Sc1041 Form 2019

What is the Sc1041 Form

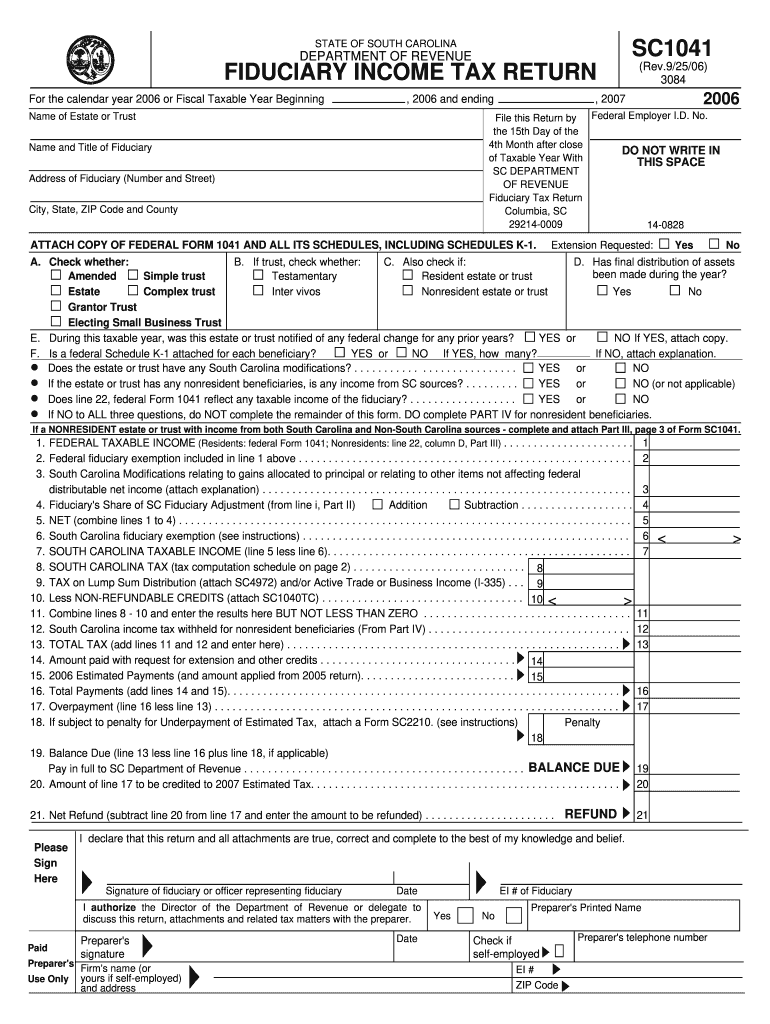

The Sc1041 Form, officially known as the South Carolina Income Tax Return for Estates and Trusts, is a tax document used by estates and trusts to report income and calculate tax liabilities in South Carolina. This form is essential for fiduciaries who manage the financial affairs of estates or trusts, ensuring compliance with state tax laws. It captures various income types, deductions, and credits applicable to the estate or trust, allowing for accurate tax reporting.

How to use the Sc1041 Form

To effectively use the Sc1041 Form, fiduciaries must first gather all necessary financial information related to the estate or trust. This includes income statements, expense records, and any applicable deductions. The form must be filled out accurately, reflecting all income earned during the tax year and any distributions made to beneficiaries. Once completed, the form should be submitted to the South Carolina Department of Revenue by the specified deadline to avoid penalties.

Steps to complete the Sc1041 Form

Completing the Sc1041 Form involves several key steps:

- Gather financial documents, including income statements and expense records.

- Fill out the identifying information for the estate or trust, including name, address, and tax identification number.

- Report all sources of income, such as interest, dividends, and rental income, in the appropriate sections of the form.

- Calculate allowable deductions and credits to determine the taxable income.

- Review the completed form for accuracy before submission.

- Submit the form to the South Carolina Department of Revenue by the deadline.

Legal use of the Sc1041 Form

The Sc1041 Form is legally binding when completed and submitted according to South Carolina tax laws. It must be signed by the fiduciary responsible for the estate or trust. Accurate reporting on this form is crucial, as incorrect information can lead to penalties or legal issues. Compliance with local tax regulations ensures that the estate or trust fulfills its financial obligations and protects the interests of the beneficiaries.

Filing Deadlines / Important Dates

Filing deadlines for the Sc1041 Form typically align with the federal tax return deadlines, which means the form is generally due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this would be April 15. It is important to stay informed about any changes to deadlines, as extensions may be available under certain circumstances.

Required Documents

To complete the Sc1041 Form, several documents are required:

- Income statements for the estate or trust, including 1099 forms.

- Expense records related to the management of the estate or trust.

- Documentation of distributions made to beneficiaries.

- Any supporting documents for deductions claimed.

Form Submission Methods (Online / Mail / In-Person)

The Sc1041 Form can be submitted through various methods to accommodate different preferences. Fiduciaries may choose to file the form online through the South Carolina Department of Revenue's e-filing system, which offers a convenient and efficient option. Alternatively, the form can be mailed to the appropriate tax office address. In-person submissions may also be possible at designated tax offices, providing another avenue for compliance.

Quick guide on how to complete sc1041 2006 form

Effortlessly Prepare Sc1041 Form on Any Device

Digital document administration has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without any interruptions. Manage Sc1041 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Simplest Way to Modify and eSign Sc1041 Form with Ease

- Locate Sc1041 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and eSign Sc1041 Form to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1041 2006 form

Create this form in 5 minutes!

How to create an eSignature for the sc1041 2006 form

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is the SC1041 Form?

The SC1041 Form is a tax document used for reporting income from trusts and estates. It is crucial for ensuring compliance with state and federal tax regulations. Understanding its significance can help in accurately filing your tax returns.

-

How can airSlate SignNow assist with the SC1041 Form?

airSlate SignNow streamlines the process of signing and sending the SC1041 Form electronically. With its user-friendly interface, you can easily fill out and eSign the form, ensuring timely submissions. This helps reduce paperwork and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for the SC1041 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, allowing you to choose the best option for handling your SC1041 Form and other documents. The plans are competitively priced, making it a cost-effective solution for businesses. You can select a plan based on features and usage requirements.

-

What features does airSlate SignNow offer for the SC1041 Form?

airSlate SignNow provides features like electronic signatures, templates, and secure storage for the SC1041 Form. These tools facilitate a more efficient process, allowing users to track document status and ensure compliance. Additionally, templates can simplify repetitive tasks.

-

Can I integrate airSlate SignNow with other applications for handling the SC1041 Form?

Absolutely! airSlate SignNow supports integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage and access your SC1041 Form seamlessly across different platforms, enhancing collaboration and efficiency.

-

What are the benefits of electronically signing the SC1041 Form with airSlate SignNow?

Electronically signing the SC1041 Form with airSlate SignNow offers numerous benefits, including increased speed, improved security, and reduced paper usage. You can complete the signing process from anywhere, ensuring a quick turnaround. Additionally, documents are securely stored, minimizing the risk of loss.

-

Is airSlate SignNow compliant with legal standards for the SC1041 Form?

Yes, airSlate SignNow adheres to industry standards and regulations, ensuring that electronic signatures on the SC1041 Form are legally binding. The platform uses encryption and secure protocols to protect sensitive information. This compliance provides peace of mind for users handling tax-related documents.

Get more for Sc1041 Form

Find out other Sc1041 Form

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now