1042 S Form 2022

What is the 1042 S Form

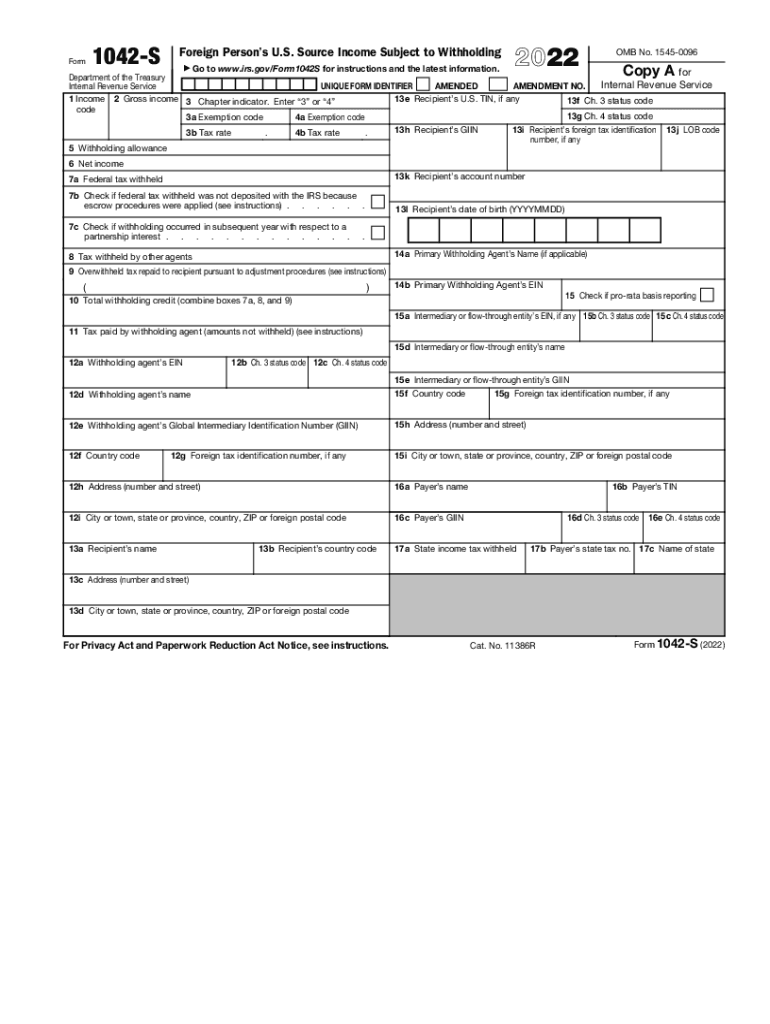

The 1042 S form is an Internal Revenue Service (IRS) document used to report income paid to foreign persons, including non-resident aliens and foreign entities. This form is essential for withholding agents who must report payments made to foreign individuals or entities, ensuring compliance with U.S. tax laws. The 1042 S form is particularly relevant for income that is subject to withholding tax, such as interest, dividends, rents, and royalties. Understanding this form is crucial for both the payers and the recipients to ensure accurate tax reporting and compliance.

How to use the 1042 S Form

Using the 1042 S form involves several key steps. First, the withholding agent must determine if the payment made to a foreign person requires reporting. If so, the agent completes the form, providing details about the payment, the recipient, and the amount withheld. The completed form must then be provided to the recipient by March fifteenth of the year following the payment. Additionally, the withholding agent must file the form with the IRS, typically by the same deadline. Proper use of the 1042 S form helps ensure that foreign recipients receive the necessary documentation for their tax filings.

Steps to complete the 1042 S Form

Completing the 1042 S form requires attention to detail. Follow these steps for accurate completion:

- Identify the payment type and ensure it is reportable under IRS guidelines.

- Gather the necessary information about the recipient, including their name, address, and taxpayer identification number (if applicable).

- Fill out each section of the form, including the amount paid and the amount withheld.

- Review the form for accuracy before submission.

- Provide a copy of the completed form to the recipient by the deadline.

- File the form with the IRS, ensuring compliance with all filing requirements.

Legal use of the 1042 S Form

The legal use of the 1042 S form is governed by U.S. tax laws, specifically regarding the reporting of income paid to foreign individuals and entities. It is essential for withholding agents to understand their obligations under the Foreign Account Tax Compliance Act (FATCA) and other relevant regulations. Proper use of the 1042 S form ensures that both the payer and recipient meet their legal responsibilities, helping to avoid potential penalties for non-compliance. Additionally, the form serves as a critical document for recipients when filing their own tax returns in their respective jurisdictions.

Filing Deadlines / Important Dates

Timely filing of the 1042 S form is crucial for compliance. The form must be provided to recipients by March fifteenth of the year following the payment. Additionally, the withholding agent must file the form with the IRS by the same date. If the fifteenth falls on a weekend or holiday, the deadline is extended to the next business day. Being aware of these deadlines helps ensure that all parties fulfill their tax obligations without incurring penalties.

Penalties for Non-Compliance

Failure to comply with the requirements related to the 1042 S form can result in significant penalties. Withholding agents may face fines for late filing, incomplete forms, or failure to provide the required copies to recipients. The IRS imposes penalties that can escalate based on the length of the delay and the amount of tax owed. Understanding these potential penalties emphasizes the importance of accurate and timely completion and submission of the 1042 S form.

Quick guide on how to complete 1042 s form

Complete 1042 S Form effortlessly on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly without any holdups. Manage 1042 S Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and electronically sign 1042 S Form with ease

- Find 1042 S Form and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize crucial sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign 1042 S Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1042 s form

Create this form in 5 minutes!

People also ask

-

What is the 1042 S form and who needs it?

The 1042 S form is a tax document used to report income paid to foreign persons. If you are a business making payments to non-resident aliens or foreign entities, you will need this form to comply with IRS regulations. Using airSlate SignNow simplifies the eSignature process for the 1042 S form, making it easy to get necessary approvals quickly.

-

How can I electronically sign the 1042 S form with airSlate SignNow?

With airSlate SignNow, you can easily sign the 1042 S form electronically by uploading your document and using our intuitive eSignature features. Simply drag and drop signature fields where needed, invite signers, and send it out for signing. This streamlines the often tedious signing process associated with tax forms.

-

Are there any costs associated with using airSlate SignNow for the 1042 S form?

AirSlate SignNow offers a cost-effective solution for managing documents like the 1042 S form. Pricing plans vary based on features and usage, allowing you to choose a package that fits your needs. The ability to save time and increase efficiency can ultimately lead to signNow savings for your business.

-

What features does airSlate SignNow offer for handling the 1042 S form?

AirSlate SignNow provides a range of features designed to optimize the handling of the 1042 S form, including customizable templates, automated workflows, and secure cloud storage. You can track the status of your document in real-time, ensuring that you never miss a signature. These features enhance your overall document management process.

-

Can I integrate airSlate SignNow with my existing tools for managing the 1042 S form?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms you may already be using, such as CRM systems or accounting software. This allows you to manage the 1042 S form and other financial documents within your existing workflows. Integration enhances productivity by centralizing your processes.

-

What are the benefits of using airSlate SignNow for the 1042 S form?

Using airSlate SignNow for the 1042 S form delivers numerous benefits, including faster document turnaround and reduced paper usage. The platform ensures compliance with IRS standards and adds a layer of security to sensitive tax documents. This enables businesses to focus on their core activities rather than getting bogged down in paperwork.

-

Is airSlate SignNow secure for signing the 1042 S form?

Absolutely! AirSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your data when signing the 1042 S form. You can feel confident knowing that your information is safeguarded from unauthorized access, complying with industry standards for security.

Get more for 1042 S Form

- Plumbing contract for contractor nebraska form

- Brick mason contract for contractor nebraska form

- Roofing contract for contractor nebraska form

- Electrical contract for contractor nebraska form

- Sheetrock drywall contract for contractor nebraska form

- Flooring contract for contractor nebraska form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract nebraska form

- Notice of intent to enforce forfeiture provisions of contact for deed nebraska form

Find out other 1042 S Form

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document