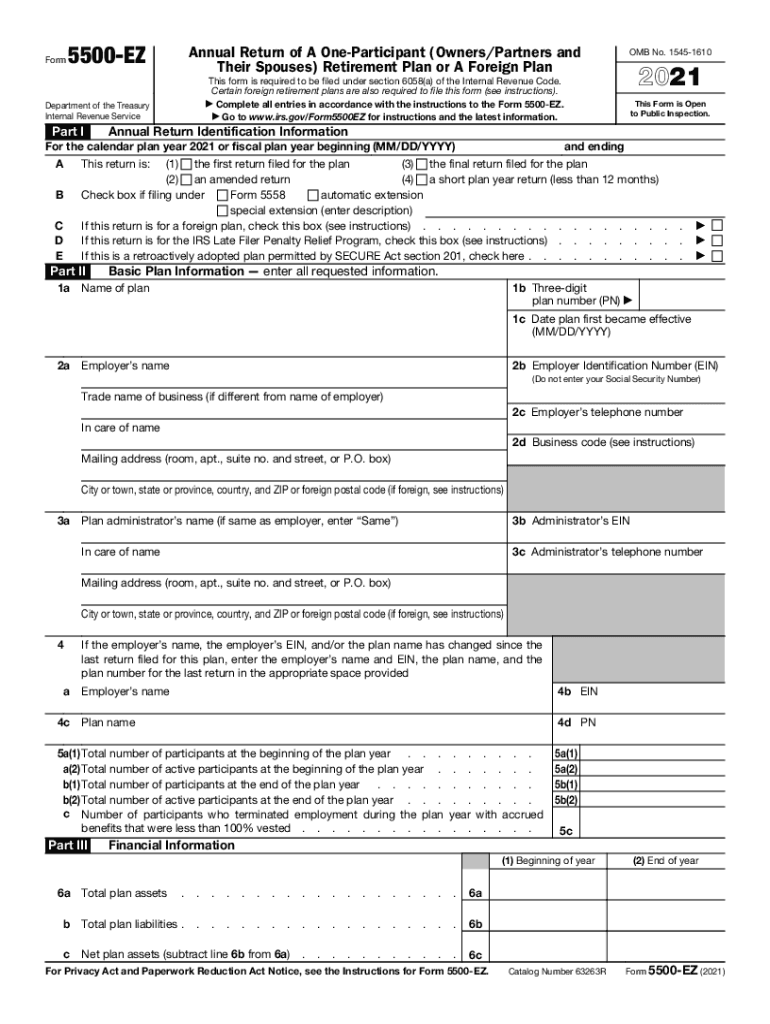

Form 5500 EZ Annual Return of a One Participant OwnersPartners and Their Spouses Retirement Plan or a Foreign Plan 2021

What is the Form 5500 EZ?

The Form 5500 EZ is an annual return specifically designed for one-participant retirement plans, which include owners, partners, and their spouses. This form is crucial for reporting the financial condition, investments, and operations of these retirement plans to the Internal Revenue Service (IRS) and the Department of Labor (DOL). It simplifies the filing process for small retirement plans, allowing them to comply with federal regulations without the complexity of the standard Form 5500.

Steps to Complete the Form 5500 EZ

Completing the Form 5500 EZ involves several key steps to ensure accuracy and compliance. First, gather necessary documents, including financial statements and plan information. Next, fill out the form with details such as plan name, sponsor information, and financial data. It is important to review the form for completeness and accuracy before submission. Finally, submit the form electronically through the DOL's EFAST2 system or by mail, ensuring that it is sent to the correct address.

Filing Deadlines / Important Dates

The filing deadline for the Form 5500 EZ is typically the last day of the seventh month after the end of the plan year. For plans operating on a calendar year, this means the form is due by July 31. If additional time is needed, an extension can be requested, allowing for a filing deadline of up to two and a half months later. It is essential to adhere to these deadlines to avoid penalties.

Legal Use of the Form 5500 EZ

The Form 5500 EZ serves a legal purpose by ensuring compliance with the Employee Retirement Income Security Act (ERISA) and IRS regulations. Filing this form is necessary for maintaining the tax-qualified status of the retirement plan. Failure to file can lead to penalties and loss of tax benefits. Therefore, understanding the legal implications of the form is vital for plan sponsors.

Key Elements of the Form 5500 EZ

Key elements of the Form 5500 EZ include basic information about the plan, such as the plan sponsor's name, plan number, and the total assets at the end of the plan year. Additionally, it requires reporting on contributions, distributions, and participant information. These elements provide a comprehensive overview of the plan's financial status and operations, which is essential for regulatory compliance.

Required Documents for Filing

When preparing to file the Form 5500 EZ, several documents are required. These typically include financial statements, a summary plan description, and any amendments to the plan. Additionally, records of contributions and distributions made during the plan year are necessary. Having these documents organized and readily available can streamline the filing process.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 5500 EZ can result in significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, failure to file may jeopardize the tax-qualified status of the retirement plan, leading to potential tax liabilities for the plan sponsor. Understanding these penalties emphasizes the importance of timely and accurate submissions.

Quick guide on how to complete 2021 form 5500 ez annual return of a one participant ownerspartners and their spouses retirement plan or a foreign plan

Prepare Form 5500 EZ Annual Return Of A One Participant OwnersPartners And Their Spouses Retirement Plan Or A Foreign Plan effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It presents an ideal eco-friendly substitute to traditional printed and signed papers, as you can obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Form 5500 EZ Annual Return Of A One Participant OwnersPartners And Their Spouses Retirement Plan Or A Foreign Plan on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Form 5500 EZ Annual Return Of A One Participant OwnersPartners And Their Spouses Retirement Plan Or A Foreign Plan effortlessly

- Obtain Form 5500 EZ Annual Return Of A One Participant OwnersPartners And Their Spouses Retirement Plan Or A Foreign Plan and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 5500 EZ Annual Return Of A One Participant OwnersPartners And Their Spouses Retirement Plan Or A Foreign Plan and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 5500 ez annual return of a one participant ownerspartners and their spouses retirement plan or a foreign plan

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 5500 ez annual return of a one participant ownerspartners and their spouses retirement plan or a foreign plan

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is Form 5500 and why is it important?

Form 5500 is a required annual report for employee benefit plans that provides information about the financial condition and operations of the plan. It helps ensure compliance with federal regulations and offers insight into plan performance, making it essential for both employers and plan participants.

-

How can airSlate SignNow help with Form 5500 submissions?

airSlate SignNow streamlines the submission process for Form 5500, making it easy for businesses to eSign and send the documents securely. Our platform offers a user-friendly interface that allows for quick document preparation and ensures that your Form 5500 is submitted accurately and on time.

-

What features does airSlate SignNow offer for managing Form 5500 documents?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure document storage that facilitate the management of Form 5500 documents. The platform also allows for real-time collaboration, enabling teams to work together seamlessly on their reports.

-

Is airSlate SignNow cost-effective for Form 5500 processing?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for processing Form 5500. The platform's efficiency can help reduce administrative costs associated with document handling and compliance.

-

Can airSlate SignNow integrate with other software for Form 5500?

Absolutely! airSlate SignNow offers integrations with various software platforms, enhancing your ability to manage Form 5500 and related documents. These integrations allow for seamless workflows and data sharing, improving overall productivity.

-

What are the benefits of using airSlate SignNow for Form 5500?

Using airSlate SignNow for Form 5500 offers multiple benefits, including enhanced security, improved compliance, and faster turnaround times. The platform simplifies the document workflow, making it easier to manage necessary filings without the hassle of traditional methods.

-

How secure is airSlate SignNow for eSigning Form 5500?

airSlate SignNow prioritizes security with features like data encryption and secure storage, ensuring that your Form 5500 documents remain protected. Compliance with industry standards and regulations guarantees that your sensitive information is handled safely.

Get more for Form 5500 EZ Annual Return Of A One Participant OwnersPartners And Their Spouses Retirement Plan Or A Foreign Plan

- Summary administration package for small estates idaho form

- Tenant eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497305736 form

- Idaho workers form

- Idaho annual form

- Notices resolutions simple stock ledger and certificate idaho form

- Minutes organizational meeting 497305741 form

- Idaho incorporation form

Find out other Form 5500 EZ Annual Return Of A One Participant OwnersPartners And Their Spouses Retirement Plan Or A Foreign Plan

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online