About Form 1042, Annual Withholding Tax Return for U S Source Income 2023

What is the About Form 1042, Annual Withholding Tax Return For U.S. Source Income

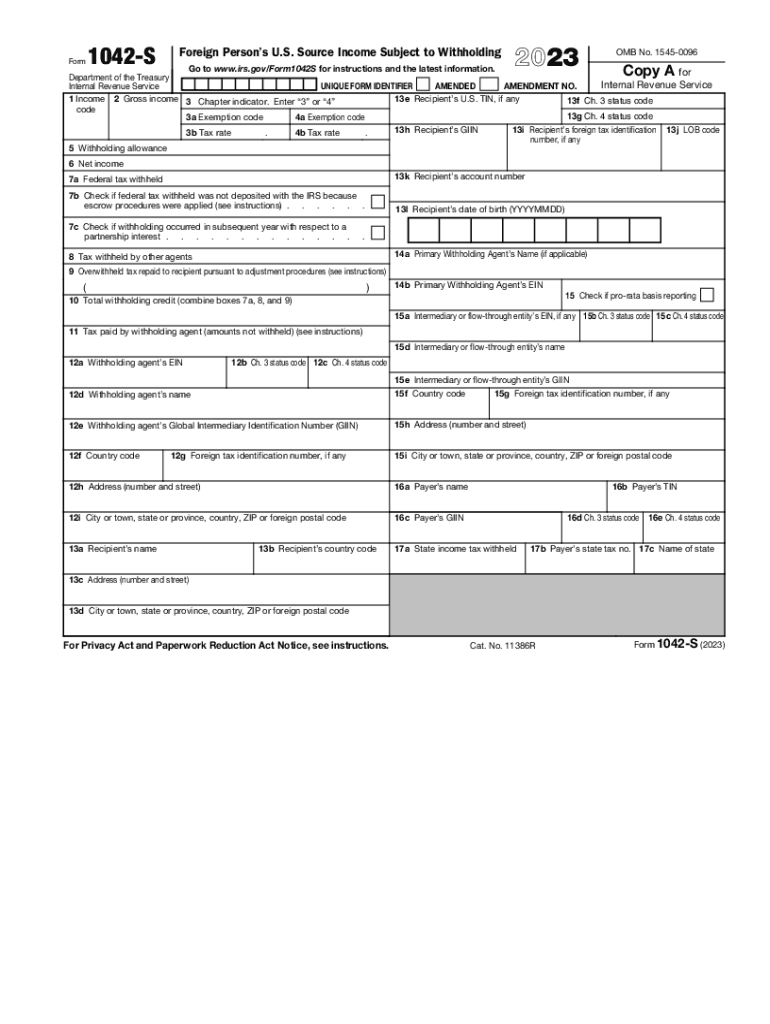

The Form 1042 is an essential document used by withholding agents to report tax withheld on certain types of income paid to foreign persons. This includes payments such as interest, dividends, rents, and royalties sourced from the United States. The form is designed to ensure compliance with U.S. tax laws, particularly for non-resident aliens and foreign entities receiving income from U.S. sources. Understanding the purpose and requirements of Form 1042 is crucial for businesses and individuals involved in international transactions.

Steps to Complete the About Form 1042, Annual Withholding Tax Return For U.S. Source Income

Completing Form 1042 involves several key steps that ensure accurate reporting and compliance. First, gather all necessary information regarding the payments made to foreign persons, including the amounts and types of income. Next, identify the withholding tax rates applicable to each payment type. It is important to calculate the total amount of tax withheld accurately. After filling out the form, review it for completeness and accuracy before submission. Finally, ensure that the form is filed by the deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 1042 are critical to avoid penalties. Typically, the form must be filed annually by March 15 of the year following the calendar year in which the income was paid. If March 15 falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, any payments made to foreign persons must be reported on Form 1042-S, which is due on the same date. Keeping track of these deadlines is essential for compliance.

Legal Use of the About Form 1042, Annual Withholding Tax Return For U.S. Source Income

The legal use of Form 1042 is governed by U.S. tax laws, which require withholding agents to report and remit taxes on certain payments to foreign persons. This form serves as a declaration of compliance with these laws and helps prevent tax evasion. It is important for businesses to understand their obligations under the Internal Revenue Code and ensure that they are using the form correctly to avoid legal repercussions.

Required Documents

To complete Form 1042, certain documents are required. These include records of payments made to foreign persons, documentation of the withholding tax rates applied, and any relevant tax treaties that may affect the withholding rate. Additionally, businesses may need to provide Form W-8BEN or W-8BEN-E from foreign payees to establish their foreign status and claim any applicable treaty benefits. Collecting and organizing these documents ahead of time can streamline the filing process.

Penalties for Non-Compliance

Failure to file Form 1042 or to remit the appropriate taxes can result in significant penalties. The IRS imposes fines for late filing, which can increase based on the duration of the delay. Additionally, if the form is filed incorrectly or contains inaccuracies, the withholding agent may face further penalties. Understanding these consequences highlights the importance of accurate and timely filing.

Quick guide on how to complete about form 1042 annual withholding tax return for us source income

Accomplish About Form 1042, Annual Withholding Tax Return For U S Source Income seamlessly on any gadget

Digital document administration has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Handle About Form 1042, Annual Withholding Tax Return For U S Source Income on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and electronically sign About Form 1042, Annual Withholding Tax Return For U S Source Income effortlessly

- Obtain About Form 1042, Annual Withholding Tax Return For U S Source Income and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign About Form 1042, Annual Withholding Tax Return For U S Source Income and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1042 annual withholding tax return for us source income

Create this form in 5 minutes!

How to create an eSignature for the about form 1042 annual withholding tax return for us source income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the pricing options for airSlate SignNow in 2022?

In 2022, airSlate SignNow offers several pricing plans tailored to fit different business needs. These plans range from a basic individual plan to comprehensive solutions for larger teams and enterprises. Each plan provides access to essential features that empower users to streamline their document signing processes.

-

What features does airSlate SignNow offer in 2022?

In 2022, airSlate SignNow includes features such as customizable templates, real-time tracking, and robust eSignature capabilities. Users can also enjoy advanced automation tools that simplify document workflows. These features ensure that businesses can manage their documents efficiently and securely.

-

How can airSlate SignNow benefit my business in 2022?

airSlate SignNow can signNowly benefit your business in 2022 by enhancing productivity and reducing turnaround time for document signing. The user-friendly interface allows team members to navigate the platform effortlessly. By adopting this solution, businesses can also save costs associated with managing physical documents.

-

Is airSlate SignNow compliant with legal eSignature standards in 2022?

Yes, airSlate SignNow complies with legal eSignature standards in 2022, including eIDAS in Europe and ESIGN in the United States. This compliance ensures that your electronically signed documents are legally binding and secure. Businesses can confidently use airSlate SignNow for fulfilling their signatory requirements.

-

What integrations does airSlate SignNow support in 2022?

In 2022, airSlate SignNow offers integrations with popular applications such as Google Drive, Salesforce, and Microsoft Office. These integrations enhance the functionality of the platform and allow users to manage their documents seamlessly across various tools. This versatility helps businesses to streamline their workflows.

-

Can I use airSlate SignNow for mobile signing in 2022?

Absolutely! airSlate SignNow provides a mobile-friendly platform that enables users to eSign documents on-the-go in 2022. The mobile app is designed for convenience, ensuring that important documents can be signed quickly and efficiently from any location. This flexibility is essential for modern businesses.

-

How secure is airSlate SignNow in 2022?

airSlate SignNow prioritizes security in 2022 by employing advanced encryption methods and multi-factor authentication. These measures help to ensure that your sensitive documents remain protected from unauthorized access. Users can trust that their data is safely managed throughout the signing process.

Get more for About Form 1042, Annual Withholding Tax Return For U S Source Income

Find out other About Form 1042, Annual Withholding Tax Return For U S Source Income

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template