Federal Income Tax Withholding and Reporting on Other 2024

What is Form 1042?

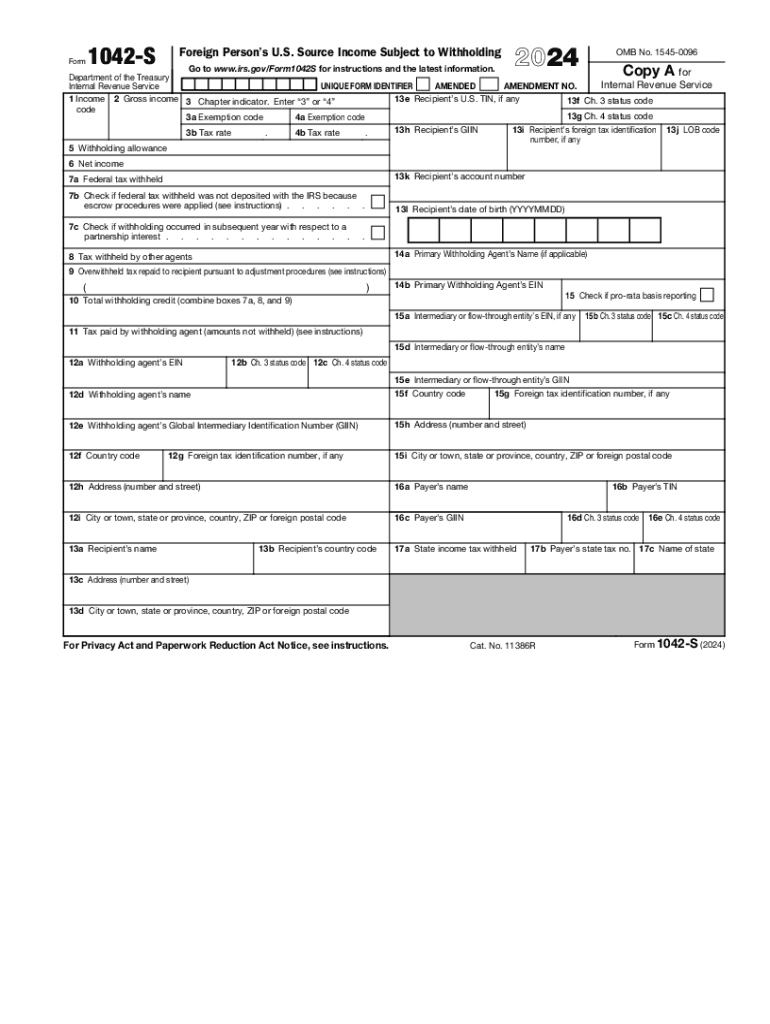

Form 1042 is an IRS document used for reporting income subject to withholding for foreign persons. This form is essential for U.S. entities that make payments to non-resident aliens and foreign corporations. It encompasses various types of income, including interest, dividends, rents, and royalties. The form ensures compliance with U.S. tax laws by detailing the amount of income paid and the tax withheld. Understanding Form 1042 is crucial for businesses that engage with foreign entities to avoid penalties and ensure proper reporting.

Key Elements of Form 1042

Form 1042 includes several key components that are vital for accurate reporting:

- Withholding Agent Information: This section identifies the U.S. entity responsible for withholding tax on payments made to foreign persons.

- Recipient Information: Details about the foreign recipient, including their name, address, and taxpayer identification number.

- Income Type: Specifies the type of income being reported, such as dividends or interest.

- Tax Withheld: The total amount of tax withheld from the payments made to the foreign recipient.

Steps to Complete Form 1042

Completing Form 1042 involves several steps to ensure accuracy and compliance:

- Gather necessary information about the withholding agent and the foreign recipients.

- Identify the types of income being reported and the corresponding amounts.

- Calculate the total tax withheld for each recipient based on applicable rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

Filing Deadlines for Form 1042

Form 1042 must be filed annually, with specific deadlines to keep in mind:

- The form is due on March 15 of the year following the calendar year for which the income was paid.

- If you are filing electronically, you may have an extension until March 31.

- Penalties may apply for late filing or failure to file, making adherence to deadlines essential.

IRS Guidelines for Form 1042

The IRS provides comprehensive guidelines for completing and submitting Form 1042. These guidelines cover:

- Eligibility criteria for withholding agents.

- Detailed instructions on how to report various types of income.

- Information on the withholding tax rates applicable to different income types.

- Compliance requirements to avoid penalties.

Penalties for Non-Compliance with Form 1042

Failure to comply with Form 1042 requirements can lead to significant penalties. These may include:

- Fines for late filing or failure to file.

- Increased scrutiny from the IRS for non-compliant businesses.

- Potential legal repercussions for withholding agents who do not adhere to reporting requirements.

Quick guide on how to complete federal income tax withholding and reporting on other

Finish Federal Income Tax Withholding And Reporting On Other effortlessly on any gadget

Web-based document organization has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage Federal Income Tax Withholding And Reporting On Other on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

Steps to modify and eSign Federal Income Tax Withholding And Reporting On Other with ease

- Obtain Federal Income Tax Withholding And Reporting On Other and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant portions of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of sharing your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Federal Income Tax Withholding And Reporting On Other and ensure seamless communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal income tax withholding and reporting on other

Create this form in 5 minutes!

How to create an eSignature for the federal income tax withholding and reporting on other

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1042 form and how does airSlate SignNow help with it?

The 1042 form is used to report income paid to non-resident aliens. airSlate SignNow simplifies the process of signing and sending 1042 forms electronically, ensuring compliance and efficiency. With our platform, you can easily manage and track your 1042 documents, making tax season less stressful.

-

How much does airSlate SignNow cost for handling 1042 forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our plans include features specifically designed for managing 1042 forms, ensuring you get the best value for your investment. You can choose a plan that fits your needs and budget while efficiently handling your 1042 documentation.

-

What features does airSlate SignNow offer for 1042 form management?

airSlate SignNow provides a range of features for 1042 form management, including customizable templates, secure eSigning, and real-time tracking. These features streamline the process of preparing and sending 1042 forms, allowing you to focus on your core business activities. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Can I integrate airSlate SignNow with other software for 1042 forms?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for 1042 forms. Whether you use accounting software or CRM systems, our platform can connect with them to automate the process of sending and signing 1042 documents. This integration helps reduce manual errors and saves time.

-

What are the benefits of using airSlate SignNow for 1042 forms?

Using airSlate SignNow for 1042 forms provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform allows you to send and sign documents quickly, ensuring that your 1042 forms are processed without delays. Additionally, the secure environment protects sensitive information, giving you peace of mind.

-

Is airSlate SignNow compliant with regulations for 1042 forms?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations regarding the handling of 1042 forms. Our platform ensures that your electronic signatures and document management practices meet legal standards, helping you avoid potential compliance issues while managing your 1042 documentation.

-

How does airSlate SignNow ensure the security of my 1042 forms?

airSlate SignNow prioritizes the security of your 1042 forms through advanced encryption and secure storage solutions. We implement industry-standard security measures to protect your documents from unauthorized access. With our platform, you can confidently manage your 1042 forms knowing that your data is safe and secure.

Get more for Federal Income Tax Withholding And Reporting On Other

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent maine form

- Letter from tenant to landlord about sexual harassment maine form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children maine form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure maine form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497310792 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497310793 form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497310794 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497310795 form

Find out other Federal Income Tax Withholding And Reporting On Other

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement