Maryland Form 502 2019

What is the Maryland Form 502

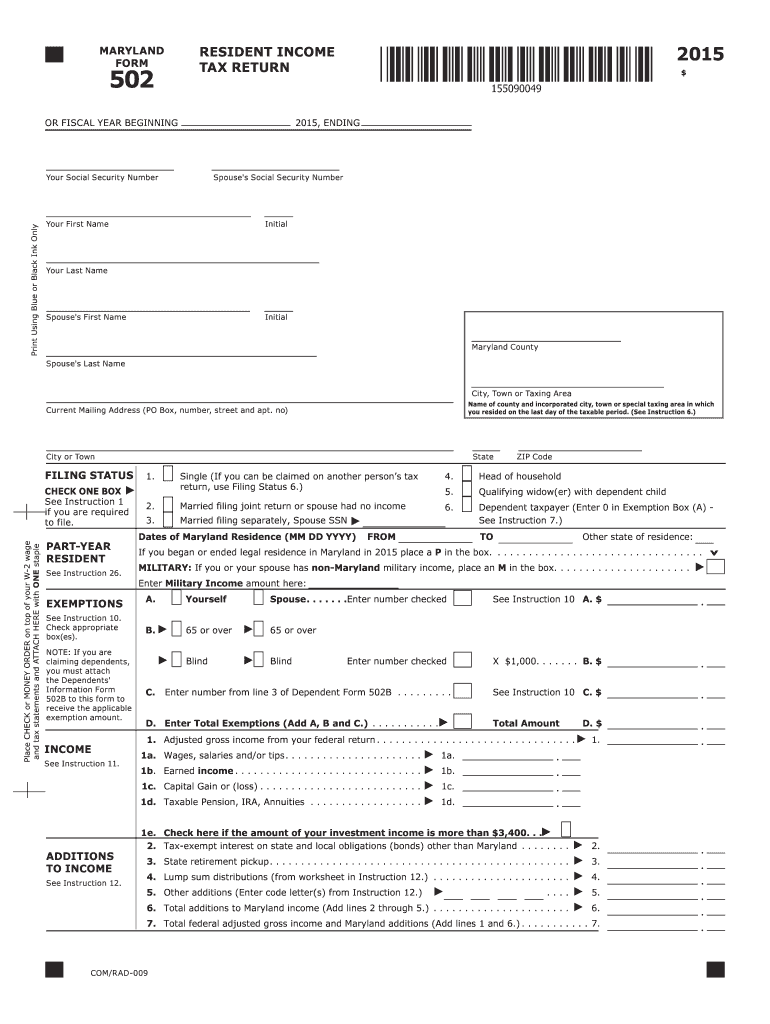

The Maryland Form 502 is the state's individual income tax return form, used by residents to report their income, calculate their tax liability, and claim any applicable credits or deductions. This form is essential for taxpayers in Maryland, as it ensures compliance with state tax laws and helps determine the amount of tax owed or refund due. The form captures various income sources, including wages, salaries, and other earnings, and allows for deductions such as those for mortgage interest and property taxes.

How to use the Maryland Form 502

Using the Maryland Form 502 involves several steps to ensure accurate completion. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and deductions. Be sure to double-check your entries for accuracy. After completing the form, you can either e-file it through approved software or print it out for mailing. Ensure that you keep a copy for your records.

Steps to complete the Maryland Form 502

Completing the Maryland Form 502 requires careful attention to detail. Follow these steps:

- Collect all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the designated lines.

- Claim any deductions and credits applicable to your situation.

- Calculate your total tax due or refund amount.

- Review the form for accuracy before submission.

Legal use of the Maryland Form 502

The Maryland Form 502 is legally binding when completed and submitted according to state tax regulations. It must be signed and dated by the taxpayer or their authorized representative. E-signatures are accepted if the submission is done electronically. Compliance with the Maryland tax laws is essential, as failure to file or inaccuracies can lead to penalties or legal issues. It is important to retain copies of the form and any supporting documentation for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 502 are crucial for taxpayers to remember. Generally, the form must be filed by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers may also request an extension, allowing for additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The Maryland Form 502 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: E-filing through approved tax software is the most efficient method.

- Mail: Completed forms can be mailed to the Maryland Comptroller's office. Ensure proper postage and use a secure envelope.

- In-Person: Taxpayers may also submit the form in person at designated local offices, where assistance may be available.

Quick guide on how to complete 2015 maryland form 502

Complete Maryland Form 502 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Maryland Form 502 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Maryland Form 502 with ease

- Obtain Maryland Form 502 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Maryland Form 502 and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 maryland form 502

Create this form in 5 minutes!

How to create an eSignature for the 2015 maryland form 502

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Maryland Form 502?

The Maryland Form 502 is the state income tax return form used by residents of Maryland to report their income and calculate their tax liability. It provides detailed instructions on how to fill it out and the various deductions available to you. For business owners, understanding how to correctly complete the Maryland Form 502 is crucial for accurate reporting.

-

How can airSlate SignNow help me with the Maryland Form 502?

airSlate SignNow simplifies the process of completing and eSigning important documents, including the Maryland Form 502. With its intuitive interface, you can easily upload your form, fill it out, and securely sign it electronically. This saves time and reduces the likelihood of errors that can occur when handling paper forms.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form 502?

Yes, airSlate SignNow offers various pricing plans to meet your business needs when filing the Maryland Form 502. These plans vary in features and capabilities, so you can choose the one that best fits your budget. Regardless of the plan, you'll find it is a cost-effective solution for managing your documents.

-

Can I integrate airSlate SignNow with other applications for filing my Maryland Form 502?

Absolutely! airSlate SignNow easily integrates with a variety of applications, making it seamless to manage your finances and submit the Maryland Form 502. Whether you're using accounting software or other productivity tools, these integrations enhance efficiency and streamline your workflow.

-

What features does airSlate SignNow offer for managing the Maryland Form 502?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking which are particularly beneficial for managing the Maryland Form 502. These features ensure that you can efficiently fill out, sign, and share your tax forms without any hassle. Additionally, you can store all your documents securely in one place.

-

How secure is airSlate SignNow when handling the Maryland Form 502?

Security is a top priority for airSlate SignNow, especially when handling important documents like the Maryland Form 502. The platform utilizes advanced encryption and security protocols to protect your sensitive information during signing and storage. You can trust that your data remains confidential and secure.

-

What are the benefits of using airSlate SignNow over traditional paper methods for the Maryland Form 502?

Using airSlate SignNow for the Maryland Form 502 offers numerous benefits over traditional paper methods. It greatly reduces processing time, minimizes the risk of errors, and enhances the overall efficiency of managing your documents. Additionally, the convenience of eSigning means you can complete your tax forms from anywhere, at any time.

Get more for Maryland Form 502

- Sjib grade card renewal form

- Bacteria review worksheet 1 answer key form

- Ho chunk win loss statement form

- Gann emblem excel download form

- Short blessed test pdf form

- Art approval form

- Living will declaration example form from pennsylv

- Dora restraining order and dora for posting drug offender restraining order and dora for posting judiciary state nj form

Find out other Maryland Form 502

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later