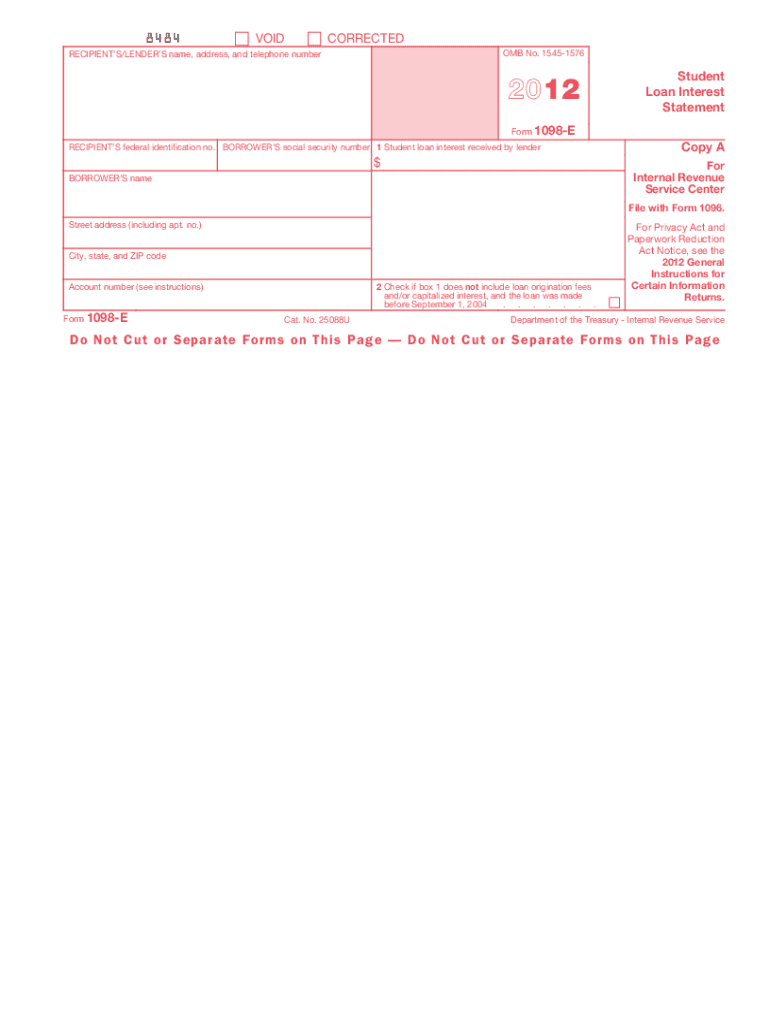

Form 1098 E Student Loan Interest Statement 2012

What is the Form 1098 E Student Loan Interest Statement

The Form 1098 E Student Loan Interest Statement is a tax document issued by lenders to report the amount of interest paid on qualified student loans during the tax year. This form is essential for taxpayers who are eligible to deduct student loan interest on their federal income tax returns. The information provided on the form helps taxpayers accurately calculate their deductions, potentially lowering their taxable income and tax liability.

How to use the Form 1098 E Student Loan Interest Statement

To utilize the Form 1098 E, taxpayers should first review the information provided, including the total interest paid on student loans. This amount can be claimed as a deduction on the taxpayer's federal tax return, specifically on Form 1040. It is important to ensure that the total interest reported aligns with the taxpayer's records. If discrepancies arise, contacting the lender for clarification is advisable.

Steps to complete the Form 1098 E Student Loan Interest Statement

Completing the Form 1098 E involves several straightforward steps:

- Gather all necessary documentation related to student loans, including loan statements.

- Review the Form 1098 E for accuracy, ensuring that the reported interest aligns with your records.

- Input the total interest amount from the form into your tax return.

- Keep a copy of the form for your records in case of future audits.

Key elements of the Form 1098 E Student Loan Interest Statement

Key elements of the Form 1098 E include:

- The lender's name, address, and taxpayer identification number.

- The borrower's name, address, and taxpayer identification number.

- The total amount of interest paid on the qualified student loans during the tax year.

- Any additional information regarding the loans that may be relevant for tax purposes.

Legal use of the Form 1098 E Student Loan Interest Statement

The Form 1098 E is legally recognized for tax reporting purposes in the United States. Taxpayers must use this form to accurately report student loan interest deductions. Compliance with IRS regulations is essential, as incorrect reporting can lead to penalties or audits. Retaining this form and any supporting documents is crucial for substantiating claims during tax filing.

Who Issues the Form 1098 E Student Loan Interest Statement

The Form 1098 E is issued by lenders or financial institutions that provide student loans. This includes both federal and private loan servicers. Taxpayers can expect to receive this form by January 31 of the following tax year, allowing ample time to prepare their tax returns. If the form is not received, borrowers should contact their loan servicer to request a copy.

Quick guide on how to complete 2012 form 1098 estudent loan interest statement

Accomplish Form 1098 E Student Loan Interest Statement effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without difficulties. Manage Form 1098 E Student Loan Interest Statement on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The most effective method to edit and eSign Form 1098 E Student Loan Interest Statement seamlessly

- Obtain Form 1098 E Student Loan Interest Statement and then click Get Form to begin.

- Employ the tools we provide to finalize your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1098 E Student Loan Interest Statement and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 1098 estudent loan interest statement

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 1098 estudent loan interest statement

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Form 1098 E Student Loan Interest Statement?

The Form 1098 E Student Loan Interest Statement is a tax document provided by lenders that details the interest paid on qualified student loans during the tax year. This form can help borrowers claim deductions on their federal tax returns, reducing their taxable income.

-

How can airSlate SignNow assist with the Form 1098 E Student Loan Interest Statement?

airSlate SignNow enables businesses to easily create, send, and eSign the Form 1098 E Student Loan Interest Statement securely and efficiently. This streamlines the process of managing essential tax documents, ensuring that all necessary signatures are obtained promptly.

-

Is there a cost to use airSlate SignNow for the Form 1098 E Student Loan Interest Statement?

airSlate SignNow offers a cost-effective solution for managing documents, including the Form 1098 E Student Loan Interest Statement. Pricing plans are available to fit various business needs, ensuring that you can find an option that works within your budget.

-

What features does airSlate SignNow provide for managing the Form 1098 E Student Loan Interest Statement?

With airSlate SignNow, you can easily customize, send, and track the Form 1098 E Student Loan Interest Statement. Additional features include templates, real-time notifications, and secure storage, enhancing the overall efficiency of document management.

-

How does airSlate SignNow ensure the security of the Form 1098 E Student Loan Interest Statement?

Security is a top priority at airSlate SignNow, with robust encryption and secure access controls in place. This ensures that your Form 1098 E Student Loan Interest Statement and other sensitive documents are protected against unauthorized access.

-

Can airSlate SignNow integrate with other software for managing the Form 1098 E Student Loan Interest Statement?

Yes, airSlate SignNow offers various integrations with popular business applications, allowing you to streamline your workflow when managing the Form 1098 E Student Loan Interest Statement. This helps consolidate your documents and enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for the Form 1098 E Student Loan Interest Statement?

Using airSlate SignNow for the Form 1098 E Student Loan Interest Statement provides numerous benefits, including time savings and reduced paperwork. The easy-to-use interface allows for quick document turnaround, ensuring that you can focus on what matters most.

Get more for Form 1098 E Student Loan Interest Statement

- Form ct w4na effective january 1 2021 employees withholding

- Of an international insurer or an form

- Sc 6042 26 oct 17pmd form

- Informative return for

- Individual income tax return inst 2018pmd form

- Form 499r 2cw 2cpr electronic filing puerto rico

- Fr 399 qualified high technology companies otrcfodcgov form

- Pdf 2004 form fr 147 statement of person claiming refund due a

Find out other Form 1098 E Student Loan Interest Statement

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will