Connecticut Tax Form 2020

What is the Connecticut Tax Form

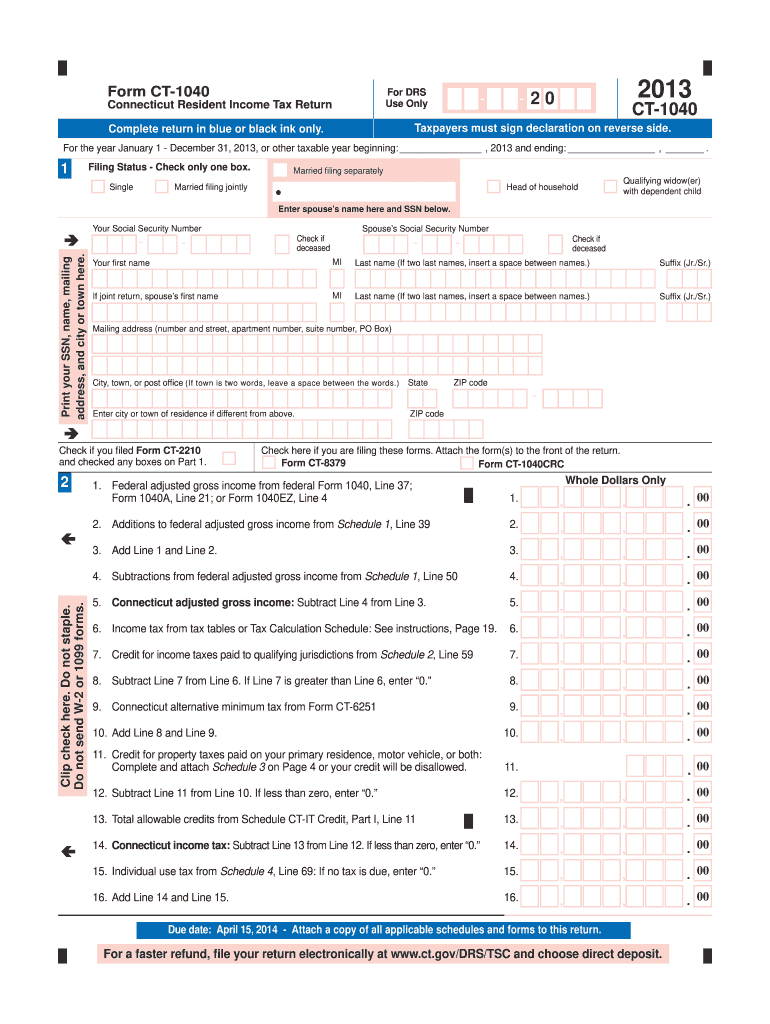

The Connecticut Tax Form is an essential document used for reporting income and calculating state taxes owed by individuals and businesses in Connecticut. This form is crucial for ensuring compliance with state tax laws and regulations. The Connecticut Department of Revenue Services (DRS) oversees the issuance and management of these forms, which vary based on the taxpayer's status, such as individual, business, or non-profit organization. Understanding the specific purpose and requirements of the Connecticut Tax Form is vital for accurate tax reporting.

How to obtain the Connecticut Tax Form

Obtaining the Connecticut Tax Form can be done through several straightforward methods. Taxpayers can access the form directly from the Connecticut Department of Revenue Services website, where it is available for download in PDF format. Additionally, physical copies of the form can be requested at local DRS offices or through tax preparation services. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to complete the Connecticut Tax Form

Completing the Connecticut Tax Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, carefully read the instructions provided with the form to understand the specific requirements. Fill out the form by entering personal information, income details, and applicable deductions. After completing the form, review all entries for accuracy, and ensure that all required signatures are included. Finally, submit the form by the designated deadline, either electronically or via mail.

Legal use of the Connecticut Tax Form

The Connecticut Tax Form is legally binding when filled out and submitted according to state regulations. To ensure its legal standing, taxpayers must comply with the guidelines set forth by the Connecticut DRS. This includes providing accurate information, signing the form, and adhering to submission deadlines. Electronic signatures are recognized as valid, provided they meet the requirements outlined in the Electronic Signatures and Records Act. Understanding these legal aspects is crucial for avoiding penalties and ensuring that the form is accepted by the authorities.

Key elements of the Connecticut Tax Form

Several key elements are essential for the proper completion of the Connecticut Tax Form. These include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Income Details: Total income earned, including wages, interest, and dividends.

- Deductions: Eligible deductions that can reduce taxable income, such as student loan interest or mortgage interest.

- Tax Calculation: The method used to calculate the amount of tax owed based on income and deductions.

- Signature: Required signature of the taxpayer or authorized representative to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut Tax Form are crucial for compliance and avoiding penalties. Typically, individual taxpayers must file their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to these deadlines, as they can vary based on specific situations, such as natural disasters or legislative changes. Marking these important dates on a calendar can help ensure timely submission.

Quick guide on how to complete 2013 connecticut tax form

Complete Connecticut Tax Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Connecticut Tax Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Connecticut Tax Form effortlessly

- Locate Connecticut Tax Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Select how you prefer to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Connecticut Tax Form to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 connecticut tax form

Create this form in 5 minutes!

How to create an eSignature for the 2013 connecticut tax form

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Connecticut Tax Form?

The Connecticut Tax Form is a document required for filing state taxes in Connecticut. This form allows individuals and businesses to report their income and calculate taxes owed to the state. Using airSlate SignNow, you can easily eSign and submit your Connecticut Tax Form efficiently.

-

How can airSlate SignNow help with filing the Connecticut Tax Form?

airSlate SignNow streamlines the process of completing and submitting your Connecticut Tax Form. By enabling electronic signatures and document management, it simplifies the workflow, allowing you to focus on your finances rather than paperwork. Plus, it’s a cost-effective solution for all your tax document needs.

-

Is there a cost associated with using airSlate SignNow for the Connecticut Tax Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Each plan includes access to features that facilitate the electronic signing of documents like the Connecticut Tax Form. Choose a plan that best fits your budget and enjoy seamless document management.

-

Can I integrate airSlate SignNow with other applications for Connecticut Tax Form processing?

Absolutely! airSlate SignNow integrates with a variety of applications, enabling you to import, fill out, and eSign your Connecticut Tax Form seamlessly. Integrations with popular platforms like Google Drive and Dropbox make handling your tax documents even easier and more efficient.

-

What are the benefits of using airSlate SignNow for the Connecticut Tax Form?

Using airSlate SignNow offers multiple benefits for handling your Connecticut Tax Form, including time savings, enhanced security, and better organization of documents. It allows you to eSign documents from anywhere, ensuring that your tax filing process is smooth and hassle-free. Additionally, you keep compliant with state regulations effortlessly.

-

How secure is my information when using airSlate SignNow for the Connecticut Tax Form?

airSlate SignNow prioritizes your security by employing SSL encryption to protect your data when eSigning your Connecticut Tax Form. This ensures that your sensitive information remains confidential and secure throughout the signing process. Trust that your documents are safe with us.

-

Are there templates available for the Connecticut Tax Form on airSlate SignNow?

Yes, airSlate SignNow provides pre-built templates for popular forms, including the Connecticut Tax Form. These templates simplify your experience by allowing you to quickly fill out required fields and eSign with ease. This feature saves you time and helps ensure accuracy in your tax submissions.

Get more for Connecticut Tax Form

Find out other Connecticut Tax Form

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free