Form 8863 2016

What is the Form 8863

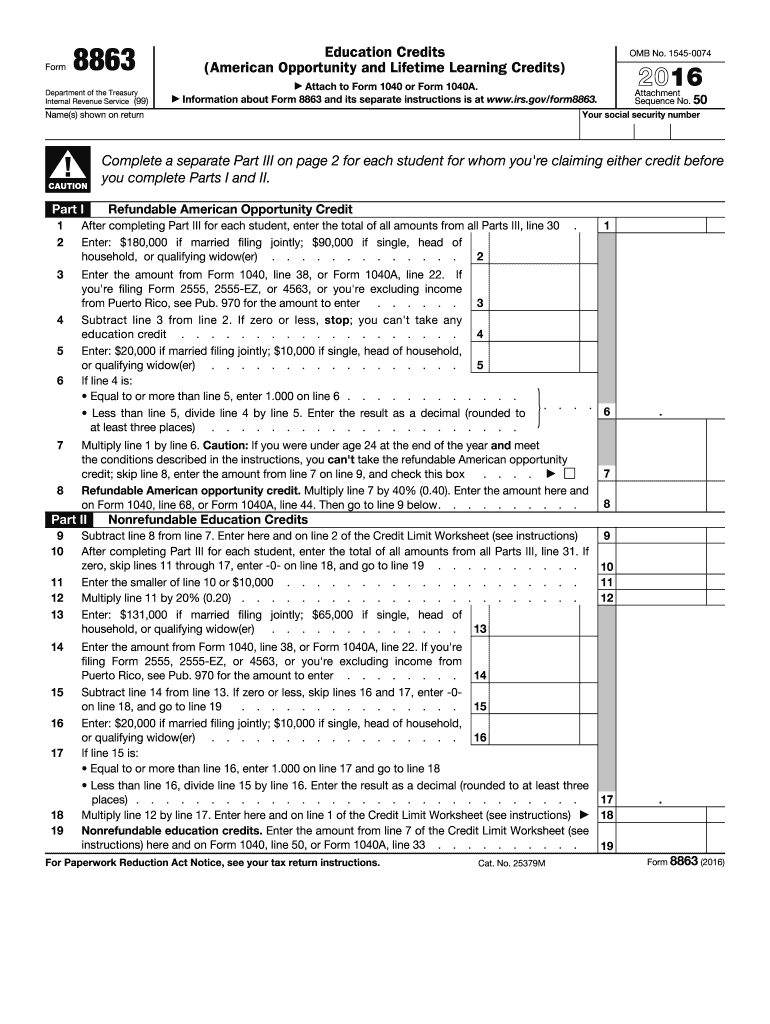

The Form 8863, also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is used by taxpayers in the United States to claim education-related tax credits. These credits can significantly reduce the amount of tax owed, making higher education more affordable. The form allows eligible students or their parents to claim credits for qualified education expenses, including tuition and related fees for post-secondary education. Understanding the purpose and benefits of Form 8863 is crucial for those looking to maximize their educational tax benefits.

How to use the Form 8863

Using Form 8863 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including Form 1098-T, which reports tuition payments. Next, determine eligibility for the American Opportunity Credit or the Lifetime Learning Credit based on your educational expenses and enrollment status. Complete the form by entering the required information, including the qualified expenses and any adjustments. Finally, attach Form 8863 to your tax return when filing, whether electronically or by mail, to claim the credits.

Steps to complete the Form 8863

Completing Form 8863 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including Form 1098-T and receipts for qualified expenses.

- Determine eligibility for the American Opportunity Credit or the Lifetime Learning Credit.

- Fill out Part I for the American Opportunity Credit or Part II for the Lifetime Learning Credit, entering the required information.

- Calculate the credit amount based on your qualified expenses.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 8863

Form 8863 is legally binding when filled out and submitted according to IRS guidelines. To ensure compliance, taxpayers must accurately report their educational expenses and maintain supporting documentation. The form must be filed with a tax return, and any discrepancies can lead to penalties or disallowance of the claimed credits. It is essential to understand the legal implications of submitting Form 8863 to avoid potential issues with the IRS.

Eligibility Criteria

To qualify for the credits claimed on Form 8863, taxpayers must meet specific eligibility criteria. For the American Opportunity Credit, the student must be enrolled at least half-time in a degree or certificate program, and the credit is available for the first four years of higher education. The Lifetime Learning Credit does not have a limit on the number of years it can be claimed but applies to students enrolled in eligible courses. Additionally, income limits apply, and taxpayers must not have felony drug convictions to qualify for these credits.

Filing Deadlines / Important Dates

Filing deadlines for Form 8863 align with the overall tax return deadlines. Typically, individual tax returns must be filed by April 15 of the following tax year. If additional time is needed, taxpayers can request an extension, but any owed taxes must still be paid by the original deadline to avoid penalties. It is crucial to stay informed about any changes to tax laws or deadlines that may affect the filing of Form 8863.

Quick guide on how to complete 2016 form 8863

Effortlessly prepare Form 8863 on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Form 8863 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Edit and eSign Form 8863 effortlessly

- Find Form 8863 and click on Retrieve Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Finish button to save your modifications.

- Select your delivery method for the form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Form 8863 and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8863

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8863

How to generate an electronic signature for the 2016 Form 8863 in the online mode

How to generate an electronic signature for the 2016 Form 8863 in Google Chrome

How to create an electronic signature for putting it on the 2016 Form 8863 in Gmail

How to make an electronic signature for the 2016 Form 8863 straight from your smartphone

How to make an electronic signature for the 2016 Form 8863 on iOS

How to create an electronic signature for the 2016 Form 8863 on Android devices

People also ask

-

What is Form 8863 and why is it important?

Form 8863 is used to claim education credits for qualified tuition and related expenses. It's essential for taxpayers seeking to maximize their education-related tax benefits. By accurately completing Form 8863, you can ensure that you receive the financial support you deserve for your educational investments.

-

How can airSlate SignNow help with completing Form 8863?

airSlate SignNow provides an intuitive platform that allows you to fill out and eSign Form 8863 easily. With its user-friendly interface, you can quickly input your information, ensuring that all fields are accurately completed. This helps streamline your tax filing process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 8863?

airSlate SignNow offers a range of pricing plans, including a free trial, making it accessible for anyone needing to complete Form 8863. The subscription options are competitively priced, providing excellent value for the features offered. You can choose a plan that best suits your needs for eSigning documents like Form 8863.

-

Can I integrate airSlate SignNow with other software for processing Form 8863?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms, enhancing your workflow when processing Form 8863. Integrations with accounting software and document management systems allow for smooth data transfer and management. This ensures that your tax documents, including Form 8863, are efficiently handled.

-

What features does airSlate SignNow offer for handling Form 8863?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Form 8863. These features streamline the completion and submission process, helping you stay organized. Furthermore, the platform ensures that your documents are secure and compliant with regulations.

-

Can I use airSlate SignNow on mobile devices for Form 8863?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to complete and eSign Form 8863 on the go. Whether you are using a smartphone or tablet, you can access your documents anytime, anywhere. This flexibility is particularly beneficial during tax season when you need to act quickly.

-

What are the benefits of using airSlate SignNow for Form 8863?

Using airSlate SignNow for Form 8863 simplifies the process of filling out and signing your tax documents. It saves time with automated workflows and reduces errors with its easy-to-use interface. Additionally, the security features ensure that your sensitive information remains protected throughout the process.

Get more for Form 8863

Find out other Form 8863

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy