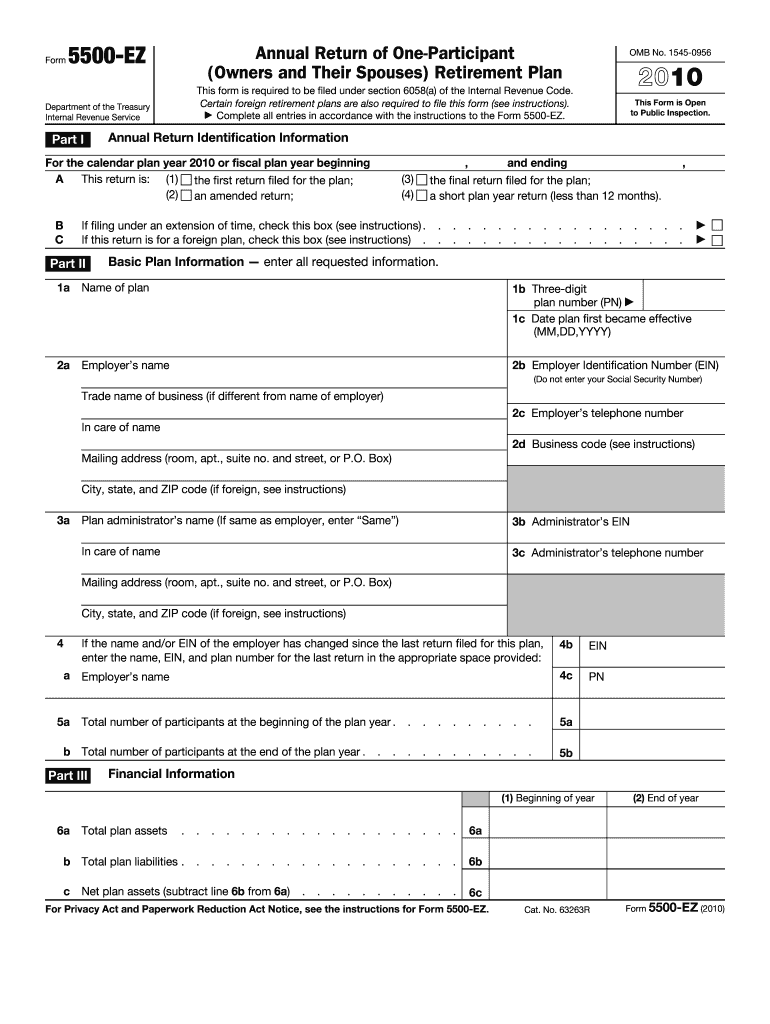

Form 5500 Ez 2010

What is the Form 5500 Ez

The Form 5500 Ez is a simplified version of the Form 5500, which is used by retirement plan administrators to report information about employee benefit plans. This form is specifically designed for one-participant plans, making it easier for small business owners and self-employed individuals to comply with federal reporting requirements. The form collects essential data regarding plan assets, income, and expenses, ensuring transparency and regulatory compliance.

How to use the Form 5500 Ez

Using the Form 5500 Ez involves several key steps. First, gather all necessary information about your retirement plan, including details about participants, plan assets, and financial transactions. Next, complete the form by filling out the required fields accurately. Once the form is filled out, review it for any errors or omissions. Finally, submit the completed form to the appropriate federal agency, ensuring that you adhere to the specified filing deadlines.

Steps to complete the Form 5500 Ez

Completing the Form 5500 Ez requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather information about the plan, including participant details and financial data.

- Access the Form 5500 Ez, available through the IRS website or authorized providers.

- Fill in the form, ensuring that all required fields are completed.

- Double-check the information for accuracy and completeness.

- Submit the form electronically or by mail, depending on your preference and compliance requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5500 Ez are critical to avoid penalties. Generally, the form must be filed by the last day of the seventh month after the plan year ends. If the plan year ends on December 31, the deadline would be July 31 of the following year. It is important to stay informed about any changes to these deadlines and to file on time to ensure compliance with federal regulations.

Legal use of the Form 5500 Ez

The Form 5500 Ez serves a legal purpose in reporting retirement plan information to the federal government. It helps ensure that plans comply with the Employee Retirement Income Security Act (ERISA) and other relevant regulations. Proper completion and timely submission of this form can protect plan sponsors from potential legal issues and penalties associated with non-compliance.

Required Documents

To complete the Form 5500 Ez, several documents are typically required. These may include:

- Plan documents that outline the structure and provisions of the retirement plan.

- Financial statements detailing the plan's assets, liabilities, income, and expenses.

- Participant information, including names, Social Security numbers, and contributions.

Having these documents readily available will streamline the completion process and help ensure accuracy.

Quick guide on how to complete form 5500 ez 2010

Complete Form 5500 Ez effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow grants you all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Form 5500 Ez on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form 5500 Ez without hassle

- Locate Form 5500 Ez and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Edit and eSign Form 5500 Ez and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5500 ez 2010

Create this form in 5 minutes!

How to create an eSignature for the form 5500 ez 2010

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Form 5500 Ez and who needs to file it?

Form 5500 Ez is a simplified annual return/report required by the Employee Benefits Security Administration (EBSA) for certain retirement plans. Businesses with one-participant plans, such as solo 401(k)s and certain pension plans, typically need to file this form. It's crucial for compliance and provides essential information about the plan's financial status.

-

How does airSlate SignNow help with filing Form 5500 Ez?

airSlate SignNow streamlines the process of preparing and filing Form 5500 Ez by allowing users to easily create, send, and eSign the necessary documents. With an intuitive interface, businesses can ensure that all required information is accurately filled out, reducing the likelihood of errors that could lead to compliance issues. Our platform is designed to simplify the documentation process for your convenience.

-

What features does airSlate SignNow offer for managing Form 5500 Ez?

AirSlate SignNow provides features such as document templates, electronic signatures, and secure storage to assist with managing Form 5500 Ez. Users can create customized templates for repeat filings, ensuring they have everything they need at their fingertips. Additionally, our platform allows for seamless collaboration among team members, making it easier to gather all necessary data.

-

Is airSlate SignNow affordable for small businesses filing Form 5500 Ez?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to file Form 5500 Ez. We offer flexible pricing plans that cater to various business sizes, ensuring you have access to the tools you need without overspending. Our platform provides excellent value with its robust features designed for compliance and efficiency.

-

Can I integrate airSlate SignNow with other software for filing Form 5500 Ez?

Absolutely! airSlate SignNow offers integrations with popular accounting and HR software, making it easier to manage data related to Form 5500 Ez. This seamless connectivity allows businesses to import necessary information directly into the platform, enhancing efficiency and reducing manual data entry.

-

What are the benefits of using airSlate SignNow for Form 5500 Ez filings?

Using airSlate SignNow for Form 5500 Ez filings provides numerous benefits, including time savings and enhanced accuracy. Our eSigning capabilities ensure documents are signed quickly and securely, while our user-friendly interface helps prevent errors. This reduces the stress associated with compliance and allows businesses to focus on their core operations.

-

How secure is my information when using airSlate SignNow for Form 5500 Ez?

Security is a top priority at airSlate SignNow. When filing Form 5500 Ez, your information is protected with state-of-the-art encryption and security protocols. We comply with industry standards to ensure that your sensitive data remains confidential and secure throughout the filing process.

Get more for Form 5500 Ez

- Hoa architectural review form

- Daily method of operation template form

- Tem621 384201439 form

- Exclusive distribution agreement form

- Participant agreement d6 night market village of form

- Inheritance account agreement piper jaffray form

- Atto di assenso form

- Animal ampampamp veterinary sciences internship learning contract form

Find out other Form 5500 Ez

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT