Schedule a Form 990 Public Charity Status and Public Support 2022

Understanding Schedule A for Form 990

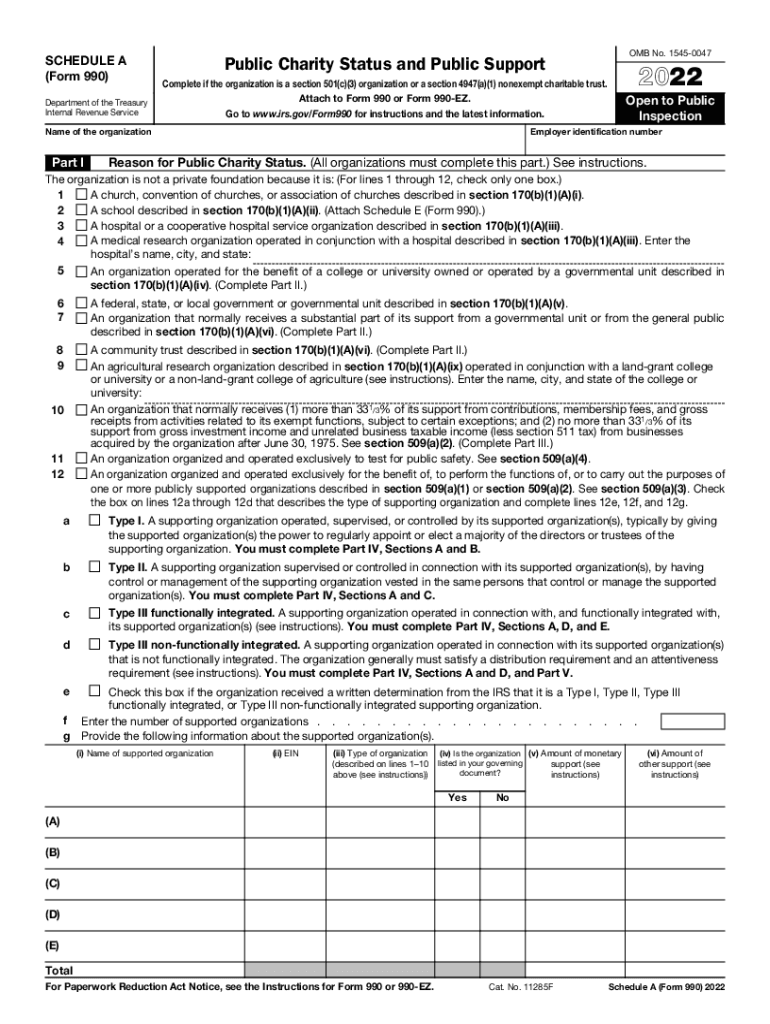

Schedule A of Form 990 is essential for organizations seeking public charity status and demonstrating public support. This schedule is specifically designed for tax-exempt organizations under Internal Revenue Code Section 501(c)(3). It helps determine whether an organization qualifies as a public charity or a private foundation based on the amount of public support it receives.

Organizations must provide detailed information about their sources of income, including contributions from the general public, government grants, and other revenue streams. This information is crucial for maintaining public charity status, as it ensures compliance with IRS regulations.

Steps to Complete Schedule A of Form 990

Completing Schedule A requires careful attention to detail. Here are the key steps to follow:

- Gather financial records, including donations, grants, and other income sources.

- Determine the total amount of public support received during the reporting period.

- Fill out the required sections of Schedule A, including the public support test and the organization’s activities.

- Review the completed schedule for accuracy and compliance with IRS guidelines.

- Attach Schedule A to your Form 990 before submission.

Legal Use of Schedule A for Form 990

Schedule A is legally significant as it substantiates an organization’s claim for public charity status. This status allows organizations to receive tax-deductible contributions from donors, which is vital for fundraising efforts. Failure to accurately complete and submit Schedule A can result in penalties, including the loss of tax-exempt status.

Organizations must adhere to the legal requirements outlined by the IRS, ensuring that all information provided is truthful and complete. Regular audits and reviews of financial records can help maintain compliance and transparency.

Filing Deadlines for Schedule A of Form 990

Timely filing of Form 990, including Schedule A, is crucial for maintaining compliance with IRS regulations. The standard deadline for filing is the fifteenth day of the fifth month after the end of the organization’s fiscal year. Organizations can apply for an extension, but they must file Form 8868 to obtain additional time.

It is important to note that failure to file on time can result in penalties, including fines and potential loss of tax-exempt status. Organizations should keep track of their filing deadlines to ensure compliance.

Eligibility Criteria for Schedule A of Form 990

To qualify for public charity status and complete Schedule A, organizations must meet specific eligibility criteria set by the IRS. These criteria include:

- Being organized and operated exclusively for charitable purposes.

- Receiving a substantial part of its support from the general public or from governmental units.

- Meeting the public support test, which assesses the level of public contributions compared to total income.

Organizations must regularly evaluate their eligibility to ensure they continue to meet these requirements and maintain their public charity status.

IRS Guidelines for Schedule A of Form 990

The IRS provides detailed guidelines for completing Schedule A of Form 990. These guidelines include instructions on how to report various types of income, calculate public support, and determine the organization’s classification as a public charity or private foundation. Organizations should refer to the latest IRS publications and instructions to ensure compliance with current regulations.

Staying informed about any changes in IRS guidelines is essential for accurate reporting and maintaining tax-exempt status.

Quick guide on how to complete 2022 schedule a form 990 public charity status and public support

Complete Schedule A Form 990 Public Charity Status And Public Support effortlessly on any device

Online document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Schedule A Form 990 Public Charity Status And Public Support on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Schedule A Form 990 Public Charity Status And Public Support without hassle

- Locate Schedule A Form 990 Public Charity Status And Public Support and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs within just a few clicks from your preferred device. Modify and electronically sign Schedule A Form 990 Public Charity Status And Public Support while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule a form 990 public charity status and public support

Create this form in 5 minutes!

People also ask

-

What is the 2022 IRS Form 990 EZ, and who needs to file it?

The 2022 IRS Form 990 EZ is a streamlined tax form used by smaller tax-exempt organizations to report income, expenses, and other financial information to the IRS. Nonprofits with gross receipts of less than $200,000 and total assets under $500,000 at the end of the year are typically required to file this form. Understanding its requirements is crucial for maintaining your tax-exempt status.

-

How can airSlate SignNow help in filing the 2022 IRS Form 990 EZ?

AirSlate SignNow facilitates the signing and submission of the 2022 IRS Form 990 EZ by providing an intuitive platform for e-signatures and document management. This enables organizations to gather necessary signatures quickly and securely, ensuring compliance with IRS deadlines. With easy-to-use features, you can streamline the filing process, saving time and reducing errors.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers robust features for document management, including customizable templates, audit trails, and advanced security options. These features are designed to ensure that the 2022 IRS Form 990 EZ is completed correctly and securely. By utilizing these tools, organizations can efficiently manage their documentation needs while staying compliant.

-

Is there a cost associated with using airSlate SignNow for filing the 2022 IRS Form 990 EZ?

Yes, there is a subscription cost associated with using airSlate SignNow, but it is designed to be cost-effective for organizations. The pricing model varies based on the features you choose, making it accessible for small nonprofits needing to file the 2022 IRS Form 990 EZ. You can select a plan that fits your budget and organizational requirements.

-

Can airSlate SignNow integrate with other software systems for filing the 2022 IRS Form 990 EZ?

Absolutely! AirSlate SignNow comes with various integrations that allow it to work seamlessly with your existing software. This means you can connect it to accounting systems or CRMs to efficiently pull data needed for the 2022 IRS Form 990 EZ, ensuring your filings are accurate and up-to-date.

-

What are the benefits of eSigning the 2022 IRS Form 990 EZ with airSlate SignNow?

Using airSlate SignNow for eSigning the 2022 IRS Form 990 EZ provides numerous benefits, including faster processing times and enhanced security. E-signatures are legally binding and often accepted by the IRS, simplifying the submission process. Additionally, you’ll have access to an audit trail to track all actions taken on the document.

-

How secure is the process of filing the 2022 IRS Form 990 EZ using airSlate SignNow?

Security is a top priority for airSlate SignNow, which employs advanced encryption and security protocols to protect your sensitive information. When filing the 2022 IRS Form 990 EZ, you can be assured that your data is securely stored and transmitted, giving you peace of mind in compliance and confidentiality.

Get more for Schedule A Form 990 Public Charity Status And Public Support

- General notice of default for contract for deed ohio form

- Ohio seller form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497322092 form

- Ohio contract deed form

- Notice of default for past due payments in connection with contract for deed ohio form

- Final notice of default for past due payments in connection with contract for deed ohio form

- Assignment of contract for deed by seller ohio form

- Notice of assignment of contract for deed ohio form

Find out other Schedule A Form 990 Public Charity Status And Public Support

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free