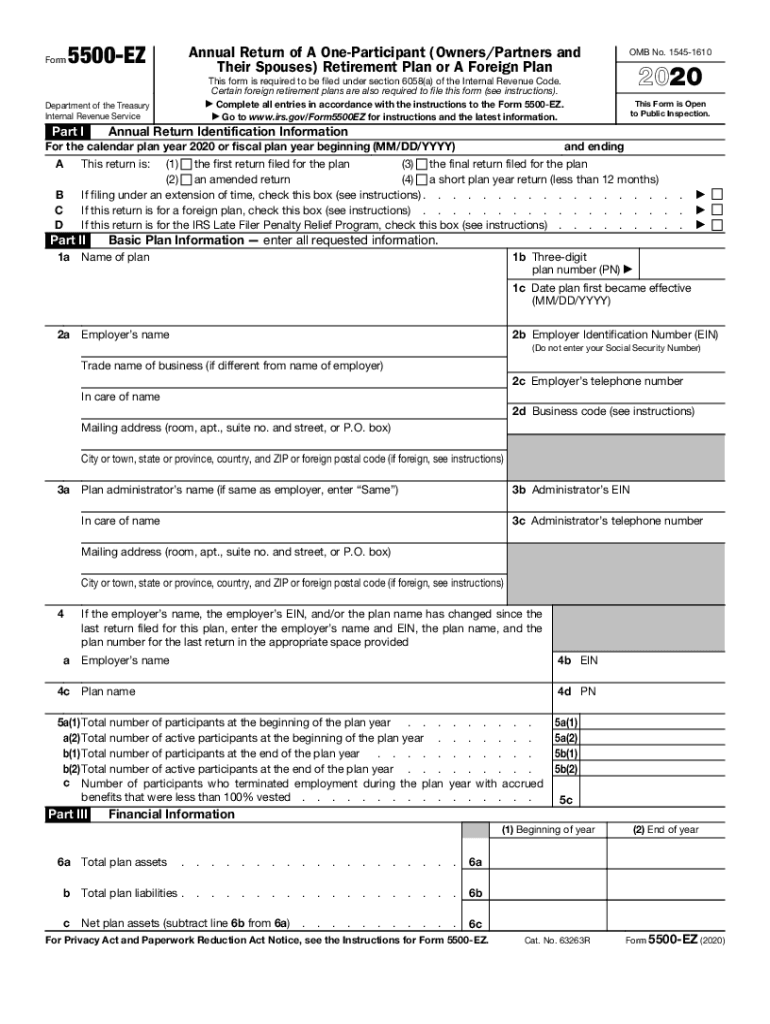

Instructions for Form 5500 EZ Internal Revenue Service 2020

What is the Instructions for Form 5500 EZ?

The Instructions for Form 5500 EZ provide essential guidance for plan administrators and employers who need to report information about their retirement plans. This form is specifically designed for one-participant retirement plans, which include solo 401(k) plans and certain other plans that cover only the owner or the owner and their spouse. Understanding these instructions is crucial for ensuring compliance with the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Service (IRS) regulations.

Steps to Complete the Instructions for Form 5500 EZ

Completing the Instructions for Form 5500 EZ involves several key steps:

- Gather Required Information: Collect all necessary data about the retirement plan, including plan details, participant information, and financial statements.

- Fill Out the Form: Carefully follow the instructions to complete each section of the form, ensuring accuracy and completeness.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to penalties or compliance issues.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the deadline.

Filing Deadlines / Important Dates

Filing deadlines for Form 5500 EZ are critical to avoid penalties. Generally, the form must be filed by the last day of the seventh month after the end of the plan year. If additional time is needed, a request for an extension can be submitted. It is important to stay informed about any changes to deadlines that may occur due to IRS updates or other regulatory changes.

Legal Use of the Instructions for Form 5500 EZ

The legal use of the Instructions for Form 5500 EZ ensures that plan administrators comply with federal regulations. Filing this form is not only a requirement but also protects the rights of plan participants. Failure to file can result in significant penalties, including fines and potential legal action. Understanding the legal implications helps ensure that all parties involved are aware of their responsibilities and rights under ERISA.

Required Documents

To complete Form 5500 EZ, several documents are required:

- Plan Documents: Include the plan's adoption agreement and any amendments.

- Financial Statements: Provide the plan's financial statements for the reporting year.

- Participant Information: Gather details about participants, including contributions and distributions.

Having these documents ready will streamline the completion process and help ensure compliance.

Form Submission Methods

Form 5500 EZ can be submitted through various methods, providing flexibility for plan administrators:

- Online Submission: Use the IRS e-file system for a quick and efficient filing process.

- Mail: Send the completed form to the appropriate IRS address based on your location.

- In-Person: Deliver the form directly to an IRS office if preferred.

Choosing the right submission method can help ensure timely processing and compliance with IRS requirements.

Quick guide on how to complete instructions for form 5500 ez 2019internal revenue service

Prepare Instructions For Form 5500 EZ Internal Revenue Service effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without any delays. Manage Instructions For Form 5500 EZ Internal Revenue Service on any device with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Instructions For Form 5500 EZ Internal Revenue Service without hassle

- Locate Instructions For Form 5500 EZ Internal Revenue Service and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), link invitation, or download it to your computer.

Forget about lost or missed files, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your device of choice. Modify and eSign Instructions For Form 5500 EZ Internal Revenue Service and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 5500 ez 2019internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 5500 ez 2019internal revenue service

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What are the form 5500 2017 instructions?

The form 5500 2017 instructions provide detailed guidelines on how to properly complete and file Form 5500, which is essential for reporting information about employee benefit plans. By following these instructions, businesses can ensure compliance with ERISA and avoid penalties. airSlate SignNow simplifies this process by allowing you to eSign and submit your forms effortlessly.

-

How does airSlate SignNow help with form 5500 2017 submissions?

airSlate SignNow streamlines the submission process for form 5500 2017 by providing a user-friendly interface for electronically signing and submitting required documents. This saves time and reduces errors by eliminating the need for manual signatures and paperwork. With our solution, completing your form 5500 2017 is straightforward and efficient.

-

Is there pricing information available for airSlate SignNow's services related to form 5500 2017 instructions?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage their form 5500 2017 submissions effectively. Our pricing is competitive and designed to fit within various budgets while providing robust features. Consider starting with a free trial to explore all available tools for handling form 5500 2017 instructions.

-

What features does airSlate SignNow offer to assist with form 5500 2017 instructions?

airSlate SignNow provides features such as easy document creation, electronic signatures, and cloud storage, all tailored to assist with the completion of form 5500 2017 instructions. Integrations with popular tools and a secure platform ensure that your documents are handled efficiently and safely. These features make navigating the complexities of form 5500 2017 much simpler.

-

Can I integrate airSlate SignNow with other tools for managing form 5500 2017?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, enhancing your workflow when managing form 5500 2017 instructions. This means you can connect systems you already use for improved efficiency and collaboration. These integrations help ensure that your document management process is cohesive and streamlined.

-

What benefits does airSlate SignNow provide for form 5500 2017 filing?

Using airSlate SignNow for form 5500 2017 filing offers numerous benefits, including time savings, increased accuracy, and enhanced compliance. The easy-to-navigate interface minimizes the chances of errors, allowing your business to stay compliant with federal regulations effectively. Additionally, the platform’s cloud-based nature ensures that you can access your documents anytime, anywhere.

-

Are there any tutorials available for understanding form 5500 2017 instructions within airSlate SignNow?

Yes, airSlate SignNow offers comprehensive tutorials and resources to help users understand the form 5500 2017 instructions better. These resources provide step-by-step guidance on filling out the form properly and utilizing the platform effectively. This support ensures that users are confident when managing their form transitions.

Get more for Instructions For Form 5500 EZ Internal Revenue Service

- Idhs keyboard testing quick reference dhsstateilus form

- Missouri department of revenue my tax portal form

- 2022 form il 941 illinois withholding income tax return 2022 form il 941 illinois withholding income tax return

- Enable selection through choice controls check and list boxes form

- Pa 115a objection to real property assessment form

- Wi dor w 700 2020 2022 fill out tax template online us legal forms

- 2021 wisconsin form 1 rbpdf tab to navigate within form use mouse

Find out other Instructions For Form 5500 EZ Internal Revenue Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors