Form 5500 EZ Annual Return of One Participant Owners and 2022

Understanding the Form 5500 EZ Annual Return

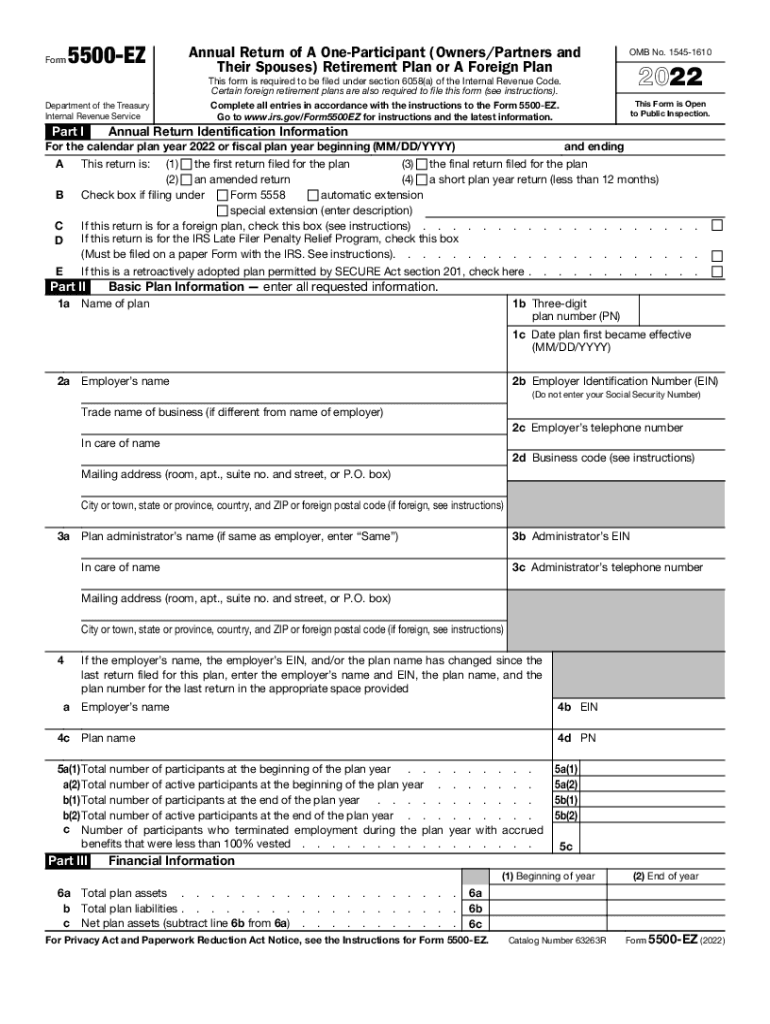

The Form 5500 EZ is an essential document used for the annual return of a one-participant retirement plan. This form is primarily designed for plan sponsors who manage a single-participant plan, such as an owner-only 401(k) plan. By filing this form, businesses can report information about their retirement plan to the IRS and the Department of Labor. The 5500 EZ simplifies the reporting process, making it easier for small business owners to comply with federal regulations while ensuring that their retirement plans are properly documented.

Steps to Complete the Form 5500 EZ

Completing the Form 5500 EZ involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about your retirement plan, including the plan's name, sponsor details, and financial information. Next, fill out the form with precise details regarding contributions, plan assets, and any distributions made during the year. Ensure that you review the instructions carefully to avoid common errors. Once completed, sign and date the form, confirming its accuracy before submission.

Filing Deadlines for the Form 5500 EZ

Timely filing of the Form 5500 EZ is crucial to avoid penalties. The due date for filing is typically the last day of the seventh month after the end of the plan year. For plans that operate on a calendar year, this means the form is due by July 31 of the following year. If additional time is needed, an extension can be requested, but it is essential to file for the extension before the original due date to maintain compliance.

Legal Use of the Form 5500 EZ

The Form 5500 EZ is legally binding and serves as an official record of your retirement plan's compliance with federal regulations. When completed accurately, it provides essential information to the IRS and the Department of Labor, ensuring that your plan adheres to the Employee Retirement Income Security Act (ERISA) requirements. Utilizing a reliable eSignature platform can further enhance the legal standing of the completed form, as it ensures secure and verifiable signatures.

Required Documents for Filing the Form 5500 EZ

Before filing the Form 5500 EZ, it is important to gather all required documents. This includes financial statements of the plan, records of contributions made during the year, and any relevant plan documents. Having these documents organized will facilitate a smoother completion process and ensure that all necessary information is accurately reported on the form.

Obtaining the Form 5500 EZ

The Form 5500 EZ can be obtained directly from the IRS website or through the Department of Labor's Employee Benefits Security Administration. It is available in a downloadable format, making it easy to access and complete. Additionally, many tax preparation software programs offer the form as part of their services, streamlining the filing process for users.

Penalties for Non-Compliance with the Form 5500 EZ

Failing to file the Form 5500 EZ on time can result in significant penalties. The IRS imposes fines for late filings, which can accumulate quickly. Additionally, non-compliance may lead to further scrutiny from regulatory agencies, potentially jeopardizing the status of your retirement plan. It is essential to adhere to all filing requirements to avoid these consequences and maintain the integrity of your retirement plan.

Quick guide on how to complete form 5500 ez annual return of one participant owners and

Effortlessly Prepare Form 5500 EZ Annual Return Of One Participant Owners And on Any Device

Managing documents online has become a trend among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly without delays. Handle Form 5500 EZ Annual Return Of One Participant Owners And on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Form 5500 EZ Annual Return Of One Participant Owners And with Ease

- Locate Form 5500 EZ Annual Return Of One Participant Owners And and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 5500 EZ Annual Return Of One Participant Owners And to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5500 ez annual return of one participant owners and

Create this form in 5 minutes!

How to create an eSignature for the form 5500 ez annual return of one participant owners and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 5500 and why is it important?

The form 5500 is a mandatory document used by employee benefit plans to report financial conditions, investments, and operations. It plays a vital role in ensuring transparency and compliance with federal regulations. Completing the form 5500 accurately can help businesses avoid penalties and provide insights into plan performance.

-

How can airSlate SignNow assist with form 5500 completion?

airSlate SignNow provides a streamlined platform to electronically sign and send documents, including the form 5500. By utilizing our features, businesses can simplify the submission process, ensuring all required signatures are obtained efficiently. This not only saves time but also improves compliance with submission deadlines.

-

Are there any costs associated with using airSlate SignNow for form 5500?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes. Our packages include features tailored for managing documents, including form 5500, at an affordable rate. You can choose a plan that fits your business needs and budget.

-

What features does airSlate SignNow offer for document management including form 5500?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning to ensure efficient document management. These tools are particularly useful for handling complex forms like form 5500, allowing users to focus on completing their reports rather than administrative tasks.

-

Is airSlate SignNow compliant with federal regulations for form 5500?

Yes, airSlate SignNow is designed to meet regulatory compliance standards, which is essential for handling documents like form 5500. Our platform employs strong security measures and electronic signature validation, helping businesses adhere to legal requirements while processing important documentation.

-

Can I integrate airSlate SignNow with other applications for managing form 5500?

Absolutely! airSlate SignNow offers various integrations with popular applications that streamline document collection and management processes. These integrations allow for seamless workflow enhancements, making it easier to gather necessary information for completing the form 5500.

-

What benefits can businesses expect from using airSlate SignNow for form 5500?

By using airSlate SignNow, businesses can expect increased efficiency in document handling, improved accuracy, and enhanced compliance when filling out the form 5500. Our user-friendly interface allows for easier collaboration, ultimately leading to faster submission and less risk of errors.

Get more for Form 5500 EZ Annual Return Of One Participant Owners And

Find out other Form 5500 EZ Annual Return Of One Participant Owners And

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed