Nys it 210592010 Form 2020

What is the Nys It 210592010 Form

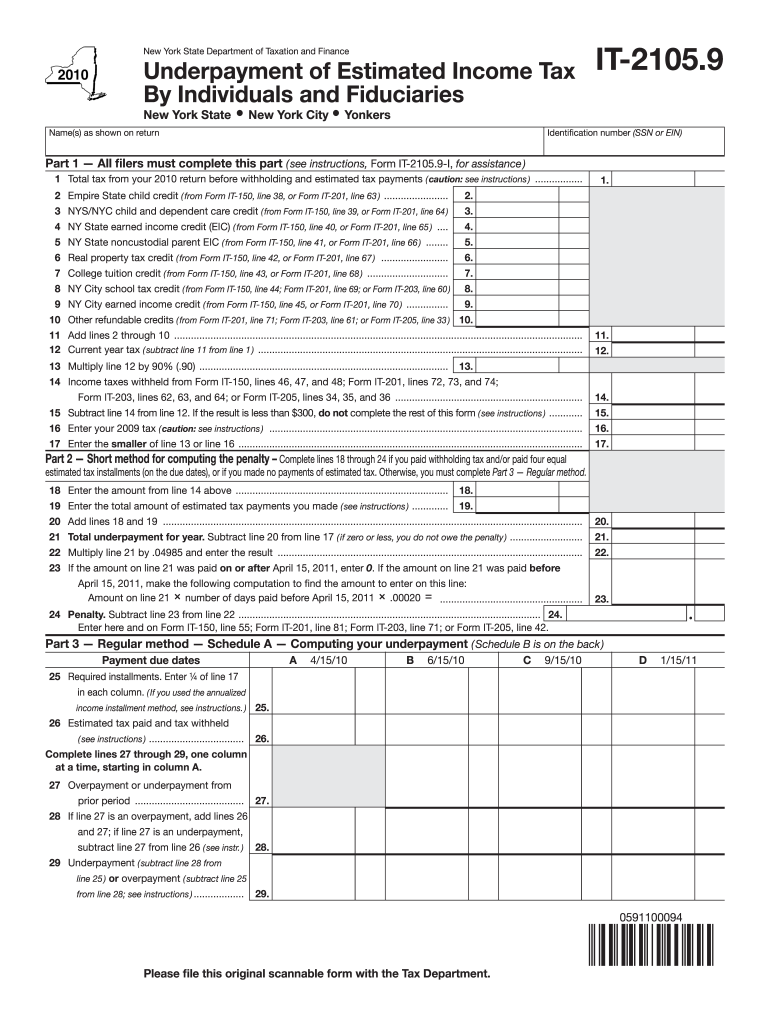

The Nys It 210592010 Form is a tax form used by individuals and businesses in New York State to report income and calculate tax liabilities. Specifically, it is utilized for the New York State personal income tax return. The form captures essential financial information, including income sources, deductions, and credits, allowing taxpayers to accurately determine their tax obligations. Understanding the purpose of this form is crucial for compliance with state tax laws.

How to use the Nys It 210592010 Form

Using the Nys It 210592010 Form involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, fill out the form by entering your personal information and income details. Be sure to include any deductions or credits you qualify for, as these can significantly affect your tax liability. Once completed, review the form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Steps to complete the Nys It 210592010 Form

Completing the Nys It 210592010 Form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all necessary documents, including income statements and deduction records.

- Begin by filling in your personal information, such as name, address, and Social Security number.

- Report your total income from all sources, ensuring you include wages, interest, and any other earnings.

- Apply any eligible deductions, such as those for student loan interest or retirement contributions.

- Calculate your total tax liability based on the information provided.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, following the instructions provided.

Legal use of the Nys It 210592010 Form

The Nys It 210592010 Form is legally binding when completed accurately and submitted in accordance with New York State tax regulations. It is essential to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or audits. Additionally, electronic signatures are recognized under state law, making it possible to submit the form digitally while maintaining its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Nys It 210592010 Form are critical for compliance. Typically, individual income tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines annually, as they can vary based on specific circumstances or legislative changes.

Form Submission Methods (Online / Mail / In-Person)

The Nys It 210592010 Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file online using approved e-filing services, which often provide immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate address provided by the New York State Department of Taxation and Finance. In-person submissions are also possible at designated tax offices, allowing for direct assistance if needed.

Quick guide on how to complete nys it 210592010 form

Effortlessly Prepare Nys It 210592010 Form on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Nys It 210592010 Form on any platform with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign Nys It 210592010 Form

- Find Nys It 210592010 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Annotate important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Nys It 210592010 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys it 210592010 form

Create this form in 5 minutes!

How to create an eSignature for the nys it 210592010 form

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Nys It 210592010 Form and why is it important?

The Nys It 210592010 Form is a crucial tax document required for individuals and businesses in New York State. It is used to report income and calculate taxes owed. Completing the Nys It 210592010 Form accurately can help avoid penalties and ensure compliance with state tax regulations.

-

How can airSlate SignNow assist with filling out the Nys It 210592010 Form?

airSlate SignNow simplifies the process of completing the Nys It 210592010 Form by providing an intuitive platform for document management and e-signatures. You can easily upload your form, fill it out online, and securely sign it. This helps save time and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the Nys It 210592010 Form?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. The cost will depend on the features you choose, but many find it to be a cost-effective solution for managing documents like the Nys It 210592010 Form. Consider checking our pricing page for detailed information.

-

What features does airSlate SignNow offer for the Nys It 210592010 Form?

airSlate SignNow provides advanced features such as customizable templates, e-signatures, and real-time tracking for the Nys It 210592010 Form. These features enhance user experience and streamline the document signing process, ensuring that all aspects of your tax filing are managed efficiently.

-

Can I store my completed Nys It 210592010 Form on airSlate SignNow?

Absolutely! With airSlate SignNow, you can securely store your completed Nys It 210592010 Form in the cloud. This ensures that your important tax documents are easily accessible whenever you need them, while also providing peace of mind with robust security measures.

-

Does airSlate SignNow integrate with other software for managing the Nys It 210592010 Form?

Yes, airSlate SignNow seamlessly integrates with various software solutions, such as accounting and document management tools, to enhance your workflow. These integrations allow you to manage the Nys It 210592010 Form alongside your other business documents without hassle.

-

Is it legal to e-sign the Nys It 210592010 Form with airSlate SignNow?

Yes, e-signatures created with airSlate SignNow are legally binding and compliant with federal and state regulations, including for the Nys It 210592010 Form. This means that you can confidently e-sign your tax documents knowing they hold legal validity.

Get more for Nys It 210592010 Form

Find out other Nys It 210592010 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors