Sc 1040 Form 2019

What is the SC 1040 Form

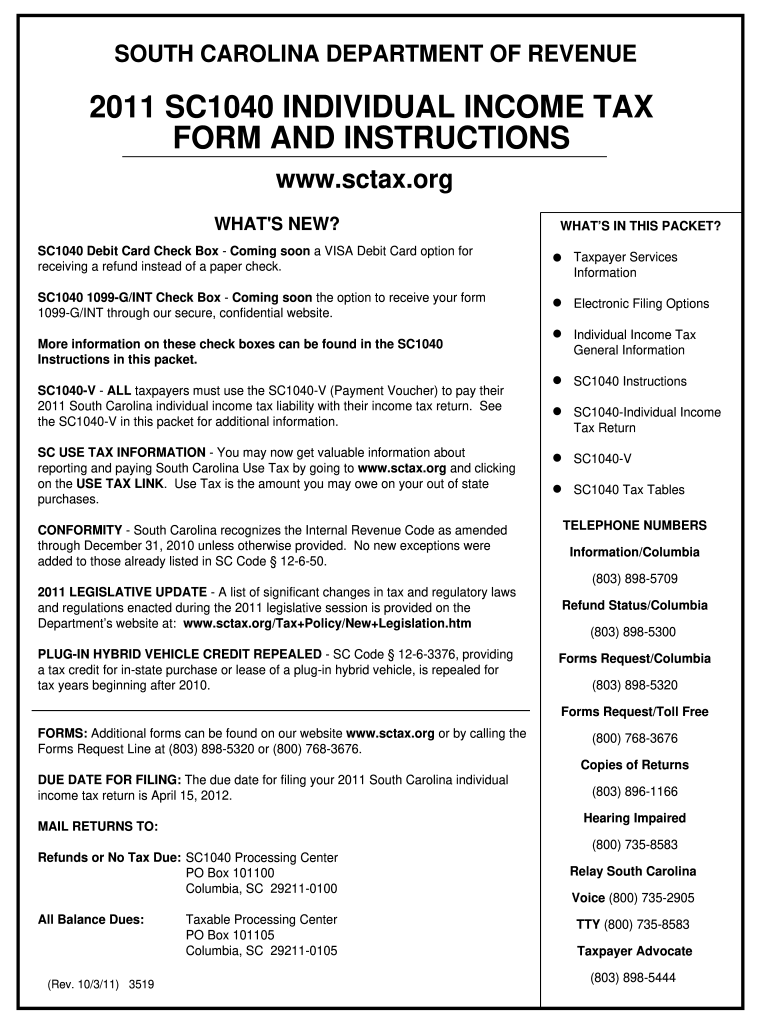

The SC 1040 Form is a state income tax return form used by residents of South Carolina to report their income and calculate their state tax liability. This form is essential for individuals and businesses alike, as it ensures compliance with state tax laws. The SC 1040 Form is typically required to be filed annually and is used to determine the amount of tax owed or the refund due based on the taxpayer's income, deductions, and credits.

How to use the SC 1040 Form

To use the SC 1040 Form effectively, taxpayers should begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the documents are collected, individuals can proceed to fill out the form by entering their personal information, income details, and applicable deductions. It is crucial to follow the instructions provided with the form to ensure accurate completion. After filling out the form, taxpayers can submit it electronically or via mail, depending on their preference and the options available.

Steps to complete the SC 1040 Form

Completing the SC 1040 Form involves several key steps:

- Gather all necessary documents, including income statements and receipts for deductions.

- Fill in personal information such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim deductions and credits applicable to your situation, such as education or healthcare expenses.

- Calculate your total tax liability or refund based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the SC 1040 Form

The SC 1040 Form holds legal significance as it is required by the South Carolina Department of Revenue for tax compliance. Submitting a completed form ensures that taxpayers fulfill their legal obligations under state law. It is important to provide accurate information, as any discrepancies could lead to penalties or audits. Additionally, e-filing the SC 1040 Form is legally recognized, provided that the electronic signature and submission comply with state regulations.

Filing Deadlines / Important Dates

Taxpayers should be aware of critical deadlines when filing the SC 1040 Form. Typically, the deadline for filing is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely filing and avoid penalties.

Form Submission Methods

There are several methods available for submitting the SC 1040 Form:

- Online Submission: Taxpayers can e-file their SC 1040 Form through approved software or tax preparation services.

- Mail Submission: The form can be printed and mailed to the appropriate address as specified in the filing instructions.

- In-Person Submission: Some taxpayers may choose to file in person at designated tax offices, although this option may vary by location.

Quick guide on how to complete 2011 sc 1040 form

Complete Sc 1040 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Sc 1040 Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Sc 1040 Form with ease

- Obtain Sc 1040 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Sc 1040 Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 sc 1040 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 sc 1040 form

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the SC 1040 Form?

The SC 1040 Form is a tax document used by residents in South Carolina to report their income and calculate their state taxes. It helps filers ensure compliance with state tax regulations while maximizing their deductions. Understanding the SC 1040 Form is crucial for accurate tax filing and to avoid potential penalties.

-

How can airSlate SignNow assist with the SC 1040 Form?

airSlate SignNow provides an efficient platform for electronically signing and sending the SC 1040 Form, making the tax filing process seamless. With its user-friendly interface, you can easily manage, sign, and track your documents. This facilitates a faster turnaround time for your tax submissions.

-

Is there a fee associated with using airSlate SignNow for the SC 1040 Form?

airSlate SignNow offers a cost-effective solution for eSigning the SC 1040 Form, with a variety of pricing plans tailored to different needs. Users can choose from monthly or annual subscriptions, which often provide better savings. Your investment ensures easy access to advanced features that streamline your document workflows.

-

What features does airSlate SignNow offer for managing the SC 1040 Form?

airSlate SignNow offers features such as customizable templates, advanced security for your SC 1040 Form documents, and real-time tracking of document status. You can collaborate with your tax professional or partners by sharing access securely. Automated reminders help ensure that deadlines are met efficiently.

-

Can I integrate airSlate SignNow with other applications for handling the SC 1040 Form?

Yes, airSlate SignNow can be integrated with various applications such as Google Drive, Dropbox, and CRM systems to facilitate seamless management of the SC 1040 Form. These integrations allow you to streamline your document workflow and ensure that your tax information is easily accessible. This interoperability enhances the overall efficiency of your tax preparation process.

-

What are the benefits of using airSlate SignNow for the SC 1040 Form over traditional methods?

Using airSlate SignNow for the SC 1040 Form offers numerous benefits, including time savings and enhanced convenience. The electronic signing process eliminates the need for printing and mailing documents, thus speeding up the filing process. Additionally, the platform's security features protect your sensitive information better than traditional methods.

-

How secure is my information when using airSlate SignNow for the SC 1040 Form?

airSlate SignNow prioritizes the security of your documents, including the SC 1040 Form, by employing advanced encryption protocols and secure servers. Your data is protected throughout the signing process, ensuring confidentiality and integrity at all times. By utilizing airSlate SignNow, you can trust that your personal information remains secure.

Get more for Sc 1040 Form

- Phq 9 gad 7 word document 255182552 form

- Sensible staffing timesheet form

- Printable form to balance check book

- Pdf bipolar depressive mood charts printable form

- Vehicle repair release form

- Pet order form fox chase cancer center fccc

- Field trip or other off premises activity notification permission form

- Bellin health hipaa form fill and sign printable template online us

Find out other Sc 1040 Form

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy