Ct 1096 Form 2020

What is the Ct 1096 Form

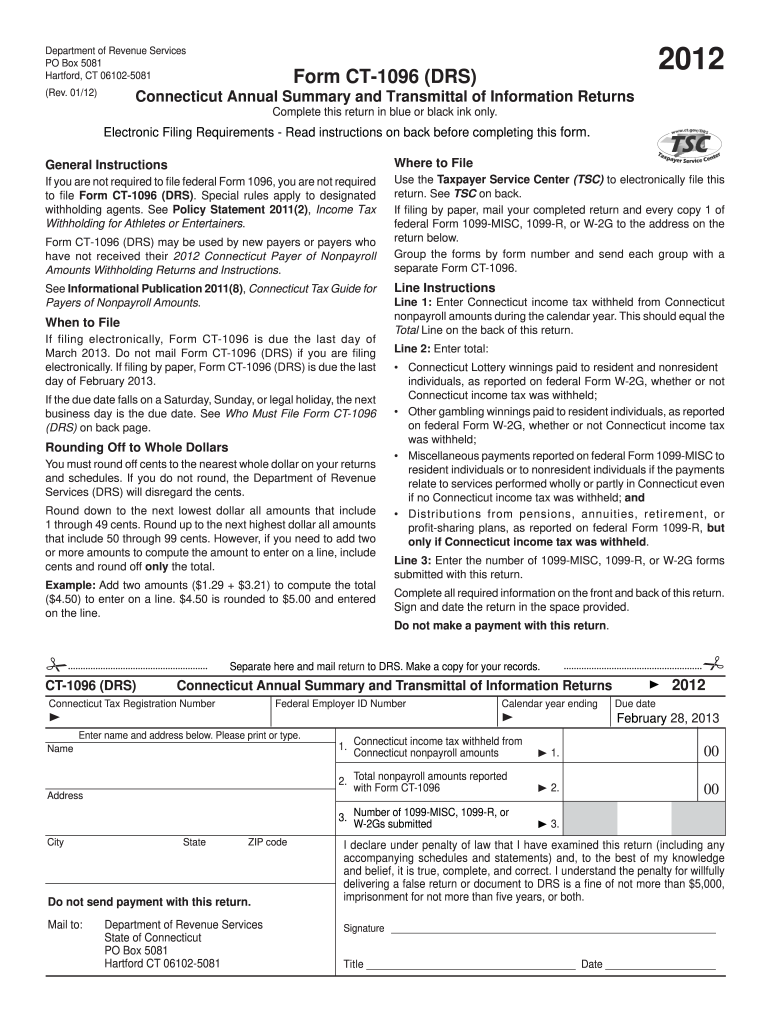

The Ct 1096 Form is a state-specific document used in Connecticut for reporting and summarizing information related to certain tax obligations. This form is primarily utilized by businesses and organizations to report payments made to independent contractors and other non-employee compensation. It serves as a summary of the information reported on individual 1099 forms issued to recipients, ensuring that the state tax authority receives accurate data for tax assessment purposes.

How to use the Ct 1096 Form

To effectively use the Ct 1096 Form, individuals or businesses must first gather all relevant information about the payments made to contractors or non-employees throughout the tax year. This includes collecting details such as the total amount paid to each recipient, their tax identification number, and any applicable withholding amounts. Once this information is compiled, it can be entered into the Ct 1096 Form, which will summarize these payments for reporting to the Connecticut Department of Revenue Services.

Steps to complete the Ct 1096 Form

Completing the Ct 1096 Form involves several key steps:

- Gather all necessary documentation, including individual 1099 forms issued to contractors.

- Enter the total amounts paid to each contractor in the appropriate sections of the form.

- Provide the tax identification numbers for each recipient to ensure accurate reporting.

- Review the form for accuracy, ensuring that all figures match the individual 1099 forms.

- Submit the completed Ct 1096 Form to the Connecticut Department of Revenue Services by the designated deadline.

Legal use of the Ct 1096 Form

The Ct 1096 Form is legally required for businesses that have made payments to independent contractors or non-employees in Connecticut. Failure to file this form accurately and on time can result in penalties and interest charges. It is essential to comply with state regulations regarding the reporting of these payments to avoid legal complications and ensure that all tax obligations are met.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Ct 1096 Form to avoid penalties. Typically, the form must be submitted by the end of January following the tax year in which payments were made. Additionally, businesses should ensure that individual 1099 forms are distributed to recipients by the same deadline, allowing them sufficient time to report their income accurately.

Who Issues the Form

The Ct 1096 Form is issued by the Connecticut Department of Revenue Services. This agency oversees the collection of state taxes and ensures compliance with tax laws. Businesses and individuals can obtain the form directly from the department's website or through authorized tax preparation software that includes state tax forms.

Quick guide on how to complete ct 1096 form 2012

Effortlessly Prepare Ct 1096 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the desired form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Ct 1096 Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Alter and Electronically Sign Ct 1096 Form with Ease

- Find Ct 1096 Form and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click the Done button to finalize your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your device of choice. Modify and electronically sign Ct 1096 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1096 form 2012

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 form 2012

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Ct 1096 Form?

The Ct 1096 Form is a tax form used by businesses in Connecticut to report income. It consolidates the information for multiple 1099 forms into one, making it easier for the IRS to process. Understanding the Ct 1096 Form is essential for proper reporting and compliance.

-

How can airSlate SignNow help with the Ct 1096 Form?

airSlate SignNow allows you to easily eSign and send your Ct 1096 Form digitally. This streamlined process reduces the physical paperwork and ensures that your submissions are secure and compliant. With airSlate SignNow’s features, you can manage your forms more efficiently.

-

Is there a cost associated with using airSlate SignNow for the Ct 1096 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including features for managing the Ct 1096 Form. These plans are cost-effective and designed to save you time and effort in document management. You can choose a plan that best fits your business's requirements.

-

What features does airSlate SignNow provide for managing the Ct 1096 Form?

airSlate SignNow provides features such as eSignature capabilities, document tracking, and customizable templates for the Ct 1096 Form. These features enhance your ability to handle tax documentation efficiently. Additionally, you can automate workflows to streamline the submission process.

-

Can I integrate airSlate SignNow with other tools for the Ct 1096 Form?

Absolutely! airSlate SignNow integrates seamlessly with popular tools and platforms, allowing you to manage your Ct 1096 Form alongside other business applications. This integration enhances efficiency and data accuracy, making your document handling more streamlined.

-

What are the benefits of using airSlate SignNow for the Ct 1096 Form?

Using airSlate SignNow for your Ct 1096 Form offers numerous benefits, including increased speed, reduced errors, and enhanced security. It also provides a user-friendly platform that simplifies the eSigning process for all stakeholders involved. With airSlate SignNow, you can ensure compliance and peace of mind.

-

Is airSlate SignNow secure for submitting the Ct 1096 Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Ct 1096 Form is protected. The platform uses advanced encryption and security protocols to safeguard your documents and data. You can submit your forms confidently, knowing they are securely handled.

Get more for Ct 1096 Form

- State of illinois affidavit and certificate of correction request form

- Citizens crime report page 2 pub read only city of lompoc form

- Etf claim form 5709144

- Dd form 2790 24420231

- Intelligence report format pdf

- A visit to the water park story form

- Termination form south carolina law enforcement division sled sc

- Form it 637 alternative fuels and electric vehicle

Find out other Ct 1096 Form

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate