax year is reported, which is critical for claiming deductions.

- Loan Type: The form may specify whether the loan is a qualified student loan, which is necessary for the deduction eligibility.

Steps to Complete Form 1098-E

Completing Form 1098-E involves several straightforward steps:

- Receive the Form: Wait for your lender to send you the completed form, typically by January 31 of the following year.

- Review the Information: Check that all details, including your name, address, and the interest amount, are accurate.

- Use the Information: Report the interest amount on your tax return, typically on Schedule 1 of Form 1040.

- Keep for Records: Retain a copy of the form for your records, as you may need it for future reference or audits.

Filing Deadlines for Form 1098-E

It is important to be aware of the key deadlines related to Form 1098-E:

- Form Issuance Deadline: Lenders must provide borrowers with Form 1098-E by January 31 of the year following the tax year in which interest was paid.

- Tax Filing Deadline: Taxpayers typically need to file their federal tax returns by April 15, unless an extension is filed.

Legal Use of Form 1098-E

The information reported on Form 1098-E is used to claim the student loan interest deduction, which can reduce taxable income. To qualify for this deduction, taxpayers must meet certain criteria, including income limits and filing status. It is essential to ensure that the interest reported is for qualified student loans, as not all loans may qualify for the deduction.

Who Issues Form 1098-E?

Form 1098-E is issued by lenders or student loan servicers. This includes banks, credit unions, and other financial institutions that provide student loans. If you have multiple loans from different lenders, you may receive a separate 1098-E form from each lender, detailing the interest paid for that specific loan.

Quick guide on how to complete gov revenue internal

Complete Gov Revenue Internal seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Gov Revenue Internal on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Gov Revenue Internal effortlessly

- Obtain Gov Revenue Internal and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or conceal sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Edit and eSign Gov Revenue Internal and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gov revenue internal

Create this form in 5 minutes!

How to create an eSignature for the gov revenue internal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1098 E and why is it important?

Form 1098 E is an IRS tax form used to report interest payments you made on student loans. It's important because it helps borrowers claim tax deductions on interest, potentially reducing their taxable income. Understanding how to use Form 1098 E can lead to signNow savings during tax season.

-

How can airSlate SignNow help with Form 1098 E?

airSlate SignNow provides a seamless solution for eSigning and sending your Form 1098 E. With our intuitive interface, you can easily manage and send your tax documents electronically, streamlining your filing process. This makes it easier to keep track of important tax documents and deadlines.

-

Is there a cost to use airSlate SignNow for Form 1098 E?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Each plan provides access to essential features for managing documents, including the ability to handle Form 1098 E effectively. You can find a plan that suits your budget and document needs on our pricing page.

-

What features does airSlate SignNow offer for handling Form 1098 E?

airSlate SignNow includes features such as eSigning, document templates, and real-time tracking, specifically designed to manage forms like Form 1098 E. These features ensure that your documents are processed quickly and securely. Additionally, you can customize templates to pre-fill information for added convenience.

-

Can I integrate airSlate SignNow with other software for Form 1098 E?

Absolutely! airSlate SignNow supports integrations with a variety of popular software platforms. This means you can connect your existing systems to automate the management of Form 1098 E and other important documents, streamlining your workflow and improving efficiency.

-

What benefits does airSlate SignNow provide for tax professionals handling Form 1098 E?

For tax professionals, airSlate SignNow offers a robust solution to manage and deliver Form 1098 E efficiently. The platform enhances collaboration with clients, allowing for quicker turnaround times on document reviews and signatures. This can lead to improved client satisfaction and retention.

-

How secure is airSlate SignNow when handling sensitive documents like Form 1098 E?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents such as Form 1098 E. Our platform employs advanced encryption and compliance features to ensure your data is protected. You can confidently sign and share documents, knowing that your information remains secure.

Get more for Gov Revenue Internal

- Gfm065 this study sought to establish the psychometric properties of a coping strategies inventory short form csisf by

- Astrolabes professional natal report form

- Event vendor contract template form

- Event venue contract template form

- Events contract template form

- Eviction notice for breach of contract template form

- Example contract template form

- Excavation contract template form

Find out other Gov Revenue Internal

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online