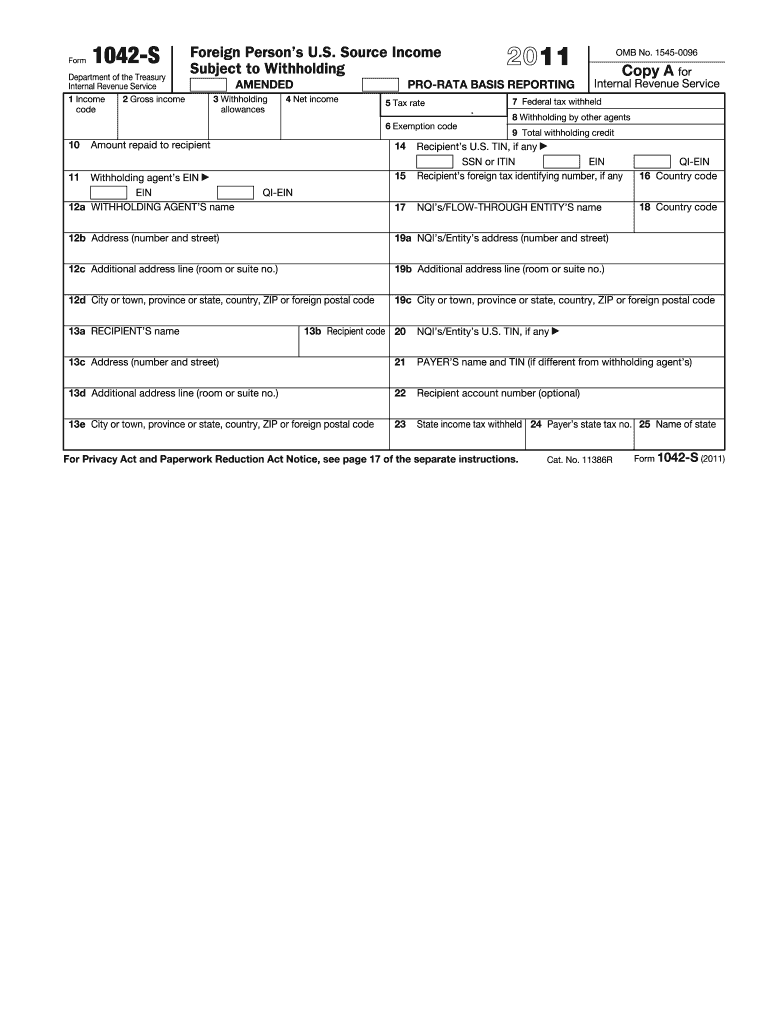

1042 S Form 2011

What is the 1042 S Form

The 1042 S Form is a tax document used by the Internal Revenue Service (IRS) in the United States to report income paid to foreign persons. This form is essential for withholding agents who must report payments made to non-resident aliens and foreign entities. It includes details about the income paid, the amount withheld, and the recipient's information. The 1042 S Form is particularly relevant for those who receive income such as dividends, interest, royalties, or other forms of compensation from U.S. sources.

How to use the 1042 S Form

Using the 1042 S Form involves several key steps. First, the withholding agent must gather accurate information about the foreign recipient, including their name, address, and taxpayer identification number. Next, the agent should complete the form by entering the appropriate details regarding the payments made and the amount withheld. After filling out the form, it must be submitted to the IRS and a copy provided to the recipient. It is crucial to ensure that all information is accurate to avoid penalties and ensure compliance with tax regulations.

Steps to complete the 1042 S Form

Completing the 1042 S Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the foreign recipient, including their identification details.

- Fill out the form, ensuring that all sections are completed accurately.

- Calculate the amount of income paid and the corresponding tax withheld.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the specified deadline.

- Provide a copy of the form to the foreign recipient for their records.

Legal use of the 1042 S Form

The 1042 S Form is legally binding when completed correctly and submitted according to IRS guidelines. It serves as a record of income payments made to foreign individuals and entities, ensuring compliance with U.S. tax laws. The form must be filed annually, and failure to do so can result in penalties for the withholding agent. It is important to understand the legal implications of the information reported on the form, as inaccuracies can lead to audits or other legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1042 S Form are crucial for compliance with IRS regulations. Generally, the form must be filed by March 15 of the year following the tax year in which the payments were made. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. Withholding agents should also be aware of any extensions that may be available and ensure that they meet all filing requirements to avoid penalties.

Penalties for Non-Compliance

Non-compliance with the requirements for the 1042 S Form can result in significant penalties. These may include fines for failure to file the form on time, inaccuracies in reporting, or failure to provide copies to recipients. The IRS may impose penalties based on the amount of tax that should have been withheld and reported. It is essential for withholding agents to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete 2011 1042 s form

Effortlessly Prepare 1042 S Form on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without any holdups. Manage 1042 S Form on any device with airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

The easiest method to modify and eSign 1042 S Form with minimal effort

- Obtain 1042 S Form and click on Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign 1042 S Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 1042 s form

Create this form in 5 minutes!

How to create an eSignature for the 2011 1042 s form

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the 1042 S Form and why do I need it?

The 1042 S Form is used to report income paid to non-resident aliens, including interest, dividends, and royalties. If your business deals with foreign clients or employees, you must file this form to comply with IRS regulations. Using airSlate SignNow simplifies the process of eSigning and sending the 1042 S Form, ensuring you stay compliant and organized.

-

How does airSlate SignNow help with the 1042 S Form eSigning process?

airSlate SignNow offers a user-friendly platform that allows you to quickly prepare, send, and eSign the 1042 S Form. Our solution ensures that all signatures are legally binding, and documents can be tracked in real-time, enhancing your workflow and efficiency. With airSlate SignNow, managing your 1042 S Form is seamless and secure.

-

Are there any costs associated with using airSlate SignNow for the 1042 S Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including a free trial for new users. Depending on the features you require for managing the 1042 S Form, you can choose a plan that best fits your budget. Our cost-effective solution ensures you get value while streamlining your document processes.

-

Can I integrate airSlate SignNow with other software for handling the 1042 S Form?

Absolutely! airSlate SignNow integrates with a range of applications, including CRM systems and accounting software, to help you manage your 1042 S Form seamlessly. These integrations allow for automatic data transfer and easy access to documents, enhancing your overall productivity and efficiency.

-

What security measures does airSlate SignNow offer for the 1042 S Form?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure data storage to protect your 1042 S Form and other sensitive documents. With our platform, you can rest assured that your information remains confidential and compliant with industry standards.

-

How can I ensure compliance when using the 1042 S Form with airSlate SignNow?

airSlate SignNow is designed to help you meet compliance requirements effortlessly. Our platform provides templates and guidance specifically for the 1042 S Form, ensuring that all necessary information is included and correctly formatted. Additionally, our audit trails offer transparency and accountability for your document transactions.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with the 1042 S Form?

Yes, airSlate SignNow is suitable for businesses of all sizes, from startups to large enterprises, when it comes to managing the 1042 S Form. Our scalable solutions can adapt to the needs of your business, providing the tools necessary for efficient document management. No matter your size, airSlate SignNow enhances your workflow.

Get more for 1042 S Form

Find out other 1042 S Form

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter