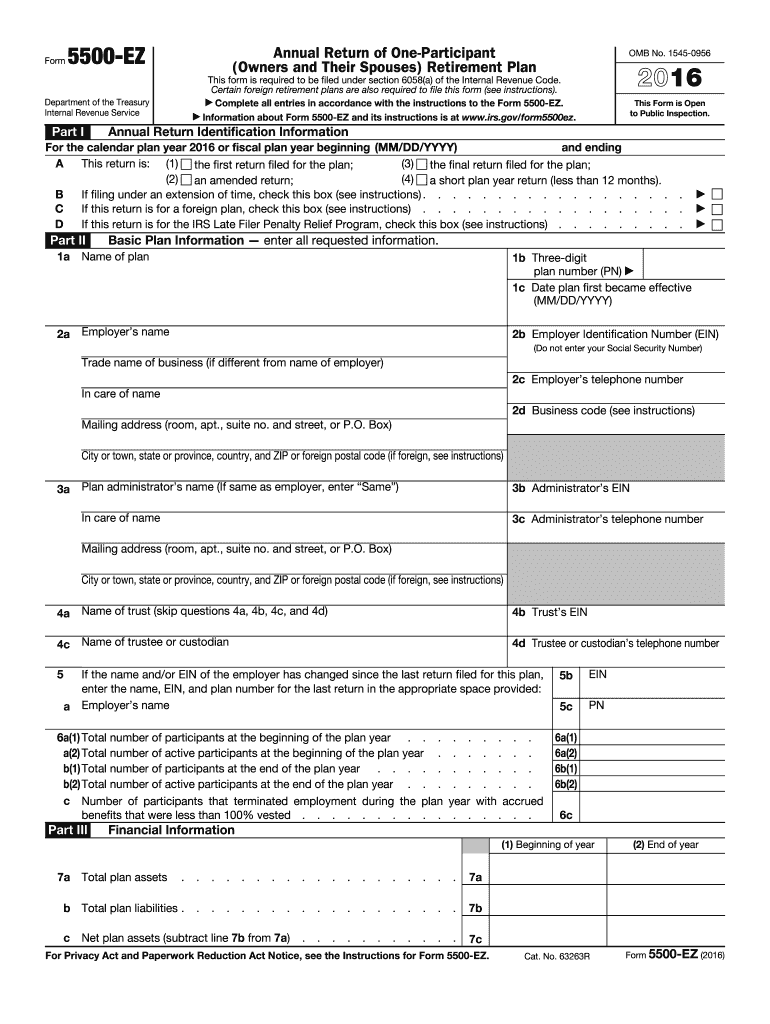

Irs Form 5500 Ez 2016

What is the IRS Form 5500 EZ

The IRS Form 5500 EZ is a simplified reporting form used by certain retirement plans to provide information to the federal government. This form is specifically designed for one-participant plans, which can include solo 401(k) plans and certain defined benefit plans. The primary purpose of the form is to ensure compliance with the Employee Retirement Income Security Act (ERISA) and to report financial information about the plan's assets and operations.

How to use the IRS Form 5500 EZ

Using the IRS Form 5500 EZ involves several key steps. First, gather all necessary information about your retirement plan, including participant details, financial statements, and asset valuations. Next, fill out the form accurately, ensuring all sections are completed as required. Once the form is filled out, it can be submitted electronically through the IRS e-File system or mailed directly to the IRS. It is important to retain a copy of the submitted form for your records.

Steps to complete the IRS Form 5500 EZ

Completing the IRS Form 5500 EZ requires careful attention to detail. Follow these steps for successful completion:

- Review the eligibility criteria to confirm that your plan qualifies to use the EZ form.

- Collect relevant financial data, including plan assets, liabilities, and participant information.

- Fill out the form, ensuring accuracy in all reported figures.

- Sign and date the form, confirming that the information provided is true and complete.

- Submit the form electronically or via mail, following the instructions provided by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 5500 EZ are critical to ensure compliance. Generally, the form must be filed by the last day of the seventh month after the plan year ends. For plans operating on a calendar year, this means the form is due by July 31. If additional time is needed, a six-month extension can be requested, but this must be done before the original deadline. Missing these deadlines can result in penalties and compliance issues.

Legal use of the IRS Form 5500 EZ

The IRS Form 5500 EZ is legally binding and must be completed in accordance with federal regulations. The information provided must be accurate and truthful, as any discrepancies can lead to penalties. Additionally, the form must be filed in a timely manner to maintain compliance with ERISA and IRS requirements. Utilizing reliable electronic signature solutions can enhance the legal validity of the form, ensuring that all signatures are secure and verifiable.

Required Documents

To complete the IRS Form 5500 EZ, certain documents are necessary. These typically include:

- Plan financial statements, detailing assets and liabilities.

- Participant information, including names and Social Security numbers.

- Documentation of plan operations and any amendments made during the plan year.

- Proof of compliance with applicable federal regulations.

Who Issues the Form

The IRS Form 5500 EZ is issued by the Internal Revenue Service (IRS), which oversees the compliance of retirement plans with federal regulations. The form is part of the broader Form 5500 series, which is designed to collect information about employee benefit plans. The IRS provides guidelines and instructions for completing the form, ensuring that plan administrators understand their reporting obligations.

Quick guide on how to complete 2016 irs form 5500 ez

Prepare Irs Form 5500 Ez seamlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents promptly without any hold-ups. Manage Irs Form 5500 Ez on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Irs Form 5500 Ez effortlessly

- Find Irs Form 5500 Ez and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Form 5500 Ez and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs form 5500 ez

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs form 5500 ez

How to generate an electronic signature for your 2016 Irs Form 5500 Ez online

How to make an electronic signature for your 2016 Irs Form 5500 Ez in Google Chrome

How to create an eSignature for signing the 2016 Irs Form 5500 Ez in Gmail

How to generate an electronic signature for the 2016 Irs Form 5500 Ez right from your smart phone

How to generate an eSignature for the 2016 Irs Form 5500 Ez on iOS

How to create an eSignature for the 2016 Irs Form 5500 Ez on Android OS

People also ask

-

What is IRS Form 5500 EZ?

IRS Form 5500 EZ is a simplified annual return for one-participant retirement plans, which allows employers to report their plan's financial information to the IRS. This form is essential for ensuring compliance with federal regulations. Using airSlate SignNow can streamline the process of completing and submitting IRS Form 5500 EZ, making it easier for businesses.

-

How can airSlate SignNow help with IRS Form 5500 EZ?

airSlate SignNow provides a user-friendly platform to electronically sign and send IRS Form 5500 EZ. With features that allow for secure document management, you can efficiently handle all required paperwork. Our solution simplifies the submission process, ensuring that your form is filed accurately and on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans to accommodate businesses of all sizes. Whether you're an individual practitioner or a large organization, you can choose a plan that fits your needs. With features tailored for efficiently handling IRS Form 5500 EZ, you can expect a great return on your investment.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you benefit from features such as customizable templates, real-time tracking, and automatic notifications. These tools make managing your IRS Form 5500 EZ and other important documents straightforward and efficient. Additionally, our secure platform ensures that all your documents remain confidential and compliant.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow is designed to be compliant with IRS regulations, making it suitable for handling documents like IRS Form 5500 EZ. Our platform adheres to best practices for electronic signatures and data security. This compliance helps protect your business and ensures that your filings meet federal requirements.

-

Can I integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and various CRM systems. This connectivity ensures a seamless workflow when preparing and submitting your IRS Form 5500 EZ, making document management more efficient.

-

What are the benefits of using airSlate SignNow for IRS Form 5500 EZ?

Using airSlate SignNow for IRS Form 5500 EZ offers numerous benefits, including time savings, ease of use, and enhanced security. Our platform allows for electronic signatures, eliminating the need for printing and scanning. Furthermore, the assurance of compliance with IRS standards gives you peace of mind for all your filing needs.

Get more for Irs Form 5500 Ez

Find out other Irs Form 5500 Ez

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer