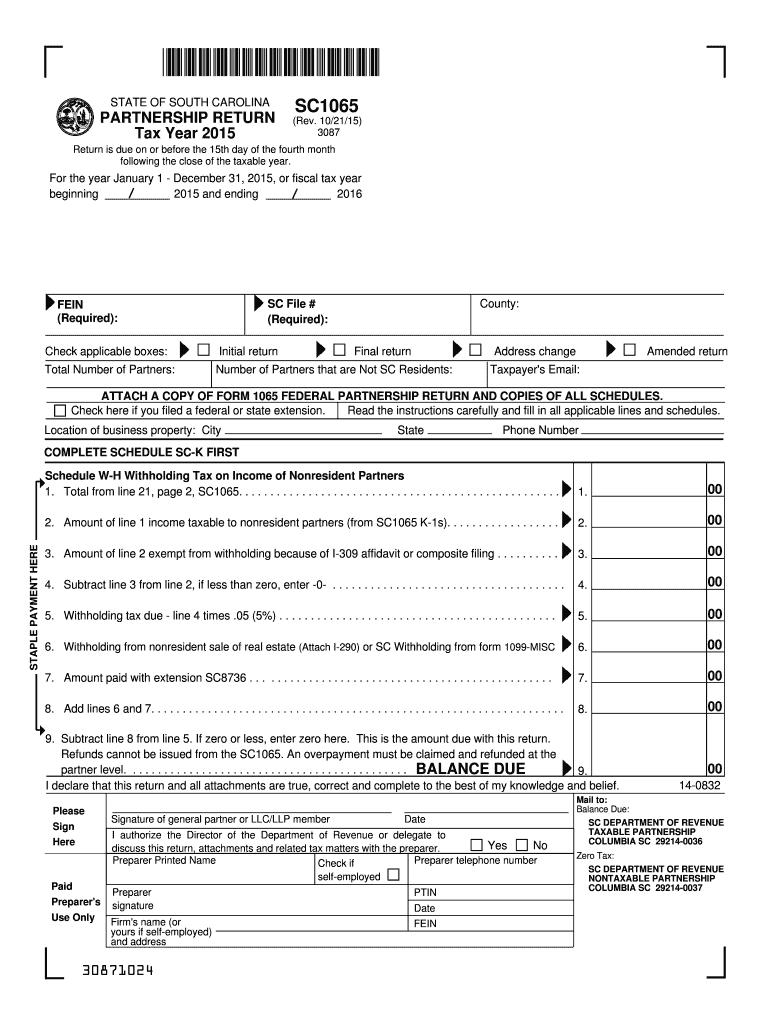

Sc 1065 Form 2019

What is the Sc 1065 Form

The Sc 1065 Form is a tax document used by partnerships in the United States to report income, deductions, gains, and losses from the partnership's operations. This form is essential for partnerships to comply with federal tax regulations. It provides a detailed overview of the financial activities of the partnership, allowing the Internal Revenue Service (IRS) to assess the tax obligations of each partner based on their share of the partnership's income.

How to use the Sc 1065 Form

To effectively use the Sc 1065 Form, partnerships must first gather all necessary financial information, including income statements, expense reports, and details about each partner's share of the partnership. The form requires accurate reporting of various financial metrics, including gross receipts, ordinary business income, and deductions. Once completed, the form must be submitted to the IRS, and copies should be provided to each partner for their tax records.

Steps to complete the Sc 1065 Form

Completing the Sc 1065 Form involves several key steps:

- Gather all financial documents related to the partnership's income and expenses.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report all income sources and deductions accurately, ensuring to follow IRS guidelines.

- Allocate income and deductions to each partner based on their partnership agreement.

- Review the completed form for accuracy before submission.

Legal use of the Sc 1065 Form

The Sc 1065 Form is legally binding when completed accurately and submitted within the designated deadlines. It must comply with IRS regulations, and any inaccuracies or omissions can lead to penalties. Partnerships should ensure that all partners agree on the reported figures and that the form is signed by an authorized representative of the partnership before submission.

Filing Deadlines / Important Dates

Partnerships must be aware of critical deadlines for filing the Sc 1065 Form. Typically, the form is due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships can file for an extension, which allows for an extra six months to submit the form.

Required Documents

To complete the Sc 1065 Form, partnerships need several key documents, including:

- Financial statements detailing income and expenses.

- Partnership agreement outlining each partner's share of profits and losses.

- Records of any distributions made to partners during the tax year.

- Supporting documentation for any deductions claimed.

Form Submission Methods (Online / Mail / In-Person)

The Sc 1065 Form can be submitted through various methods, providing flexibility for partnerships. It can be filed electronically using IRS-approved software, which is often the most efficient method. Alternatively, partnerships can mail a paper copy of the form to the appropriate IRS address. In-person submission is generally not available for this form, as it is primarily processed through electronic or mail channels.

Quick guide on how to complete sc 1065 2015 form

Effortlessly Prepare Sc 1065 Form on Any Device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, since you can acquire the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Sc 1065 Form on any device with airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest method to edit and electronically sign Sc 1065 Form with ease

- Find Sc 1065 Form and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your amendments.

- Choose your preferred method to send your form, whether it be via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Sc 1065 Form to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 1065 2015 form

Create this form in 5 minutes!

How to create an eSignature for the sc 1065 2015 form

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the SC 1065 Form?

The SC 1065 Form is a tax document used by partnerships in South Carolina to report income, deductions, and other important information. This form needs to be submitted along with the federal Form 1065 to ensure compliance with state tax regulations. Understanding the SC 1065 Form is essential for maintaining accurate tax records for your partnership.

-

How can airSlate SignNow help with signing the SC 1065 Form?

airSlate SignNow provides a user-friendly platform for electronically signing the SC 1065 Form, making the process faster and more efficient. With our solution, you can easily upload, send, and manage your documents, ensuring that your SC 1065 Form is signed securely. This technology helps streamline your workflow and reduce paper clutter.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, ensuring affordable access to eSigning solutions. Plans include customizable features that allow you to efficiently manage your documents, including the SC 1065 Form. You can check our website to find the best plan that fits your specific requirements.

-

What features does airSlate SignNow offer for managing the SC 1065 Form?

With airSlate SignNow, you get features like customizable templates, document tracking, and secure storage specifically to handle the SC 1065 Form. These features help you streamline the signing process and keep all your tax documentation organized. Additionally, automated reminder notifications ensure that important deadlines are not missed.

-

Is airSlate SignNow compliant with legal standards for the SC 1065 Form?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, making it a trusted choice for signing the SC 1065 Form. Our platform meets industry regulations to ensure the validity of your signed documents. You can confidently submit your SC 1065 Form, knowing that it adheres to all legal requirements.

-

Can I integrate airSlate SignNow with other applications for the SC 1065 Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications that can help you manage the SC 1065 Form more effectively. Whether you use accounting software, CRM systems, or cloud storage, our integrations enhance your workflow and provide easy access to your signed documents.

-

What are the benefits of using airSlate SignNow for the SC 1065 Form?

Using airSlate SignNow to manage your SC 1065 Form saves time and enhances productivity by simplifying the signing process. Our platform offers security features that protect sensitive information, ensuring that your tax documents are handled safely. Ultimately, airSlate SignNow helps you focus more on your business while ensuring efficient document management.

Get more for Sc 1065 Form

Find out other Sc 1065 Form

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement