1099 Int 2021

What is the 1099-INT?

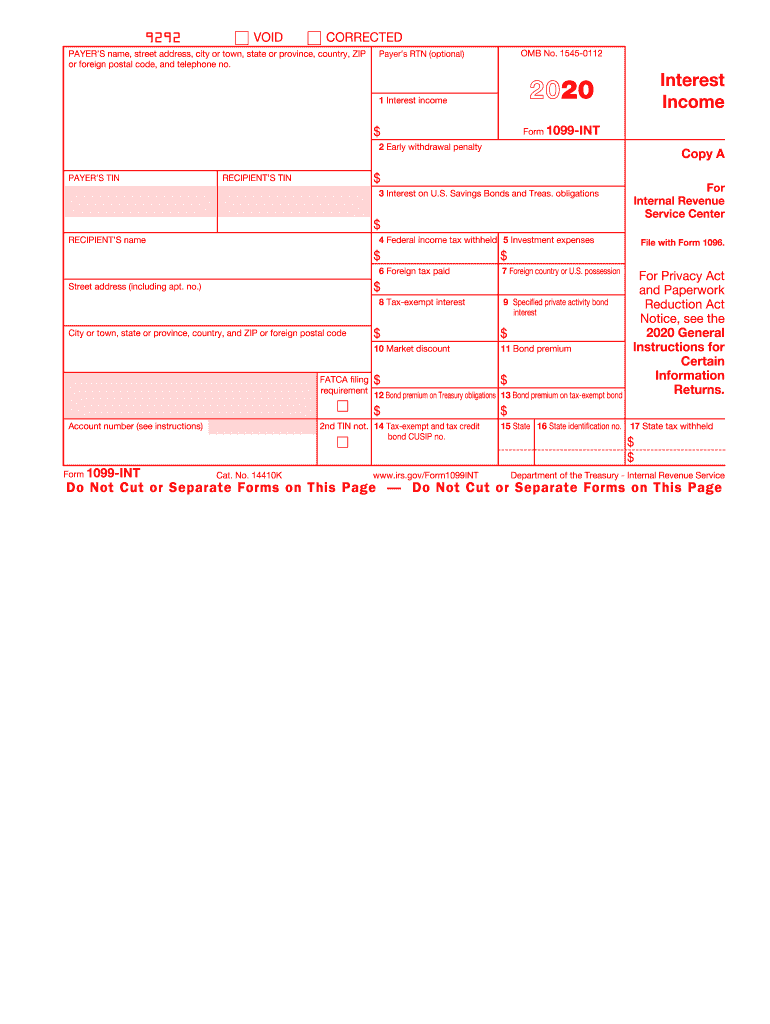

The 1099-INT is a tax form used in the United States to report interest income earned by individuals and businesses. This form is typically issued by banks, credit unions, and other financial institutions to account holders who have received interest payments of ten dollars or more during the tax year. The information reported on the 1099-INT is essential for taxpayers to accurately report their income when filing their federal tax returns. Understanding this form is crucial for ensuring compliance with IRS regulations.

How to Use the 1099-INT

Using the 1099-INT involves several steps. First, taxpayers should review the form for accuracy, ensuring that the reported interest income matches their records. Next, the information from the 1099-INT must be entered into the appropriate section of the federal tax return, typically on Form 1040. Taxpayers should also keep a copy of the 1099-INT for their records. It is important to note that the IRS receives a copy of this form as well, so discrepancies can lead to audits or penalties.

Steps to Complete the 1099-INT

Completing the 1099-INT requires careful attention to detail. Follow these steps:

- Gather all relevant financial statements that show interest income.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report the total interest earned in the designated box on the form.

- If applicable, include any federal income tax withheld in the appropriate section.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The IRS requires that 1099-INT forms be sent to recipients by January 31 of the year following the tax year in which the interest was earned. Additionally, financial institutions must file these forms with the IRS by February 28 if submitting by mail or by March 31 if filing electronically. Being aware of these deadlines is crucial to avoid penalties and ensure timely reporting.

Who Issues the Form

The 1099-INT is typically issued by banks, credit unions, and other financial institutions that pay interest to account holders. These entities are responsible for preparing and sending the form to both the taxpayer and the IRS. It is important for taxpayers to ensure they receive this form from all relevant financial institutions to accurately report their interest income.

Penalties for Non-Compliance

Failure to report interest income using the 1099-INT can result in significant penalties from the IRS. If a taxpayer does not report income that is documented on a 1099-INT, they may face fines, interest on unpaid taxes, and potential audits. Additionally, financial institutions may incur penalties for failing to issue the form on time or for inaccuracies. Compliance with reporting requirements is essential for avoiding these consequences.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 1099-INT. Taxpayers are advised to refer to IRS Publication 550, which outlines the tax treatment of interest income. This publication includes information on how to report interest income, the types of interest that must be reported, and any exceptions that may apply. Staying informed about IRS guidelines helps ensure that taxpayers fulfill their obligations accurately and efficiently.

Quick guide on how to complete 1099 int 2020

Easily Prepare 1099 Int on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the right template and safely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle 1099 Int on any device with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to Edit and eSign 1099 Int Effortlessly

- Locate 1099 Int and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you would prefer to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Edit and eSign 1099 Int and maintain excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 int 2020

Create this form in 5 minutes!

How to create an eSignature for the 1099 int 2020

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What are 1099 forms printable 2018 and who needs them?

1099 forms printable 2018 are tax documents used to report income other than wages, salaries, and tips. Independent contractors, freelancers, and business owners typically need these forms to declare income received during the tax year. This is crucial for both reporting to the IRS and for recipients to accurately file their taxes.

-

How can I download 1099 forms printable 2018?

You can easily download 1099 forms printable 2018 from our website. Simply navigate to our forms section, select the 1099 forms, and choose the 2018 version. The forms are available in a user-friendly format that you can print or fill out digitally.

-

Are there any costs associated with obtaining 1099 forms printable 2018?

The 1099 forms printable 2018 are available for free through our platform. However, there may be costs involved if you opt for additional services, such as eSigning or enhanced integrations with your accounting software. We offer a variety of pricing plans to suit your business needs.

-

What features does airSlate SignNow offer for handling 1099 forms printable 2018?

airSlate SignNow provides customizable templates for 1099 forms printable 2018, making it easy to input your data. Our platform supports eSigning, allowing recipients to sign the forms electronically, and offers secure storage for your documents. Additionally, our system ensures compliance with IRS regulations for a hassle-free experience.

-

Can I use airSlate SignNow to send 1099 forms printable 2018 to multiple recipients?

Yes, airSlate SignNow allows you to send 1099 forms printable 2018 to multiple recipients in a single action. You can easily manage bulk sending which saves time and ensures that all your contractors receive their documents promptly. This feature enhances your efficiency in document distribution.

-

What integrations does airSlate SignNow support for 1099 forms printable 2018?

airSlate SignNow integrates seamlessly with various accounting and CRM systems to streamline your workflow with 1099 forms printable 2018. Our platform works with popular solutions like QuickBooks, Salesforce, and more, enabling you to manage your financial documents effectively. These integrations allow for automatic data population to minimize manual data entry.

-

How does using airSlate SignNow benefit my business with regards to 1099 forms printable 2018?

By using airSlate SignNow for your 1099 forms printable 2018, you benefit from enhanced efficiency and reduced paper waste. Our electronic signing process speeds up document turnaround, allowing you to focus on your business operations. Additionally, our platform ensures compliance and security, giving you peace of mind.

Get more for 1099 Int

- Thumbprint form oregon

- Aaa subpoena form 43520671

- Scrub order form fillable form

- Summer school program teacher application form vancouver

- Summer school teacher application1 form

- Offence declaration form athletics ontario

- How to get a driving instructor license form

- Application for miscellaneous matters home qcat form

Find out other 1099 Int

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple