Form 5500 EZ Annual Return of One Participant Pension Retirement Plan Irs 2001

What is the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan IRS

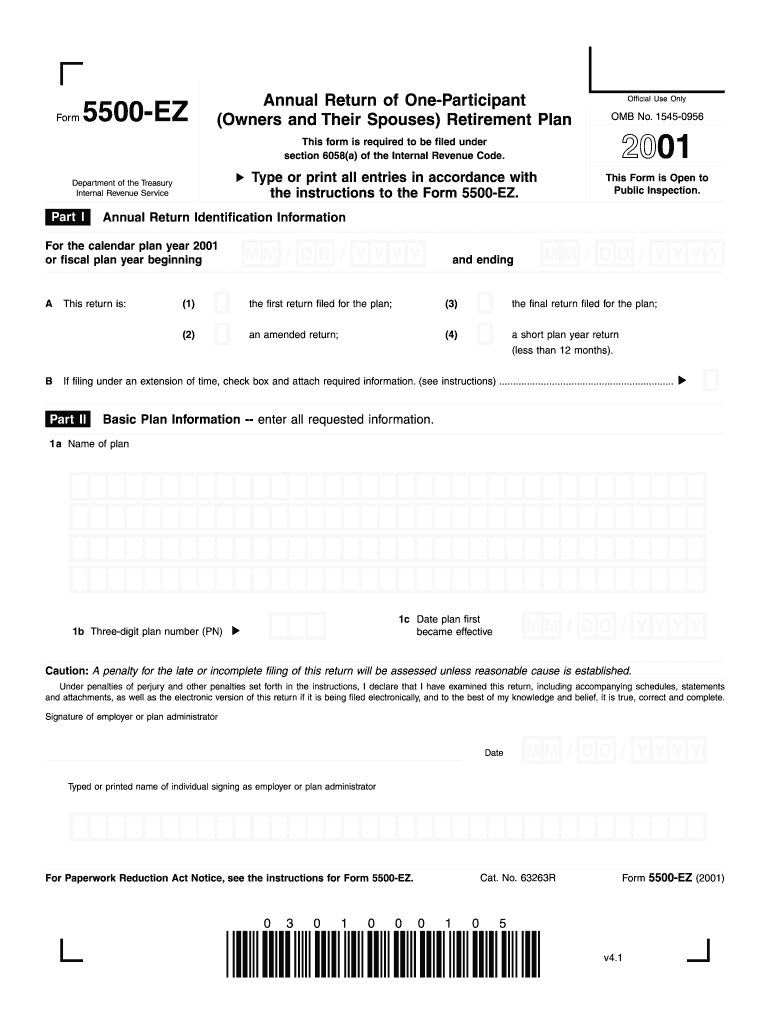

The Form 5500 EZ Annual Return of One Participant Pension Retirement Plan is a document required by the IRS for reporting information about pension plans with only one participant. This form is essential for plan sponsors to comply with federal regulations. It provides the IRS and the Department of Labor with crucial data regarding the plan's financial status and operations. By filing this form, plan sponsors ensure transparency and adherence to legal obligations, which helps maintain the integrity of retirement plans in the United States.

Steps to Complete the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan IRS

Completing the Form 5500 EZ involves several key steps:

- Gather necessary information, including plan details, participant information, and financial data.

- Access the form from the IRS website or through authorized providers.

- Fill out the form accurately, ensuring all sections are completed, including plan identification and financial statements.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail, depending on your preference and requirements.

How to Obtain the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan IRS

The Form 5500 EZ can be obtained from the IRS website, where it is available for download in PDF format. Additionally, tax professionals and financial advisors may provide access to the form, along with guidance on its completion. It is advisable to ensure that you are using the most current version of the form to comply with the latest regulations.

Legal Use of the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan IRS

The legal use of the Form 5500 EZ is crucial for maintaining compliance with federal regulations. Filing this form is mandatory for plan sponsors of one-participant pension plans. Failure to file can result in penalties and loss of tax benefits associated with the retirement plan. It is essential to ensure that the form is completed accurately and submitted within the specified deadlines to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5500 EZ are critical for compliance. Generally, the form must be filed by the last day of the seventh month after the end of the plan year. If the plan year ends on December 31, for instance, the form is due by July 31 of the following year. Extensions may be available, but it is important to file the form on time to avoid penalties.

Digital vs. Paper Version

The Form 5500 EZ can be filed either digitally or on paper. The digital version is often preferred due to its efficiency and ease of submission. Electronic filing allows for faster processing and reduces the risk of errors associated with manual entry. However, some plan sponsors may still opt for the paper version, which requires mailing to the appropriate IRS address. Understanding the advantages of each method can help ensure a smoother filing process.

Quick guide on how to complete 2001 form 5500 ez annual return of one participant pension retirement plan irs

Complete Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents quickly without delays. Manage Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs without hassle

- Locate Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs and then click Get Form to begin.

- Utilize the tools at your disposal to finish your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to submit your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2001 form 5500 ez annual return of one participant pension retirement plan irs

Create this form in 5 minutes!

How to create an eSignature for the 2001 form 5500 ez annual return of one participant pension retirement plan irs

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs?

The Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs is a simplified filing required by the IRS for single-participant retirement plans. This form allows filers to report information regarding their retirement plan's financial condition and operations. It is essential for compliance with federal requirements to avoid penalties.

-

How can airSlate SignNow assist with submitting Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs?

airSlate SignNow simplifies the submission process of Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs by offering a user-friendly platform to create, send, and eSign necessary documents. Our solution ensures that your filings are completed efficiently and securely, reducing the likelihood of errors during submission.

-

What are the main features of airSlate SignNow for Form 5500 EZ filings?

AirSlate SignNow provides features tailored for Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs filings, such as document templates, customizable forms, and secure eSignature capabilities. Additionally, our platform allows for easy collaboration with financial advisors and plan administrators, enhancing the filing process.

-

Is airSlate SignNow cost-effective for filing the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs. With affordable pricing plans, you can streamline your document management while ensuring compliance without breaking the bank, providing signNow savings over traditional methods.

-

Can I integrate airSlate SignNow with other tools for Form 5500 EZ processing?

Absolutely! AirSlate SignNow seamlessly integrates with a variety of software tools commonly used for managing retirement plans and financial data. By connecting your existing applications with airSlate SignNow, you can enhance your workflow while ensuring that Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs submissions are coordinated efficiently.

-

What benefits does eSigning provide for the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs?

eSigning through airSlate SignNow offers numerous benefits for the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs, including speed, security, and convenience. Participants can easily sign documents from any device, which accelerates the filing process and enhances compliance with submission deadlines.

-

Who is required to file the Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs?

The Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs must be filed by owners or sponsors of one-participant retirement plans. If you meet the eligibility requirements for this simplified form, it is crucial to file to comply with IRS regulations and avoid potential penalties.

Get more for Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs

- Contract for deed package idaho form

- Power attorney poa 497305805 form

- Revised uniform anatomical gift act donation idaho

- Idaho process application form

- Uniform anatomical gift act donation declaration idaho

- Revocation of anatomical gift donation idaho form

- Employment or job termination package idaho form

- Newly widowed individuals package idaho form

Find out other Form 5500 EZ Annual Return Of One Participant Pension Retirement Plan Irs

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter