Connecticut Form Tax 2020

What is the Connecticut Form Tax

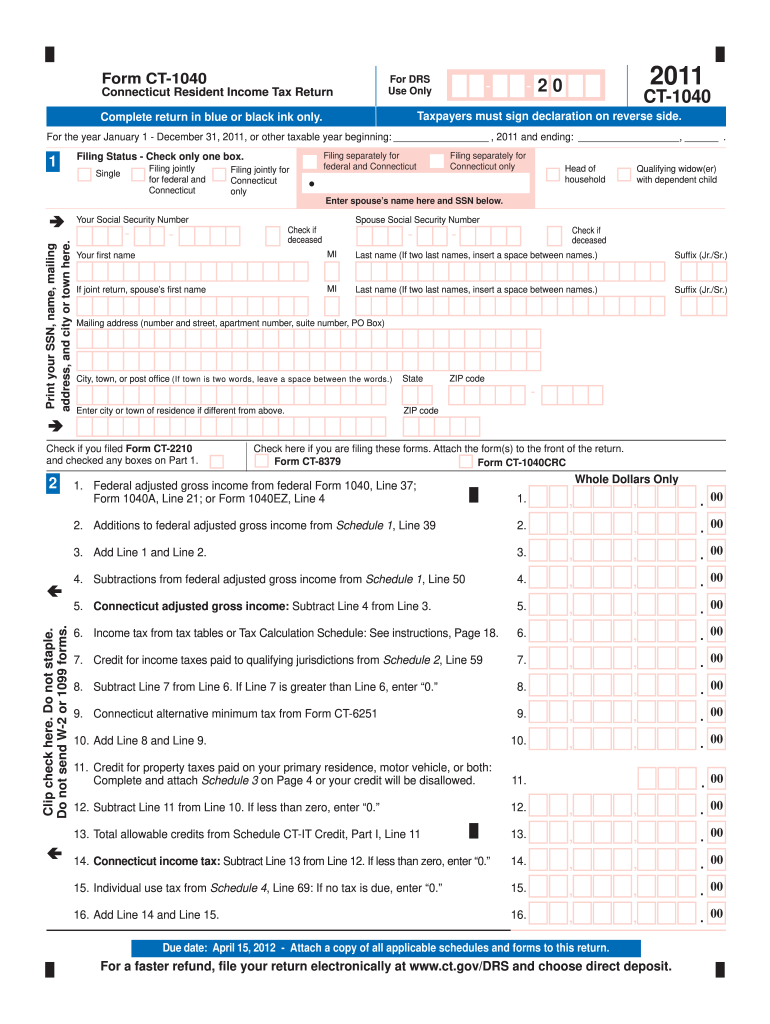

The Connecticut Form Tax is a specific document used for reporting income and calculating tax obligations for individuals and businesses within the state of Connecticut. This form is essential for ensuring compliance with state tax laws and is designed to capture various income sources, deductions, and credits applicable to Connecticut taxpayers. Understanding the purpose and requirements of this form is crucial for accurate tax filing and avoiding potential penalties.

How to use the Connecticut Form Tax

Using the Connecticut Form Tax involves several steps to ensure proper completion and submission. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. After collecting these documents, individuals can fill out the form by entering their income, claiming deductions, and calculating their tax liability. It's advisable to review the instructions carefully to ensure all information is accurate and complete before submission.

Steps to complete the Connecticut Form Tax

Completing the Connecticut Form Tax requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, such as income statements and receipts.

- Obtain the latest version of the Connecticut Form Tax from the official state website or authorized sources.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include wages, interest, and dividends.

- Claim any eligible deductions or credits, following the guidelines provided in the form instructions.

- Calculate total tax liability based on the information provided.

- Review the completed form for accuracy before signing and dating it.

- Submit the form by the specified deadline, either electronically or via mail.

Legal use of the Connecticut Form Tax

The Connecticut Form Tax is legally binding when completed and submitted according to state regulations. To ensure its legal standing, taxpayers must provide accurate information and adhere to the guidelines set forth by the Connecticut Department of Revenue Services. Electronic submissions are permissible and recognized as valid under state law, provided that all electronic signature requirements are met. It is crucial to retain copies of submitted forms and any supporting documents for future reference and compliance verification.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut Form Tax are critical to avoid penalties and interest. Typically, individual tax returns are due on April fifteenth of each year, while business entities may have different deadlines based on their fiscal year. It is essential to check for any extensions or changes in deadlines, especially during tax season. Marking these important dates on a calendar can help ensure timely submission and compliance with state tax laws.

Required Documents

To complete the Connecticut Form Tax accurately, taxpayers must gather several required documents. These typically include:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or educational costs.

- Previous year’s tax return for reference.

- Any other relevant financial documents that support income and deductions.

Who Issues the Form

The Connecticut Form Tax is issued by the Connecticut Department of Revenue Services. This state agency is responsible for overseeing tax collection, ensuring compliance with tax laws, and providing guidance to taxpayers. The department regularly updates the form and its accompanying instructions to reflect current tax regulations and policies, making it essential for taxpayers to use the most recent version when filing their taxes.

Quick guide on how to complete 2011 connecticut form tax

Effortlessly Prepare Connecticut Form Tax on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Connecticut Form Tax on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The Easiest Method to Edit and Electronically Sign Connecticut Form Tax with Ease

- Find Connecticut Form Tax and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or hide sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Connecticut Form Tax while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 connecticut form tax

Create this form in 5 minutes!

How to create an eSignature for the 2011 connecticut form tax

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the Connecticut Form Tax and why is it important?

The Connecticut Form Tax is a crucial document used for reporting various tax obligations in the state of Connecticut. Understanding this form is vital for individuals and businesses to ensure compliance with tax regulations and avoid penalties.

-

How can airSlate SignNow help with the Connecticut Form Tax?

airSlate SignNow streamlines the process of completing and signing the Connecticut Form Tax electronically. Our platform ensures that your documents are securely signed and efficiently filed, saving you time and reducing the potential for errors.

-

Is there a cost associated with using airSlate SignNow for Connecticut Form Tax?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different needs, ensuring a cost-effective solution for managing your Connecticut Form Tax. Our pricing is transparent, and there are options for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Connecticut Form Tax?

Our platform provides features such as customizable templates, secure digital signatures, and automatic reminder notifications for deadlines related to the Connecticut Form Tax. These tools enhance efficiency and accuracy in the eSigning process.

-

Can airSlate SignNow integrate with other software for filing Connecticut Form Tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, allowing you to manage your Connecticut Form Tax processes without leaving your existing workflow. This integration helps simplify tax preparation and filing.

-

What are the benefits of using airSlate SignNow for Connecticut Form Tax?

Using airSlate SignNow for your Connecticut Form Tax offers multiple benefits, including enhanced security, faster turnaround times, and reduced paperwork. Our eSignature solution eliminates the need for physical signatures, making the process more efficient.

-

Is airSlate SignNow secure for managing Connecticut Form Tax documents?

Yes, airSlate SignNow follows industry-leading security protocols to ensure your Connecticut Form Tax documents are protected. We use encryption methods to safeguard sensitive information during transmission and storage.

Get more for Connecticut Form Tax

- Renew land title sarawak form

- Warranty deed arizona download form

- Classify rational and irrational numbers worksheet form

- Fire extinguisher training handout form

- Enrollment form 407553805

- New zealand degree diploma form

- Bill richards appn form athleticscanterbury org

- Yessenia dog boarding form pets namessurnameoc

Find out other Connecticut Form Tax

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe