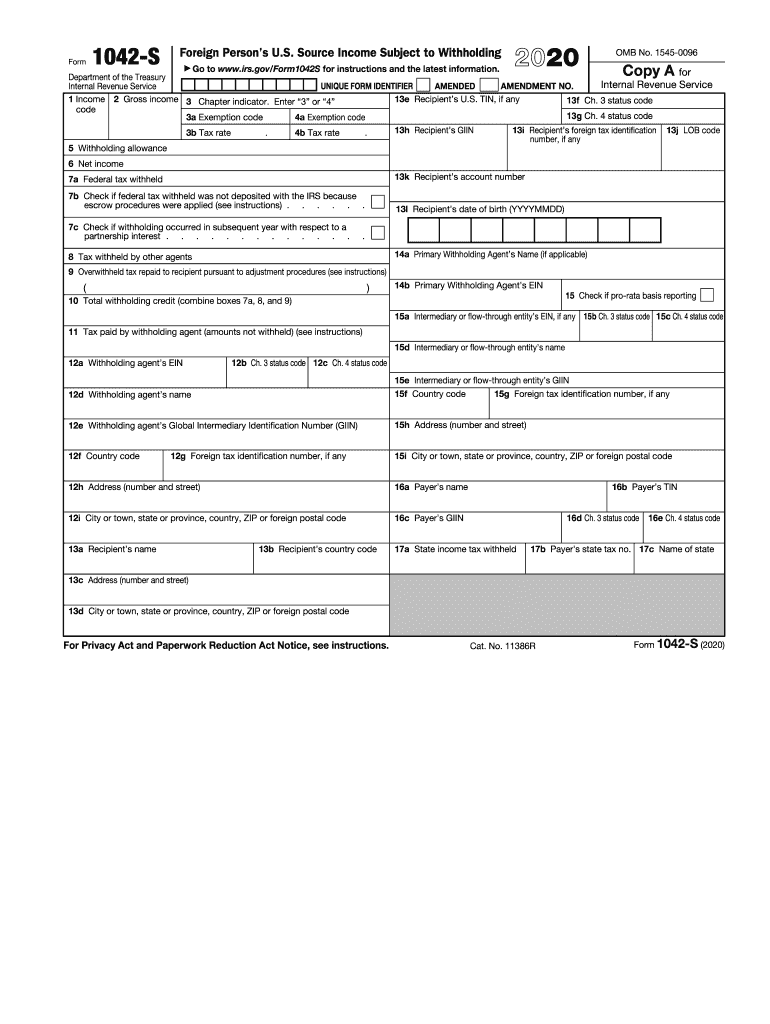

Form 1042 S Foreign Person's U S Source Income Subject to Withholding 2020

What is the Form 1042 S Foreign Person's U S Source Income Subject To Withholding

The Form 1042 S is a tax document used by withholding agents to report payments made to foreign persons that are subject to U.S. withholding tax. This form is specifically designed for reporting income such as interest, dividends, rents, and royalties that are sourced from within the United States. It is essential for both the payer and the recipient to understand the implications of this form, as it ensures compliance with U.S. tax laws and helps foreign recipients claim any applicable tax treaty benefits.

How to use the Form 1042 S Foreign Person's U S Source Income Subject To Withholding

To effectively use the Form 1042 S, the withholding agent must first determine the amount of income paid to the foreign person and the applicable withholding tax rate. Once this is established, the agent fills out the form with the necessary details, including the recipient's name, address, and taxpayer identification number. The completed form must be provided to the foreign recipient and filed with the IRS by the specified deadlines. Understanding how to use this form correctly is crucial for ensuring that both parties fulfill their tax obligations.

Steps to complete the Form 1042 S Foreign Person's U S Source Income Subject To Withholding

Completing the Form 1042 S involves several key steps:

- Gather the required information about the foreign recipient, including their name, address, and taxpayer identification number.

- Determine the total amount of U.S. source income paid to the foreign person during the tax year.

- Identify the appropriate withholding tax rate based on the type of income and any applicable tax treaties.

- Fill out the form accurately, ensuring all fields are completed as required.

- Provide a copy of the completed form to the foreign recipient by the deadline.

- File the form with the IRS by the required due date.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1042 S. These guidelines include instructions on the information required, deadlines for filing, and penalties for non-compliance. It is important for withholding agents to stay updated on any changes to these guidelines to ensure compliance with federal tax laws. The IRS also offers resources and publications that can assist in understanding the requirements associated with this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042 S are crucial for compliance. Generally, the form must be filed with the IRS by March 15 of the year following the tax year in which the income was paid. Additionally, a copy of the form must be provided to the foreign recipient by the same date. It is important to keep track of these deadlines to avoid potential penalties for late filing.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 1042 S can result in significant penalties. These may include fines for late filing, incorrect information, or failure to provide the form to the recipient. The IRS takes non-compliance seriously, and withholding agents should ensure they adhere to all filing requirements to avoid these penalties.

Quick guide on how to complete 2020 form 1042 s foreign persons us source income subject to withholding

Complete Form 1042 S Foreign Person's U S Source Income Subject To Withholding effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can acquire the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 1042 S Foreign Person's U S Source Income Subject To Withholding on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 1042 S Foreign Person's U S Source Income Subject To Withholding with ease

- Find Form 1042 S Foreign Person's U S Source Income Subject To Withholding and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from a device of your choice. Edit and eSign Form 1042 S Foreign Person's U S Source Income Subject To Withholding and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1042 s foreign persons us source income subject to withholding

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1042 s foreign persons us source income subject to withholding

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the IRS 1042 form for the 2020 year?

The IRS 1042 form for the 2020 year is used to report income paid to non-resident aliens, as well as the withholding tax on those payments. Understanding this form is crucial for compliance with tax regulations and to ensure accurate reporting for both the payer and the recipient.

-

How can airSlate SignNow assist with IRS 1042 form for the 2020 year?

airSlate SignNow streamlines the process of filling out and electronically signing the IRS 1042 form for the 2020 year. With its easy-to-use interface, you can efficiently manage and store your forms, keeping everything organized and accessible.

-

What features does airSlate SignNow offer for IRS forms?

airSlate SignNow offers features like document templates, automated workflows, and secure eSignature functionality specifically designed for IRS forms, including the IRS 1042 form for the 2020 year. These features enhance productivity and ensure that you meet all necessary requirements.

-

Is airSlate SignNow a cost-effective solution for managing IRS forms?

Yes, airSlate SignNow provides a cost-effective solution for managing IRS forms, including the IRS 1042 form for the 2020 year. With competitive pricing plans, businesses of all sizes can utilize its extensive features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting and tax preparation software, making it easier to manage the IRS 1042 form for the 2020 year alongside your other financial documentation. Custom integrations can further enhance your workflow efficiency.

-

What are the benefits of using airSlate SignNow for the IRS 1042 form?

Using airSlate SignNow for the IRS 1042 form for the 2020 year offers numerous benefits, such as time-saving automation, improved accuracy, and enhanced document security. It simplifies the eSigning process, allowing for quicker turnaround times and reduced hassles.

-

How secure is airSlate SignNow for handling IRS documents?

airSlate SignNow prioritizes security with advanced encryption and compliance measures, ensuring that documents like the IRS 1042 form for the 2020 year are handled safely. You can trust that your sensitive information is protected throughout the eSigning and document storage processes.

Get more for Form 1042 S Foreign Person's U S Source Income Subject To Withholding

Find out other Form 1042 S Foreign Person's U S Source Income Subject To Withholding

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement