Form 1042 S Foreign Person's U S Source Income Subject to Withholding 2021

What is the Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding

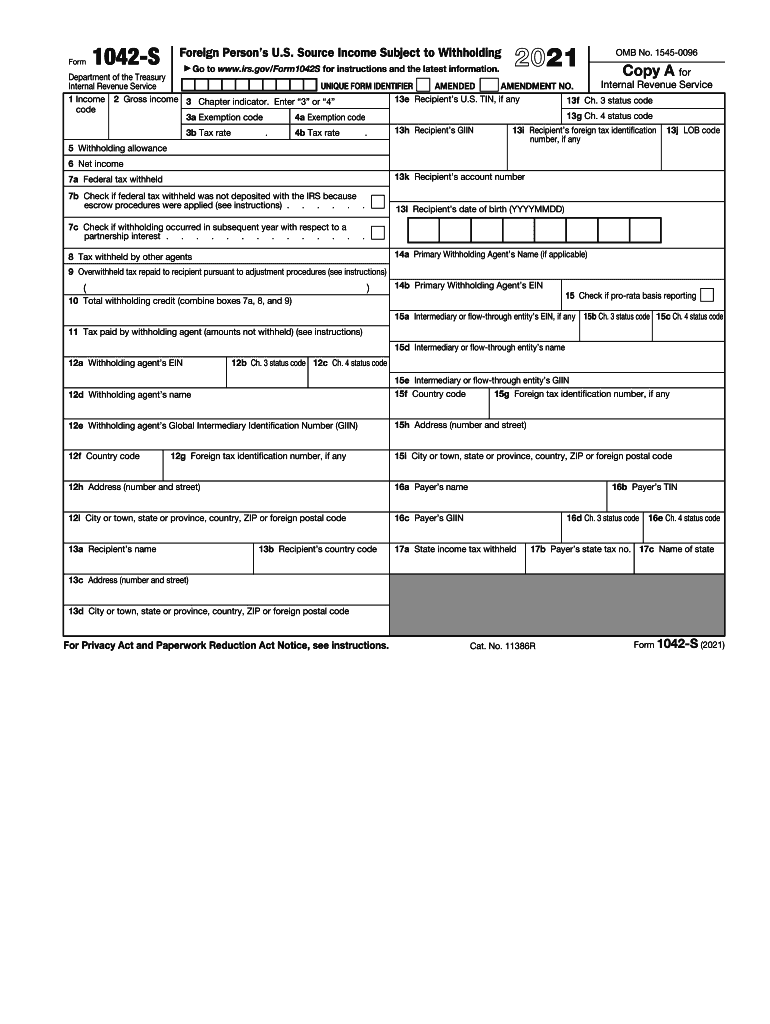

The Form 1042-S is a crucial document used by U.S. withholding agents to report income paid to foreign persons that is subject to withholding tax. This form is essential for ensuring compliance with U.S. tax laws and regulations. It includes details about the income type, the amount paid, and the withholding tax applied. The form is typically used for various types of income, including interest, dividends, rents, and royalties. Understanding the purpose and requirements of the Form 1042-S is vital for both payers and recipients to avoid potential penalties.

Steps to Complete the Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding

Completing the Form 1042-S involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the foreign recipient, including their name, address, and taxpayer identification number (TIN). Next, identify the type of income being reported and the applicable withholding rate. Fill out the form by entering the required details in the appropriate fields, ensuring that all information is accurate and complete. Finally, review the form for any errors before submission. It is essential to keep a copy of the completed form for your records.

How to Obtain the Form 1042-S Foreign Person's U.S. Source Income Subject to Withholding

The Form 1042-S can be obtained directly from the Internal Revenue Service (IRS) website or through authorized tax software that supports IRS forms. It is available in a downloadable format, allowing users to fill it out electronically or by hand. For those who prefer a physical copy, the form can also be requested by calling the IRS or visiting a local IRS office. Ensuring you have the correct version of the form is important, as updates may occur annually.

IRS Guidelines for Form 1042-S

The IRS provides specific guidelines for completing and filing the Form 1042-S. These guidelines include instructions on how to report various types of income, the proper withholding rates, and the deadlines for submission. It is important to follow these guidelines closely to ensure compliance and avoid penalties. Taxpayers should also be aware of the reporting requirements for both the payer and the recipient, including the need for the recipient to report the income on their tax return.

Penalties for Non-Compliance with Form 1042-S

Failure to comply with the requirements of the Form 1042-S can result in significant penalties. These may include fines for late filing or incorrect information, as well as potential legal repercussions for withholding agents who fail to report income accurately. It is crucial for businesses and individuals to understand their obligations regarding this form to avoid these penalties. Regular training and updates on IRS regulations can help ensure compliance and minimize risks associated with non-compliance.

Eligibility Criteria for Form 1042-S

Eligibility for the Form 1042-S primarily revolves around the status of the income recipient. Foreign persons, including non-resident aliens and foreign corporations, who receive U.S. source income that is subject to withholding must be reported on this form. Additionally, the payer must be a U.S. withholding agent responsible for withholding tax on the payments made. Understanding these eligibility criteria is essential for both payers and recipients to ensure proper reporting and compliance with U.S. tax laws.

Quick guide on how to complete 2021 form 1042 s foreign persons us source income subject to withholding

Effortlessly Prepare Form 1042 S Foreign Person's U S Source Income Subject To Withholding on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Form 1042 S Foreign Person's U S Source Income Subject To Withholding on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Form 1042 S Foreign Person's U S Source Income Subject To Withholding with Ease

- Locate Form 1042 S Foreign Person's U S Source Income Subject To Withholding and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors needing the reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Form 1042 S Foreign Person's U S Source Income Subject To Withholding to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1042 s foreign persons us source income subject to withholding

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1042 s foreign persons us source income subject to withholding

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

How to create an e-signature for a PDF document on Android devices

People also ask

-

What is form1042s and why is it important?

Form1042s is a tax document used to report amounts paid to non-resident aliens and foreign entities. It is essential for compliance with U.S. tax regulations, ensuring that withholding taxes are correctly reported and remitted. Understanding form1042s helps businesses avoid penalties and streamline their tax reporting process.

-

How can airSlate SignNow simplify the process of handling form1042s?

airSlate SignNow provides a user-friendly platform to create, send, and eSign form1042s with ease. Our solution allows you to automate the document workflow, reducing the time spent on manual tasks. With digital storage, tracking, and reminders, managing form1042s becomes streamlined.

-

What are the pricing options for using airSlate SignNow for form1042s?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Whether you're a small business or a large organization, you can choose from various subscription tiers that provide access to form1042s functionalities. All plans come with a free trial to explore our features before committing.

-

Does airSlate SignNow integrate with other software for managing form1042s?

Yes, airSlate SignNow integrates seamlessly with popular business applications, such as accounting software and CRM systems. This ensures that the process of generating and managing form1042s fits smoothly into your existing workflows. Our API allows for further custom integrations to optimize your document management.

-

What security measures does airSlate SignNow implement for form1042s?

airSlate SignNow prioritizes data security with encryption, secure user authentication, and compliance with industry standards. When handling sensitive documents like form1042s, you can rest assured that your data is protected. Our security protocols ensure safe eSigning and document storage.

-

Can airSlate SignNow help with tracking the status of form1042s?

Absolutely! airSlate SignNow provides features for tracking the status of your form1042s throughout the signing process. You will receive notifications when documents are viewed or signed, allowing for enhanced visibility and control over your tax-related documents.

-

What benefits does airSlate SignNow offer for businesses dealing with form1042s?

The key benefits of using airSlate SignNow for form1042s include increased efficiency, reduced processing time, and enhanced compliance. By digitizing the signing process, businesses can eliminate paper clutter and improve their document management. Additionally, automatic reminders help ensure timely submission of form1042s.

Get more for Form 1042 S Foreign Person's U S Source Income Subject To Withholding

- Disclosure residential form

- Idaho seller 497305371 form

- Notice of default for past due payments in connection with contract for deed idaho form

- Final notice of default for past due payments in connection with contract for deed idaho form

- Assignment of contract for deed by seller idaho form

- Notice of assignment of contract for deed idaho form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement idaho form

- Buyers home inspection checklist idaho form

Find out other Form 1042 S Foreign Person's U S Source Income Subject To Withholding

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document