Form N 311, Rev , Refundable FoodExcist Tax Credit 2020

What is the Form N-311, Rev, Refundable FoodExcist Tax Credit

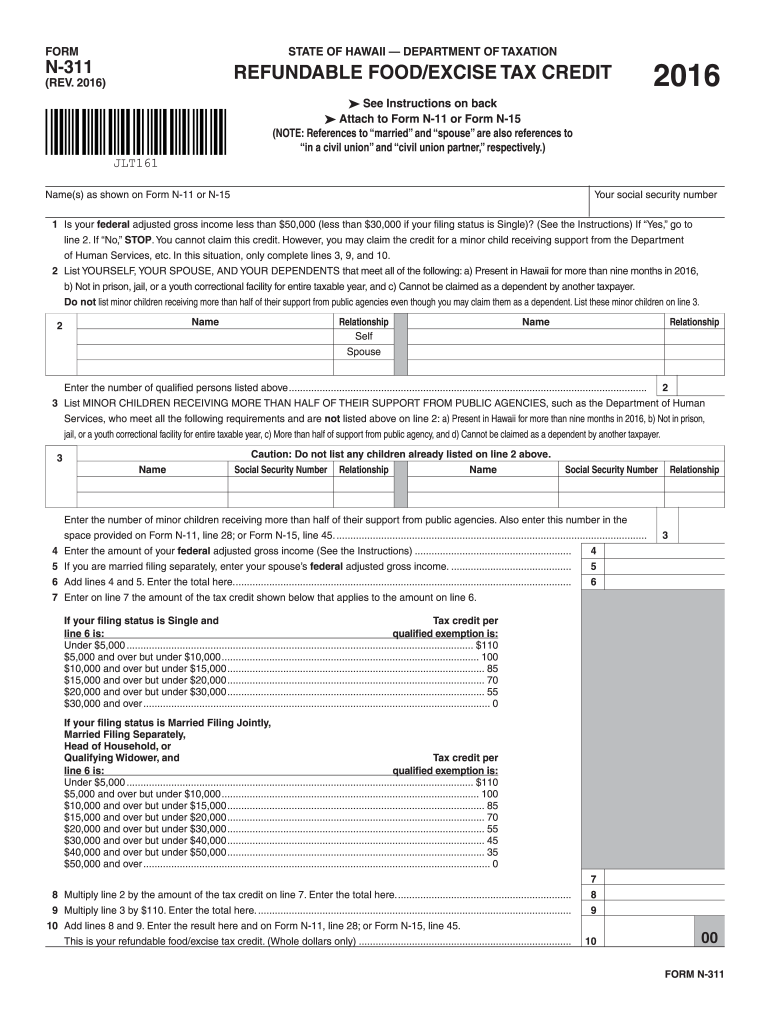

The Form N-311, Rev, Refundable FoodExcist Tax Credit is a tax form used by eligible individuals to claim a refundable tax credit related to food expenses. This form is specifically designed to assist taxpayers in receiving financial relief for food costs, thereby supporting low-income households. The credit is intended to reduce the financial burden of purchasing food, making it an essential resource for qualifying applicants.

How to use the Form N-311, Rev, Refundable FoodExcist Tax Credit

Using the Form N-311 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including proof of income and expenses related to food purchases. Next, fill out the form with accurate personal information, including your name, address, and Social Security number. After completing the form, review it for any errors before submitting it to the appropriate tax authority. Utilizing a digital platform can streamline this process, allowing for easy corrections and secure submission.

Steps to complete the Form N-311, Rev, Refundable FoodExcist Tax Credit

Completing the Form N-311 requires careful attention to detail. Follow these steps:

- Gather required documents, such as income statements and receipts for food purchases.

- Fill in your personal information accurately, including your filing status.

- Calculate your eligible food expenses based on the guidelines provided.

- Complete the sections of the form related to your income and household size.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the Refundable FoodExcist Tax Credit, applicants must meet specific eligibility criteria. Generally, these criteria include having a household income below a certain threshold and being responsible for food expenses for dependents. Additionally, applicants must be residents of the state where the form is filed. It is essential to review the specific requirements outlined by the tax authority to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form N-311 can be submitted through various methods, depending on the preferences of the taxpayer. Options typically include:

- Online submission through the state’s tax portal, which may offer an expedited process.

- Mailing a printed version of the completed form to the designated tax office.

- In-person submission at local tax offices, which may provide immediate assistance and confirmation.

Filing Deadlines / Important Dates

Filing deadlines for the Form N-311 are crucial to ensure that applicants receive their credits in a timely manner. Typically, the deadline aligns with the annual tax filing date, which is usually April 15. However, it is important to check for any state-specific extensions or changes to the filing schedule. Marking these dates on a calendar can help ensure timely submission.

Quick guide on how to complete form n 311 rev 2016 refundable foodexcist tax credit

Effortlessly Complete Form N 311, Rev , Refundable FoodExcist Tax Credit on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly and without hassle. Manage Form N 311, Rev , Refundable FoodExcist Tax Credit on any device using the airSlate SignNow applications for Android or iOS and simplify your document-based processes today.

How to Edit and eSign Form N 311, Rev , Refundable FoodExcist Tax Credit with Ease

- Obtain Form N 311, Rev , Refundable FoodExcist Tax Credit and click Get Form to begin.

- Take advantage of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your updates.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Form N 311, Rev , Refundable FoodExcist Tax Credit to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 311 rev 2016 refundable foodexcist tax credit

Create this form in 5 minutes!

How to create an eSignature for the form n 311 rev 2016 refundable foodexcist tax credit

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is Form N 311, Rev, Refundable FoodExcist Tax Credit?

Form N 311, Rev, Refundable FoodExcist Tax Credit is a tax credit form that eligible taxpayers can use to apply for refunds related to food excise taxes. This credit is designed to ease the financial burden on families by refunding a portion of the food excise tax they have paid. Understanding how to properly fill out this form can help you maximize your tax benefits.

-

How does airSlate SignNow support the completion of Form N 311, Rev, Refundable FoodExcist Tax Credit?

airSlate SignNow provides an intuitive platform for eSigning and managing Form N 311, Rev, Refundable FoodExcist Tax Credit documents. With its user-friendly interface, you can easily complete and send this form for signatures, ensuring quick processing and submission. This leads to an efficient tax refund claim process for users.

-

Is there a cost associated with using airSlate SignNow for Form N 311, Rev, Refundable FoodExcist Tax Credit?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs, including packages that allow for easy handling of Form N 311, Rev, Refundable FoodExcist Tax Credit. The pricing is competitive and designed to provide a cost-effective solution for all users. You can choose a plan that fits your volume of document handling and eSigning needs.

-

What features of airSlate SignNow make it suitable for filing Form N 311, Rev, Refundable FoodExcist Tax Credit?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and document storage, which streamline the process of filing Form N 311, Rev, Refundable FoodExcist Tax Credit. Additionally, the platform allows for real-time collaboration, enabling multiple users to review and sign documents efficiently. This leads to faster and more accurate submissions.

-

Can I integrate airSlate SignNow with other software for filing Form N 311, Rev, Refundable FoodExcist Tax Credit?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, allowing for seamless workflow management when handling Form N 311, Rev, Refundable FoodExcist Tax Credit. These integrations help streamline your process, ensuring that all your documents are easily signNowable and organized within your existing systems.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form N 311, Rev, Refundable FoodExcist Tax Credit?

Using airSlate SignNow for tax-related documents like Form N 311, Rev, Refundable FoodExcist Tax Credit ensures secure and efficient document management. The platform's electronic signing feature accelerates the submission process, helping you receive your refund faster. Additionally, it enhances compliance and reduces the risk of errors associated with paper forms.

-

How can I ensure my data is secure when using airSlate SignNow for Form N 311, Rev, Refundable FoodExcist Tax Credit?

airSlate SignNow prioritizes user security and employs advanced encryption to protect your data when filling out and submitting Form N 311, Rev, Refundable FoodExcist Tax Credit. Regular security audits and compliance with industry standards also contribute to a safe user experience. This commitment to security gives you peace of mind about your sensitive tax information.

Get more for Form N 311, Rev , Refundable FoodExcist Tax Credit

Find out other Form N 311, Rev , Refundable FoodExcist Tax Credit

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple