IRS Issues Guidance on Exceptions from Electronic Filing 2023-2026

Understanding the IRS Guidance on Exceptions from Electronic Filing

The IRS provides specific guidance regarding exceptions to the requirement for electronic filing of the Form 5500. This guidance is essential for businesses and plan administrators who may qualify for an exemption based on certain criteria. Understanding these exceptions helps ensure compliance with federal regulations while also facilitating the filing process.

Common exceptions include scenarios where the plan is not subject to the electronic filing mandate due to its size or type. For example, small plans with fewer than 100 participants may be eligible for a simplified filing process. Additionally, certain governmental and church plans may also be exempt from electronic filing requirements.

Steps to Complete the Form 5500

Completing the Form 5500 involves several key steps to ensure accurate and compliant submission. First, gather all necessary information about the employee benefit plan, including financial statements, participant data, and plan provisions. This information is crucial for filling out the form correctly.

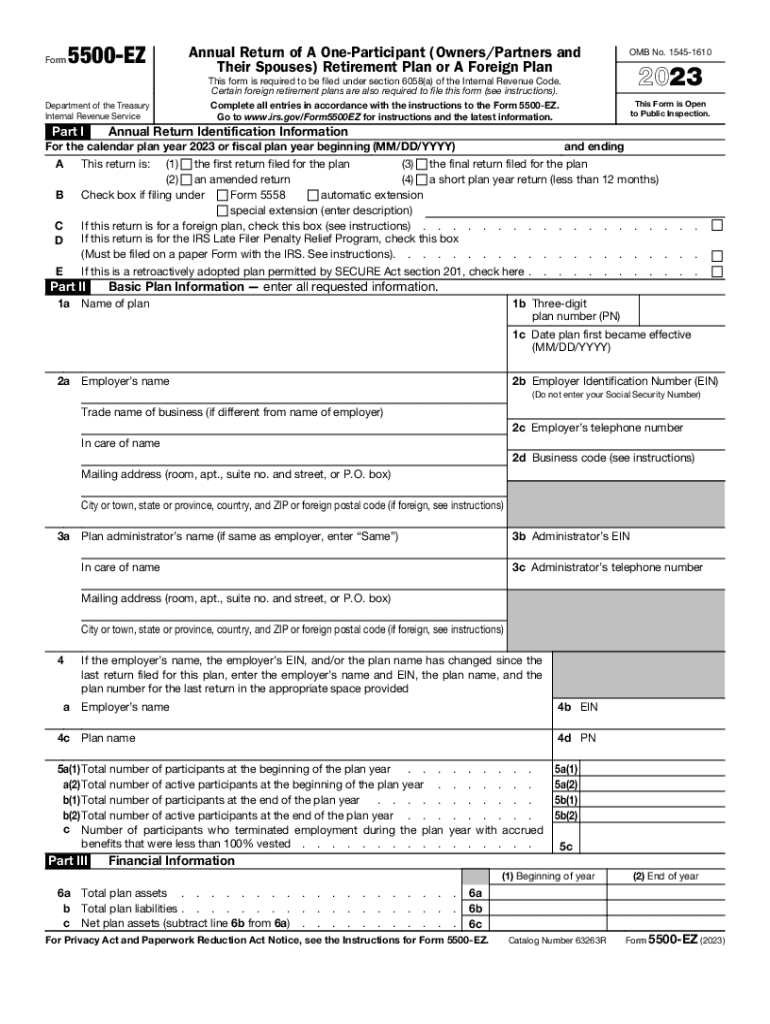

Next, choose the appropriate version of the Form 5500 based on the plan type and size. For instance, smaller plans may use the Form 5500-EZ, while larger plans typically require the standard Form 5500. After selecting the correct form, fill it out carefully, ensuring all required fields are completed.

Finally, review the completed form for accuracy before submitting it electronically or via mail, depending on the applicable filing requirements.

Filing Deadlines for Form 5500

Timely filing of the Form 5500 is crucial to avoid penalties and ensure compliance with IRS regulations. The standard deadline for submitting the Form 5500 is the last day of the seventh month after the plan year ends. For example, if the plan year ends on December 31, the Form 5500 is due by July 31 of the following year.

If additional time is needed, filers can request an extension by submitting Form 5558, which grants an automatic two-and-a-half-month extension. However, it is important to note that this extension does not apply to the payment of any taxes owed.

Required Documents for Filing Form 5500

Filing the Form 5500 requires several supporting documents to provide a complete picture of the employee benefit plan. Essential documents include the plan's financial statements, which must be prepared in accordance with generally accepted accounting principles (GAAP).

Additionally, the plan's summary plan description (SPD) and any amendments should be included to provide clarity on plan provisions. Other documents may include actuarial reports, participant count, and compliance statements. Ensuring all required documents are submitted with the Form 5500 helps facilitate a smooth filing process.

Penalties for Non-Compliance with Form 5500 Requirements

Failure to file the Form 5500 on time or submitting incomplete information can result in significant penalties. The IRS imposes a penalty of up to $2,400 per day for late filings, which can quickly accumulate. Additionally, the Department of Labor (DOL) may impose separate penalties for non-compliance, including fines for failure to provide required disclosures to participants.

To mitigate the risk of penalties, it is advisable for plan administrators to maintain accurate records and establish a filing schedule well in advance of the deadline. Regular reviews of filing requirements and deadlines can help ensure compliance and avoid costly fines.

Form Variants and Their Uses

The Form 5500 has several variants tailored to different types of employee benefit plans. The most common forms include the standard Form 5500, the Form 5500-SF for small plans, and the Form 5500-EZ for one-participant plans. Each form serves a specific purpose and is designed to accommodate the unique reporting needs of various plan types.

For example, the Form 5500-SF is a streamlined version intended for small plans with fewer than 100 participants, while the Form 5500-EZ is used primarily by solo practitioners or businesses with a single participant. Understanding which form to use is essential for accurate reporting and compliance with IRS regulations.

Quick guide on how to complete irs issues guidance on exceptions from electronic filing

Complete IRS Issues Guidance On Exceptions From Electronic Filing effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents promptly without delays. Manage IRS Issues Guidance On Exceptions From Electronic Filing on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to edit and eSign IRS Issues Guidance On Exceptions From Electronic Filing seamlessly

- Locate IRS Issues Guidance On Exceptions From Electronic Filing and click on Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign IRS Issues Guidance On Exceptions From Electronic Filing to ensure smooth communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs issues guidance on exceptions from electronic filing

Create this form in 5 minutes!

How to create an eSignature for the irs issues guidance on exceptions from electronic filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5500 and why is it important?

Form 5500 is a critical document that employee benefit plans must file with the Department of Labor. It provides important information about a plan's financial condition, investments, and operations. Understanding and filing Form 5500 correctly is essential for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with Form 5500 compliance?

airSlate SignNow offers a streamlined process for electronically signing and submitting Form 5500. With our easy-to-use platform, you can ensure that your documents are signed securely and quickly, reducing the time spent on compliance tasks. This efficient method helps businesses meet their filing deadlines without the hassle of traditional paperwork.

-

What are the benefits of using airSlate SignNow for Form 5500 filings?

Using airSlate SignNow for Form 5500 filings provides increased efficiency and security. Our platform allows for quick eSigning, document tracking, and storage, which simplifies the management of all necessary filings. Moreover, the cost-effective solution can save your business both time and money.

-

Does airSlate SignNow integrate with other tools for Form 5500 management?

Yes, airSlate SignNow seamlessly integrates with various HR and document management systems that can assist in managing Form 5500. These integrations facilitate easier access to data and improve the overall workflow for compliance management. This ensures your filing process is as efficient as possible.

-

Is there training available for using airSlate SignNow for Form 5500?

Absolutely! airSlate SignNow provides comprehensive training materials and customer support to help businesses understand how to efficiently use our services for Form 5500 filing. Our user-friendly interface is designed to minimize the learning curve for all team members involved in compliance tasks.

-

What is the pricing structure for airSlate SignNow when filing Form 5500?

airSlate SignNow offers a range of pricing plans tailored to the needs of businesses, ensuring access to essential features for Form 5500 management. Our cost-effective solutions mean that organizations of all sizes can find a plan that fits their budget without sacrificing quality. For detailed pricing information, please visit our website.

-

How secure is airSlate SignNow for handling Form 5500 documents?

Security is a top priority at airSlate SignNow. We implement state-of-the-art encryption and security protocols to safeguard your Form 5500 documents. This ensures that your sensitive information is protected throughout the eSigning and filing process.

Get more for IRS Issues Guidance On Exceptions From Electronic Filing

Find out other IRS Issues Guidance On Exceptions From Electronic Filing

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent