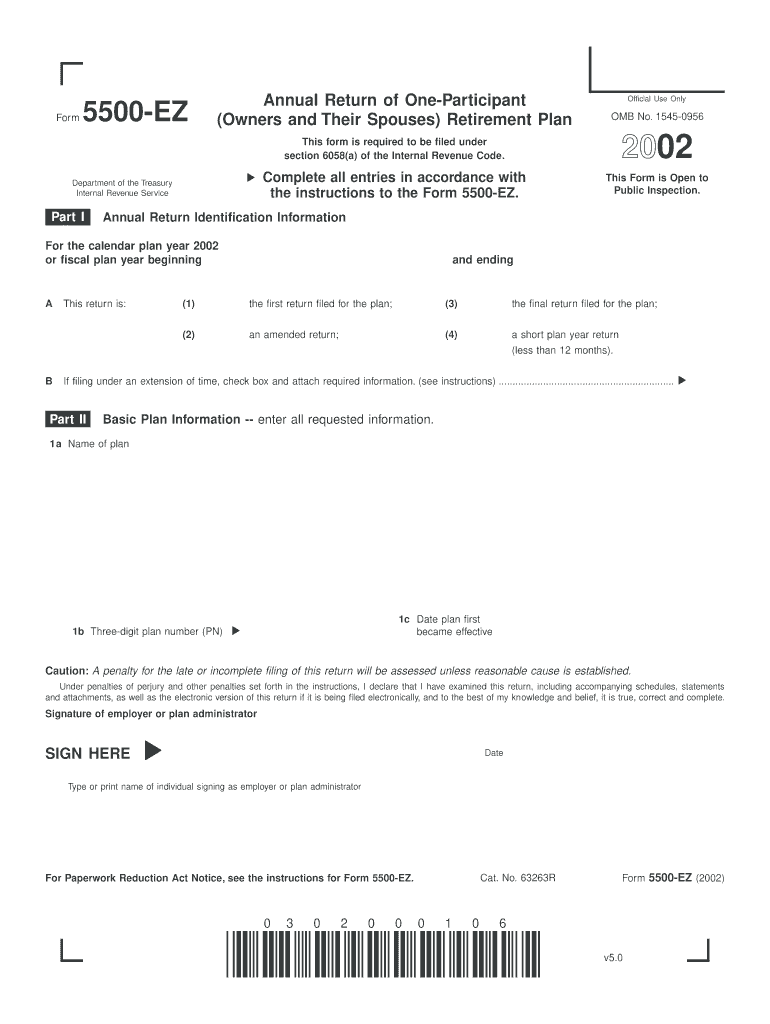

5500 Ez Form 2002

What is the 5500 EZ Form

The 5500 EZ Form is a simplified annual return filed by certain retirement plans in the United States. It is primarily used by one-participant plans, which are retirement plans that cover only the owner and their spouse. This form provides the Internal Revenue Service (IRS) with essential information about the plan's financial condition, investments, and operations. The 5500 EZ Form is crucial for maintaining compliance with federal regulations and ensuring that the plan meets the necessary reporting requirements.

How to use the 5500 EZ Form

Using the 5500 EZ Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial information related to the retirement plan, including assets, liabilities, and contributions. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for any errors or omissions before submission. Once completed, the form can be filed electronically through the IRS e-File system or mailed directly to the IRS, depending on your preference and the specific requirements for your plan.

Steps to complete the 5500 EZ Form

Completing the 5500 EZ Form requires attention to detail and a systematic approach. Follow these steps:

- Gather all relevant financial documents, including plan assets, liabilities, and contributions.

- Access the 5500 EZ Form from the IRS website or through authorized software.

- Fill in the plan’s identifying information, including the name, EIN, and plan number.

- Provide detailed financial information, including total assets and liabilities.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the completed form electronically or via mail, adhering to the submission guidelines.

Legal use of the 5500 EZ Form

The legal use of the 5500 EZ Form is governed by IRS regulations. To be considered legally valid, the form must be completed accurately and submitted on time. Compliance with the Employee Retirement Income Security Act (ERISA) is also essential. This includes maintaining proper records and ensuring that the plan adheres to reporting requirements. Failure to comply with these regulations can result in penalties, making it crucial for plan administrators to understand the legal implications of filing the 5500 EZ Form.

Filing Deadlines / Important Dates

Filing deadlines for the 5500 EZ Form are critical to avoid penalties. The form is typically due on the last day of the seventh month after the end of the plan year. For example, if the plan year ends on December 31, the form must be filed by July 31 of the following year. If additional time is needed, a six-month extension can be requested, but this must be done before the original deadline. Keeping track of these dates is essential for compliance and to ensure that the retirement plan remains in good standing.

Who Issues the Form

The 5500 EZ Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that plan administrators understand their responsibilities. It is important to refer to the IRS website for the most current version of the form and any updates to the filing requirements.

Quick guide on how to complete 5500 ez 2002 form

Manage 5500 Ez Form easily on any device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to construct, modify, and eSign your documents swiftly without delays. Manage 5500 Ez Form across any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign 5500 Ez Form with minimal effort

- Locate 5500 Ez Form and then click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign function, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 5500 Ez Form and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5500 ez 2002 form

Create this form in 5 minutes!

How to create an eSignature for the 5500 ez 2002 form

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the 5500 Ez Form, and who needs it?

The 5500 Ez Form is a simplified version of the Form 5500 required for certain employee benefit plans. It's essential for businesses that offer retirement plans to report to the Department of Labor and ensure compliance with federal regulations.

-

How can airSlate SignNow facilitate the completion of the 5500 Ez Form?

airSlate SignNow provides an easy-to-use platform that allows users to eSign and send the 5500 Ez Form quickly. Its intuitive features simplify the document workflow, enabling businesses to handle their compliance needs efficiently.

-

Is there a cost associated with using airSlate SignNow for the 5500 Ez Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. However, considering its cost-effectiveness and the time saved in managing the 5500 Ez Form, it provides exceptional value for organizations handling employee benefit plans.

-

What are the benefits of using airSlate SignNow for eSigning the 5500 Ez Form?

Using airSlate SignNow for the 5500 Ez Form streamlines the signing process, reduces paperwork, and enhances security. It helps businesses maintain compliance while improving efficiency and turnaround time for submitting necessary documents.

-

Does airSlate SignNow integrate with other software for managing the 5500 Ez Form?

Yes, airSlate SignNow offers integrations with multiple software applications, facilitating seamless management of the 5500 Ez Form. This helps businesses connect their existing systems, ensuring a smooth workflow and better data management.

-

Can I access the 5500 Ez Form through mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing users to access and complete the 5500 Ez Form from any device. This flexibility ensures that businesses can manage their compliance documentation on-the-go.

-

How does airSlate SignNow ensure the security of the 5500 Ez Form?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect the 5500 Ez Form throughout the signing process. This dedication to security helps businesses feel confident in their compliance submissions.

Get more for 5500 Ez Form

- Amendment of residential lease idaho form

- Agreement for payment of unpaid rent idaho form

- Commercial lease assignment from tenant to new tenant idaho form

- Tenant consent to background and reference check idaho form

- Residential lease or rental agreement for month to month idaho form

- Residential rental lease agreement idaho form

- Tenant welcome letter idaho form

- Warning of default on commercial lease idaho form

Find out other 5500 Ez Form

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document