Form 1041 Qft 2011

What is the Form 1041 Qft

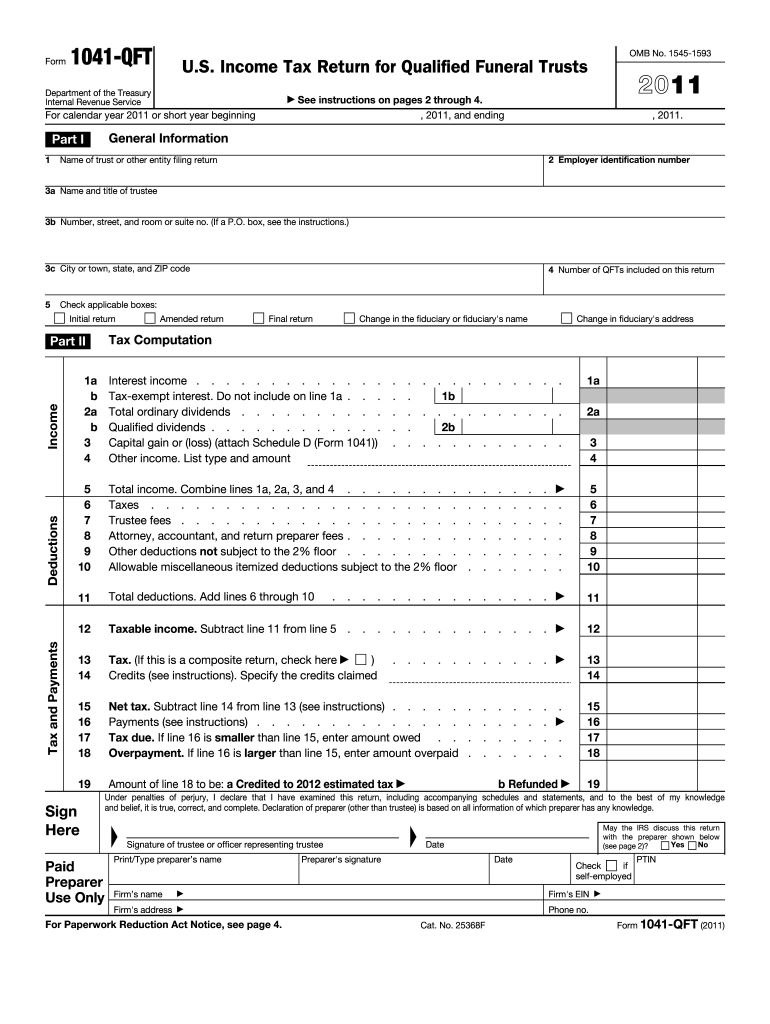

The Form 1041 QFT is a tax return specifically designed for qualified funeral trusts. This form is utilized by the fiduciary of a qualified funeral trust to report income, deductions, and tax liability to the Internal Revenue Service (IRS). It is essential for ensuring compliance with tax regulations related to funeral expenses and trusts. The form helps manage the financial aspects of funeral arrangements, providing a structured way to report income generated by the trust's assets.

How to use the Form 1041 Qft

Using the Form 1041 QFT involves several steps. First, the fiduciary must gather necessary financial information related to the trust, including income and deductions. Next, the form must be completed accurately, ensuring that all required fields are filled out. Once completed, the form should be signed and submitted to the IRS by the specified deadline. It is crucial to maintain accurate records of all transactions related to the trust for future reference and compliance.

Steps to complete the Form 1041 Qft

Completing the Form 1041 QFT requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant financial documents, including income statements and expense records.

- Fill out the identifying information section, including the trust's name and taxpayer identification number.

- Report all income received by the trust in the appropriate sections.

- Detail any deductions that apply, such as funeral expenses or administrative costs.

- Calculate the total tax liability based on the reported income and deductions.

- Review the completed form for accuracy before signing.

- Submit the form to the IRS by the designated deadline.

Legal use of the Form 1041 Qft

The legal use of the Form 1041 QFT is governed by IRS regulations concerning qualified funeral trusts. To ensure compliance, the fiduciary must adhere to specific guidelines, including maintaining accurate records and filing the form timely. The form serves as a legal document that reports the trust's financial activities, making it essential for fulfilling tax obligations. Proper use of the form helps avoid potential penalties or legal issues associated with misreporting income.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 QFT typically align with the tax year. The form is generally due on the fifteenth day of the fourth month following the end of the tax year. For trusts operating on a calendar year, this means the form is due by April fifteenth. It is crucial for fiduciaries to be aware of these deadlines to ensure timely submission and avoid penalties. Extensions may be available, but must be requested in advance.

Who Issues the Form

The Form 1041 QFT is issued by the Internal Revenue Service (IRS). The IRS provides guidelines and instructions for completing the form, ensuring that fiduciaries understand their responsibilities when managing qualified funeral trusts. It is important for users to refer to the official IRS publications for the most current information regarding the form and its requirements.

Quick guide on how to complete form 1041 qft 2011

Complete Form 1041 Qft seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Form 1041 Qft on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign Form 1041 Qft effortlessly

- Locate Form 1041 Qft and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing additional document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Edit and eSign Form 1041 Qft and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 qft 2011

Create this form in 5 minutes!

How to create an eSignature for the form 1041 qft 2011

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 1041 Qft?

Form 1041 Qft is a tax form used by estates and trusts to report income, deductions, and credits. It is crucial for fiduciaries managing an estate or trust to understand how to properly file this form. Utilizing tools like airSlate SignNow can streamline the signature process to ensure timely submission.

-

How can airSlate SignNow assist with Form 1041 Qft?

airSlate SignNow provides a seamless eSigning platform that simplifies the process of completing and signing Form 1041 Qft. Users can easily upload the form, share it with stakeholders, and collect electronic signatures all in one go. This efficiency can save valuable time during tax season.

-

Is there a cost associated with using airSlate SignNow for Form 1041 Qft?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, including options for individual users and larger teams. This makes it a cost-effective solution for managing Form 1041 Qft and other documents. Prospective users can choose the plan that best fits their budget and requirements.

-

What features does airSlate SignNow offer for managing Form 1041 Qft?

Key features of airSlate SignNow include customizable templates, security measures for data protection, and real-time tracking of document status. These features are particularly beneficial when dealing with important tax forms like Form 1041 Qft, ensuring that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for Form 1041 Qft?

Yes, airSlate SignNow offers integrations with various third-party applications, including accounting and tax software. This allows for a smooth workflow when preparing and signing Form 1041 Qft, enhancing productivity and reducing the risk of errors during the process.

-

What are the benefits of using airSlate SignNow for Form 1041 Qft?

Using airSlate SignNow for Form 1041 Qft allows for faster turnaround times and improved accuracy. The eSigning capabilities help ensure that all necessary parties can sign the form quickly and efficiently. Additionally, it reduces the potential for paper document loss and offers a more environmentally friendly solution.

-

Is airSlate SignNow user-friendly for completing Form 1041 Qft?

Absolutely! airSlate SignNow is designed with user experience in mind. Even those who may not be tech-savvy will find the interface intuitive for uploading, editing, and sending Form 1041 Qft for signatures, making it accessible to everyone.

Get more for Form 1041 Qft

- Warranty deed for parents to child with reservation of life estate iowa form

- Warranty deed for separate or joint property to joint tenancy iowa form

- Warranty deed to separate property of one spouse to both spouses as joint tenants iowa form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries iowa form

- Warranty deed from limited partnership or llc is the grantor or grantee iowa form

- Iowa deed form

- Quitclaim deed from one individual to two individuals as joint tenants with right of survivorship iowa form

- Quitclaim deed from two individuals to two individuals as tenants in common iowa form

Find out other Form 1041 Qft

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now